|

|

Recent Articles

-

Update: J&J Reports Messy Q4, Free Cash Flow Remains Robust But Looming Kenvue Split Adds Uncertainty

Update: J&J Reports Messy Q4, Free Cash Flow Remains Robust But Looming Kenvue Split Adds Uncertainty

Mar 3, 2023

-

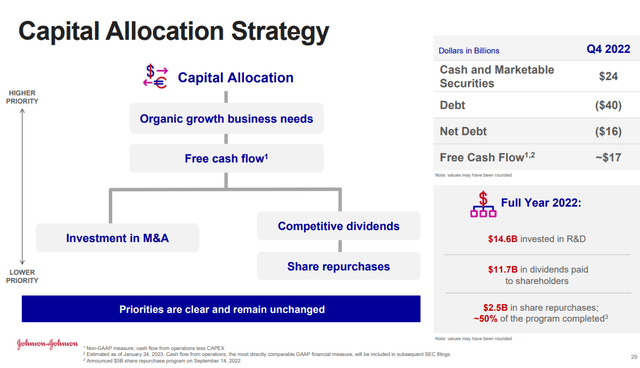

Image: Johnson & Johnson’s free cash flow generation remains far in excess of its cash dividends paid. Image Source: J&J.

Johnson & Johnson reported messy fourth-quarter 2022 results that showed a large difference between GAAP and non-GAAP reporting. The company’s free cash flow presentation wasn’t great either, and we can’t help but feel management is a bit distracted given that the firm is working to spin off its Consumer Health division (Kenvue) later during 2023. J&J will retain its two larger divisions, Pharma and MedTech, including its key drugs Stelara, Darzalek, Tremfya, Erleada, and Uptravi, as well as its MedTech operations that have exposure to a number of areas including electrophysiology, wound closure, procedures for knees and hips, as well as surgical vision and trauma. We continue to like J&J’s coverage of the dividend with free cash flow, but we doubt the company will stay in the newsletter portfolios for much longer in light of the messy presentation and impending Kenvue split, expected in November 2023. We like to keep things simple. Shares yield ~2.7%. [We have updated this work to reflect that we are considering removing JNJ from both the Dividend Growth Newsletter portfolio and the Best Ideas Newsletter portfolio.]

-

Dividend Increases/Decreases for the Week of March 3

Dividend Increases/Decreases for the Week of March 3

Mar 3, 2023

-

Let's take a look at firms raising/lowering their dividends this week.

-

Our Reports on Stocks in the Oil and Gas Complex Industry

Our Reports on Stocks in the Oil and Gas Complex Industry

Feb 27, 2023

-

Our reports on stocks in the Oil and Gas Complex industry can be found in this article. Reports include BKR, HAL, SLB, BP, CVX, COP, XOM, SHEL, TTE, CTRA, EOG, OXY, PXD, ENB, ET, EPD, MMP, KMI, PSX.

-

Dividend Increases/Decreases for the Week of February 24

Dividend Increases/Decreases for the Week of February 24

Feb 24, 2023

-

Let's take a look at firms raising/lowering their dividends this week.

|