|

|

Recent Articles

-

Markets Don’t Look Bad

Markets Don’t Look Bad

Apr 11, 2023

-

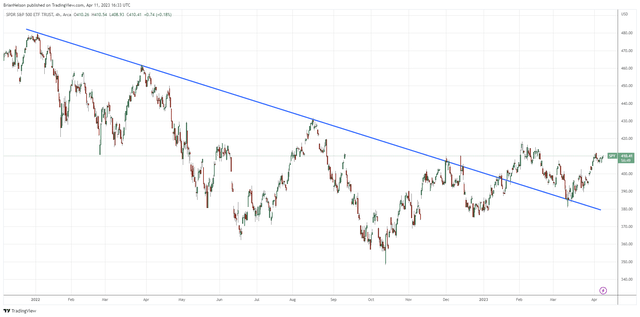

Image: The market-capitalization weighted S&P 500 continues to hold its January breakout, while support held in mid-March.

The market-capitalization weighted S&P 500 is no longer in a downtrend, and while the regional banking crisis gave investors pause, we’d have to say the markets don’t look bad. From a technical standpoint, the SPY broke through its downtrend in January, while it held support in mid-March. If the S&P 500 can break through the early February near-term highs, technically, things are looking quite good for the beginnings of this nascent market leg-up. It’s been a long road to get to what looks like a “bottom,” but we might have witnessed it in October of last year.

-

Not Worried About Global PC Demand Weakness

Not Worried About Global PC Demand Weakness

Apr 11, 2023

-

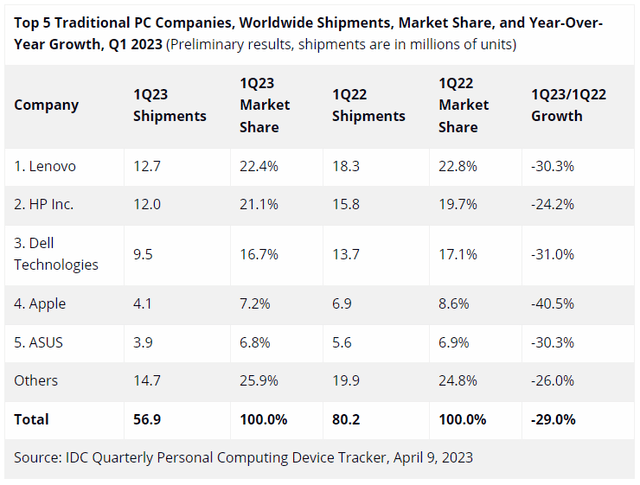

Image Source: IDC.

On April 9, International Data Corporation (IDC) issued preliminary findings for the first quarter of 2023 for global personal computer (PC) shipments in its Worldwide Quarterly Personal Computing Device Tracker. The results were a bit surprising, with the firm noting that “weak demand, excess inventory, and a worsening macroeconomic climate were all contributing factors for the precipitous drop in shipments of traditional PCs during the first quarter of 2023.” According to the IDC report, global PC shipments fell 29% to 56.9 million compared to the first quarter of 2022. Apple experienced the biggest year-over-year percentage decline, where shipments fell more than 40%. Dell Technologies, Lenovo and ASUS experienced declines greater than 30%, while HP Inc. and a basket of other PC makers witnessed declines in the mid-20% range. Channel inventory remains elevated, and investors should expect more discounting from the PC makers, as the industry continues to optimize the supply chain amid pre-COVID and post-COVID demand dynamics.

-

Best Ideas Newsletter Portfolio Idea Republic Services Continues to Execute Well

Best Ideas Newsletter Portfolio Idea Republic Services Continues to Execute Well

Apr 10, 2023

-

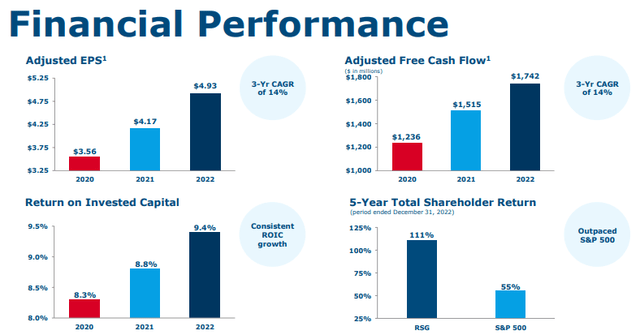

Image: Republic Services has been executing nicely, growing its adjusted free cash flow at a 14% compound annual growth rate the past three years. Image Source: Republic Services.

Shares of Republic are trading about in line with our fair value estimate ($130-$135) but have valuation upside on the basis of the high end of our fair value estimate range ($158 per share), in our view. The company boasts an investment-grade credit rating and has liquidity of ~$1.7 billion, while most of its debt doesn’t come due until after 2029. Republic Services’ equity is currently yielding ~1.5% at the moment, and we think it is a great fit for the newsletter portfolios. The garbage hauler continues to deliver in both good times and bad, and we have no reason to believe that it won’t continue to do so. Trash is cash when it comes to the waste-management business.

-

Taiwan Semiconductor Experiences Revenue Weakness in March

Taiwan Semiconductor Experiences Revenue Weakness in March

Apr 10, 2023

-

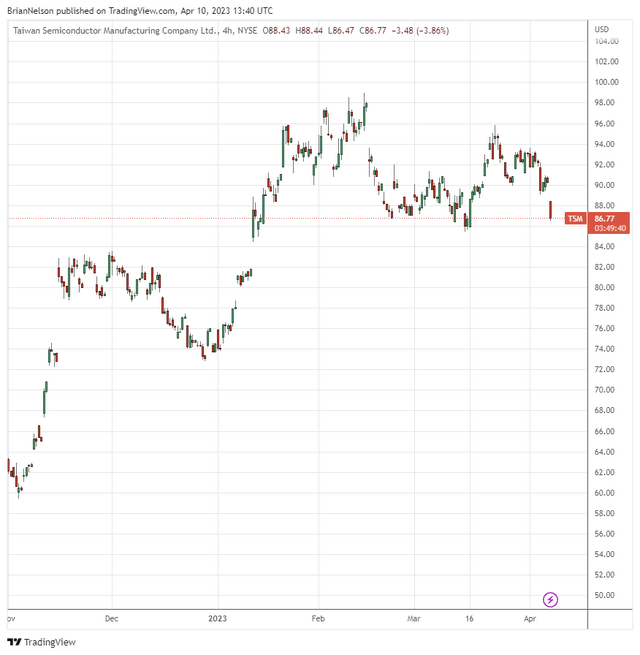

Image: Taiwan Semiconductor’s shares have rallied nicely since the beginning of November of last year.

Taiwan Semiconductor reported March revenue on April 10. During the month, net revenue dropped nearly 11% on a sequential basis and more than 15% on a year-over-year basis from March 2022. Though the top-line weakness in the month was somewhat of a surprise, the company’s revenue advanced 3.6% during the first quarter of this year.

|