|

|

Recent Articles

-

Get Excited: Dividend Growth Investors Rejoice! – More “Outperformance”

Get Excited: Dividend Growth Investors Rejoice! – More “Outperformance”

Oct 20, 2022

-

Image: Valuentum’s simulated Dividend Growth Newsletter portfolio continues to “outperform” relative to almost any dividend-paying benchmark this year! Past performance is not a guarantee of future results. This is not a real money portfolio.

As of the last tally through October 19, the simulated Dividend Growth Newsletter portfolio is beating the S&P 500 Dividend ETF SPDR (SDY) by roughly ~3.2 percentage points so far in 2022 (-8.4% versus -11.6%), all the while we’ve seen some awesome dividend growth across the board, with Microsoft (MSFT), Lockheed Martin (LMT), Honeywell (HON), and Realty Income (O) recently pushing through some nice dividend increases. What’s ~3.2 percentage points on a million-dollar portfolio? ~$32,000 in capital one doesn’t have to make up when the market’s coming roaring back in the coming years – and that’s relative to a dividend growth benchmark that is “outperforming” the SPY in a big way in 2022.

-

Announcing Valuentum’s Customer Appreciation Day Winners!

Announcing Valuentum’s Customer Appreciation Day Winners!

Oct 20, 2022

-

Let's see who won an autographed copy of Value Trap and what they said about Valuentum's research! We applaud all of our members in their quest to preserve and generate long-term wealth. Keep going strong!

-

AT&T’s Free Cash Flow Coverage of Its Dividend Is Looking Better But Economic Malaise Awaits

AT&T’s Free Cash Flow Coverage of Its Dividend Is Looking Better But Economic Malaise Awaits

Oct 20, 2022

-

Image: AT&T’s dividend obligations have been substantially reduced, aiding in its coverage of the payout with free cash flow. Image Source: AT&T.

AT&T’s free cash flow generation in the third-quarter 2022 was good enough to significantly cover the cash dividends paid in the period, generating a free cash flow dividend payout ratio of 52.3% versus 98.1% in the same period a year-ago. Though its massive net debt position will continue to weigh on its Dividend Cushion ratio, AT&T’s free cash flow coverage of the dividend is looking much better these days. Still, AT&T has a lot to prove, and CEO John Stankey has said as much. The WarnerMedia acquisition and spin-off has left a sour taste in many an AT&T investor’s mouth, and while we liked the improvement shown in AT&T’s third-quarter 2022 results, we’re not looking to add the shares to any of the newsletter portfolios at this time. Our fair value estimate stands at $16 per share, and its Dividend Cushion ratio is decidedly negative. Shares yield ~7.1%.

-

Philip Morris Is One of Our Favorite High-Yielding Income Generation Ideas

Philip Morris Is One of Our Favorite High-Yielding Income Generation Ideas

Oct 20, 2022

-

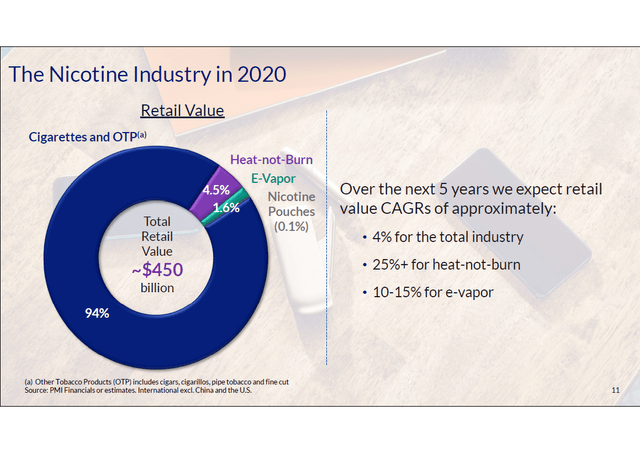

Image Shown: Philip Morris International Inc expects alternative nicotine products will grow at a robust pace over the coming years, with an eye towards heated tobacco units and oral nicotine products. By capitalizing on those opportunities, the company aims to diversify its revenues away from traditional cigarette sales. Image Source: Philip Morris International Inc – 2021 Investor Day Event Presentation.

Philip Morris is a strong cash flow generator with ample pricing power and a bright growth outlook. Underlying demand for its IQOS heated tobacco offerings remains robust and demand for its traditional cigarette offerings is holding up well, even in the face of substantial inflationary pressures weighing negatively on consumer spending power around the global. Philip Morris’ near term guidance indicates that it should remain a strong free cash flow generator in 2022, allowing the firm to stay on top of its payout obligations. Management remains committed to rewarding income seeking shareholders, and we continue to like exposure to shares of Philip Morris in our High Yield Dividend Newsletter portfolio.

|