|

|

Recent Articles

-

Norfolk Southern’s Environmental and Safety Troubles Plague Stock

Norfolk Southern’s Environmental and Safety Troubles Plague Stock

Mar 14, 2023

-

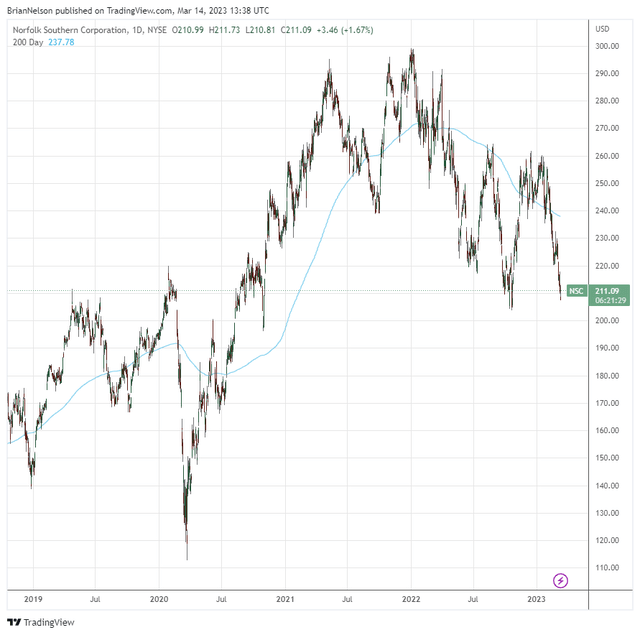

Image: Norfolk Southern’s environmental troubles have sent its stock back to pre-pandemic levels. The company is yet another example of why companies cannot take for granted how their operations can negatively impact the environment. Image Source: TradingView.

Neglecting the environment and employee and consumer/resident safety is a sure way for companies to end up in hot water. Norfolk Southern is under special investigation by the National Transportation Safety Board (NTSB) for a series of accidents during the past couple years, punctuated by the derailment and chemical spill occurring in East Palestine, Ohio, in early February. Though the firm’s costs associated with the high-profile train derailment may be capped at $75 million, its reputation may be irreparably harmed. Norfolk Southern is a prime example of why ESG investing has an important role in the marketplace, as the company simply dropped the ball when it came to ‘Environmental’ and ‘Social’ considerations within the ESG construct.

-

ALERT: We’re ‘Raising Cash’ in the Newsletter Portfolios

ALERT: We’re ‘Raising Cash’ in the Newsletter Portfolios

Mar 13, 2023

-

Image: American Union Bank, New York City. April 26, 1932. Public Domain.

Almost a decade ago now, we wrote the following: “We firmly believe that an investment in a bank must come with the acknowledgement of the distinct possibility that another financial crisis may occur at an unknown time in the future. Why? Banks do not keep a 100% reserve against deposits. Our good friend George Bailey knew this very well when he tried to discourage Bedford Falls residents from making a “run” on the famous and beloved Building and Loan.” – Brian Nelson, CFA, September 4, 2013

-

ICYMI: How Big Is Your "Too Hard" Bucket?

ICYMI: How Big Is Your "Too Hard" Bucket?

Mar 12, 2023

-

Image Source: Christian Schnettelker.

In investing, it's okay to admit that there are some things that investors can't know. It's not a poor reflection of one's analytical ability or a possible shortcoming of one's experience, but rather quite the contrary: Understanding and accepting that some things are "unknowable" is a sign of the quality of one's judgment. Quite simply, certain critical components of the equity evaluation process are more "unknowable" than others. The intelligent investor recognizes the variance (fair value estimate ranges) and the magnitude of the "unknowable" between companies and generally tries to identify entities that have the least "unknowable" characteristics as possible or situations where the "unknowable" might actually be weighted in their favor (an asymmetric fair value distribution).

-

Dividend Increases/Decreases for the Week of March 10

Dividend Increases/Decreases for the Week of March 10

Mar 10, 2023

-

Let's take a look at firms raising/lowering their dividends this week.

|