|

|

Recent Articles

-

Online Sports Betting Surges But DraftKings’ Cash Burn Continues to Intensify; We Prefer More Conservative Gaming Plays Such as Churchill Downs

Online Sports Betting Surges But DraftKings’ Cash Burn Continues to Intensify; We Prefer More Conservative Gaming Plays Such as Churchill Downs

Feb 19, 2023

-

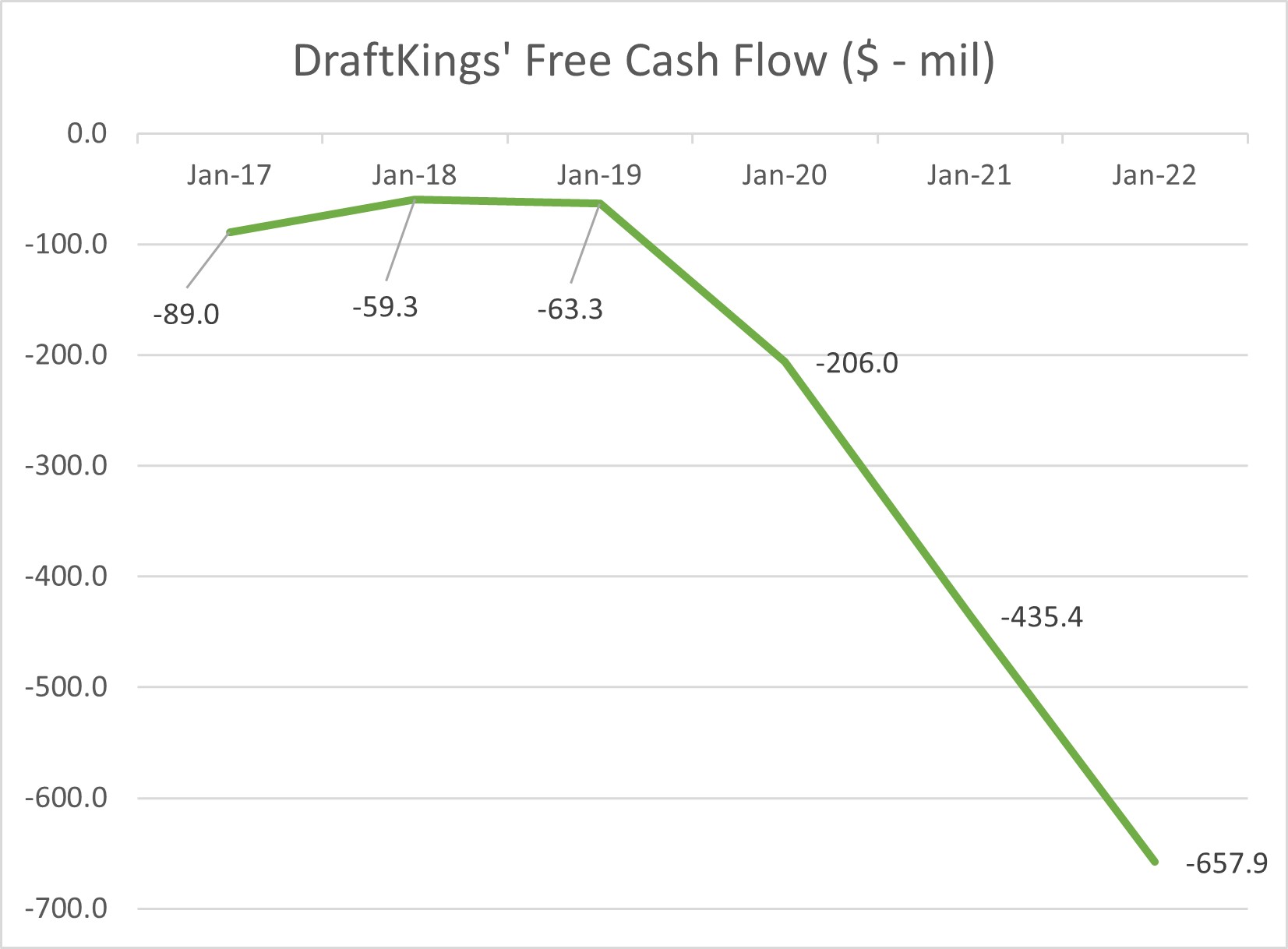

Image: Online sports betting platform DraftKings continues to burn through hundreds of millions of dollars each year. Data: SEC Filings, Seeking Alpha.

Over the past 52 weeks, Churchill Downs’ stock has advanced ~10%, while DraftKings’ stock is down ~7% and Penn Entertainment’s shares have fallen over 34%. Online sports betting will only grow as more and more states pass laws in favor of its adoption and more and more consumers take up gambling as a hobby, but the best risk-adjusted opportunities may still rest with the more traditional gaming operators that aren’t burning through hundreds of millions in free cash flow every year to chase growth. We don’t like the moral underpinnings of the gambling industry at all, but we cannot deny the long-term growth potential of the industry. Churchill Downs may not be levered to online sports gaming anymore, but the company remains free cash flow rich with a tremendously lucrative asset base, and for that, it’s one of our favorite picks in the group.

-

Dividend Increases/Decreases for the Week of February 17

Dividend Increases/Decreases for the Week of February 17

Feb 17, 2023

-

Let's take a look at firms raising/lowering their dividends this week.

-

Investing's Odd Couple: Value and Momentum

Investing's Odd Couple: Value and Momentum

Feb 16, 2023

-

The American Association of Individual Investors highlighted the significant benefits of combining value and momentum strategies in the July 2013 edition of its Journal. This article previously appeared on our website.

-

PepsiCo's Pricing Actions Fantastic; Needs Better Free Cash Flow in 2023 to Cover 10% Dividend Hike

PepsiCo's Pricing Actions Fantastic; Needs Better Free Cash Flow in 2023 to Cover 10% Dividend Hike

Feb 13, 2023

-

Image Source: PepsiCo.

PepsiCo revealed tremendous product pricing power during its fourth quarter of 2022, but inflationary pressures were still present across its business operations. The beverage and snacks giant raised its dividend 10%, marking the 51st consecutive year the company has upped its payout. However, PepsiCo will have to step up its free cash flow generation during 2023 in order to cover the increased payout obligations. During 2022, for example, free cash flow came up short in covering cash dividends paid. PepsiCo also has a rather large net debt position, even as it plans to spend $1 billion in buybacks during 2023. We still like PepsiCo as an idea in the Best Ideas Newsletter portfolio, however, and peg its fair value estimate at $187 per share. Shares yield ~2.8% at the time of this writing.

|