|

|

Recent Articles

-

Dividend Increases/Decreases for the Week of April 21

Dividend Increases/Decreases for the Week of April 21

Apr 21, 2023

-

Let's take a look at firms raising/lowering their dividends this week.

-

Philip Morris’ First-Quarter 2023 Results Just Okay

Philip Morris’ First-Quarter 2023 Results Just Okay

Apr 20, 2023

-

Image: Philip Morris’ smoke-free product portfolio. Image Source: Philip Morris 2022 Form 10-K.

We like that Philip Morris has raised its quarterly dividend by more than 170% since it became a public company in 2008, reflecting a compound annual growth rate of ~7.5%, and further growth in the dividend payout should ensue. The company’s Dividend Cushion ratio stands at 1.0, but the mediocre ratio is more of a function of the company’s large net debt position than anything else, as free cash flow generation remains robust. Shares of Philip Morris yield ~5% at the time of this writing.

-

AT&T Disappoints Again

AT&T Disappoints Again

Apr 20, 2023

-

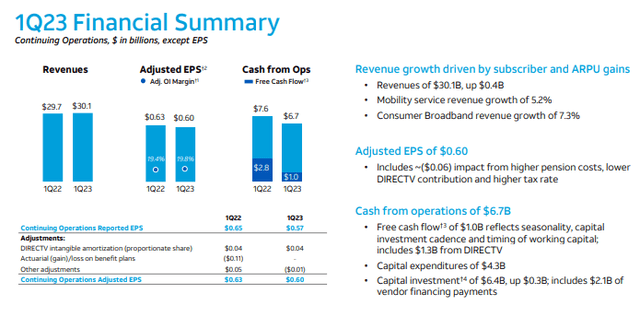

Image: AT&T is back in the doghouse, as free cash flow generation came in worse than expected during its first-quarter 2023 results. Image Source: AT&T.

AT&T’s forward estimated dividend yield of 5.6% is attractive at face value, but the economics of its business continue to leave a lot to be desired, in our view. Not only is the company saddled with a tremendous amount of net debt to the tune of a whopping $134.7 billion, resulting in an annualized net debt to adjusted EBITDA ratio of 3.22x, but the company operates a capital-intensive model that eats into its operating cash flow.

-

1Q 2023 Earnings Coming in Better Than Feared Thus Far

1Q 2023 Earnings Coming in Better Than Feared Thus Far

Apr 19, 2023

-

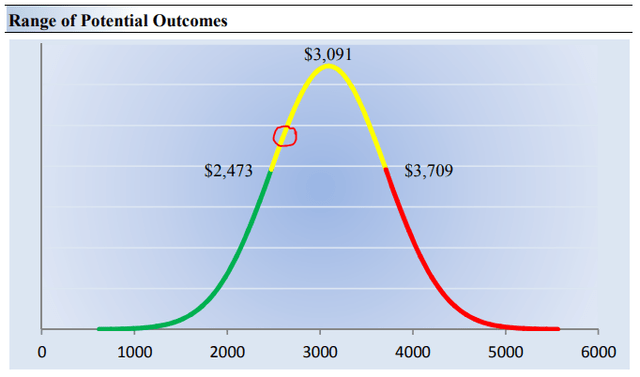

Image: We view valuation as a range of probable fair value outcomes. Our updated fair value estimate for Booking Holding stands north of $3,000, while shares are trading at less than $2,700.

First-quarter 2023 earnings season has been coming in better than feared, in our view, and bank earnings have not spooked the market as many may have thought they would. But again, any banking crisis takes far more than just a month or two to work through the system, and in the event another shoe drops – whether in Europe or in U.S. commercial real estate or U.S. housing – things could get ugly for the banking sector. We continue to prefer equities over bonds, and as was shown once again during SVB Financial meltdown, the Fed was there once again to bail out the “market” and prevent contagion at any cost. With roughly 10% of the S&P 500 reporting first-quarter 2023 earnings so far, many companies have been beating consensus estimates.

|