|

|

Recent Articles

-

Cisco Systems Expects Its Growth Trajectory Will Resume in Earnest This Fiscal Year

Cisco Systems Expects Its Growth Trajectory Will Resume in Earnest This Fiscal Year

Aug 26, 2022

-

Image Shown: Cisco Systems Inc is incredibly shareholder friendly. Image Source: Cisco Systems Inc – Fourth Quarter of Fiscal 2022 IR Earnings Presentation.

Cisco Systems reported fourth quarter earnings for fiscal 2022 (period ended July 30, 2022) that beat both consensus top- and bottom-line estimates. The networking hardware and software provider also issued promising guidance for fiscal 2023 that Wall Street appreciated. Cisco Systems is steadily putting supply chain hurdles (with an eye towards a shortage of semiconductor components and transportation bottlenecks) behind it and its growth outlook is starting to improve as a result. We continue to like shares of CSCO as an idea in both the Best Ideas Newsletter and Dividend Growth Newsletter portfolios. Shares of CSCO yield ~3.2% as of this writing.

-

Dividend Increases/Decreases for the Week of August 26

Dividend Increases/Decreases for the Week of August 26

Aug 26, 2022

-

Let's take a look at firms raising/lowering their dividends this week.

-

Dividend Growth Idea Dick’s Sporting Goods Beats Estimates, Raises Guidance

Dividend Growth Idea Dick’s Sporting Goods Beats Estimates, Raises Guidance

Aug 25, 2022

-

Image Shown: Shares of Dick’s Sporting Goods Inc have been on a nice upward climb of late. The sporting goods retailer raised its full-year guidance for fiscal 2022 during its fiscal second quarter earnings report.

On August 23, Dick’s Sporting Goods Inc reported second quarter earnings for fiscal 2022 (period ended July 30, 2022) that beat both consensus top- and bottom-line estimates. The sporting goods retailer also raised its full-year guidance for fiscal 2022 in conjunction with the report, after previously lowering its guidance during its fiscal first quarter earnings update in May 2022. We continue to like Dick’s Sporting Goods as an idea in the Dividend Growth Newsletter portfolio. Shares of DKS yield ~1.8% as of this writing when looking at its regular quarterly payout. The company has also paid out special dividends in the recent past, including a $5.50 per share special dividend in fiscal 2021 along with a $2.00 per share special dividend back in fiscal 2012.

-

Dividend Growth Idea Qualcomm Growing at a Robust Clip

Dividend Growth Idea Qualcomm Growing at a Robust Clip

Aug 25, 2022

-

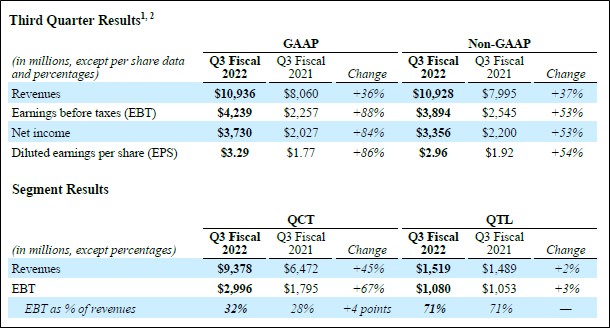

Image Shown: Dividend growth idea Qualcomm Inc put up strong performance last fiscal quarter. Image Source: Qualcomm Inc – Third Quarter of Fiscal 2022 Earnings Press Release.

Qualcomm recently reported third quarter earnings for fiscal 2022 (period ended June 26, 2022) that beat both consensus top- and bottom-line estimates. The company provided guidance for the fiscal fourth quarter that was a tad lighter than what Wall Street was looking for, though its near term forecasts still call for substantial revenue and earnings growth on a year-over-year basis. We like Qualcomm as an idea in the Dividend Growth Newsletter portfolio given its stellar free cash flow generating abilities, healthy balance sheet, pricing power, bright growth outlook, and margin expansion potential. Shares of QCOM yield ~2.2% as of this writing.

|