|

|

Recent Articles

-

Korn Ferry’s Stock Helps Diversify Best Ideas Newsletter Portfolio

Korn Ferry’s Stock Helps Diversify Best Ideas Newsletter Portfolio

Sep 7, 2022

-

Image Shown: Within the realm of the global consulting industry, Korn Ferry’s revenues are well-diversified in terms of both the geographic markets and industries it caters to. We like shares of Korn Ferry as an idea in our Best Ideas Newsletter portfolio. Image Source: Korn Ferry – First Quarter of Fiscal 2023 IR Earnings Presentation.

We continue to be big fans of Korn Ferry and view its growth outlook quite favorably. The company’s pivot towards digitally providing its services combined with its pristine balance sheet has resulted in a rock-solid business model that can withstand the various exogenous shocks seen of late, from inflationary pressures to supply chain hurdles to labor shortages to rising geopolitical tensions across the globe. Korn Ferry’s capital appreciation upside potential remains substantial, and while the stock is facing pressure following the report, we still like shares as an important diversifying presence in the simulated Best Ideas Newsletter portfolio.

-

Valuentum: Now Bearish, We’ve Been Here Every Step of the Way

Valuentum: Now Bearish, We’ve Been Here Every Step of the Way

Sep 5, 2022

-

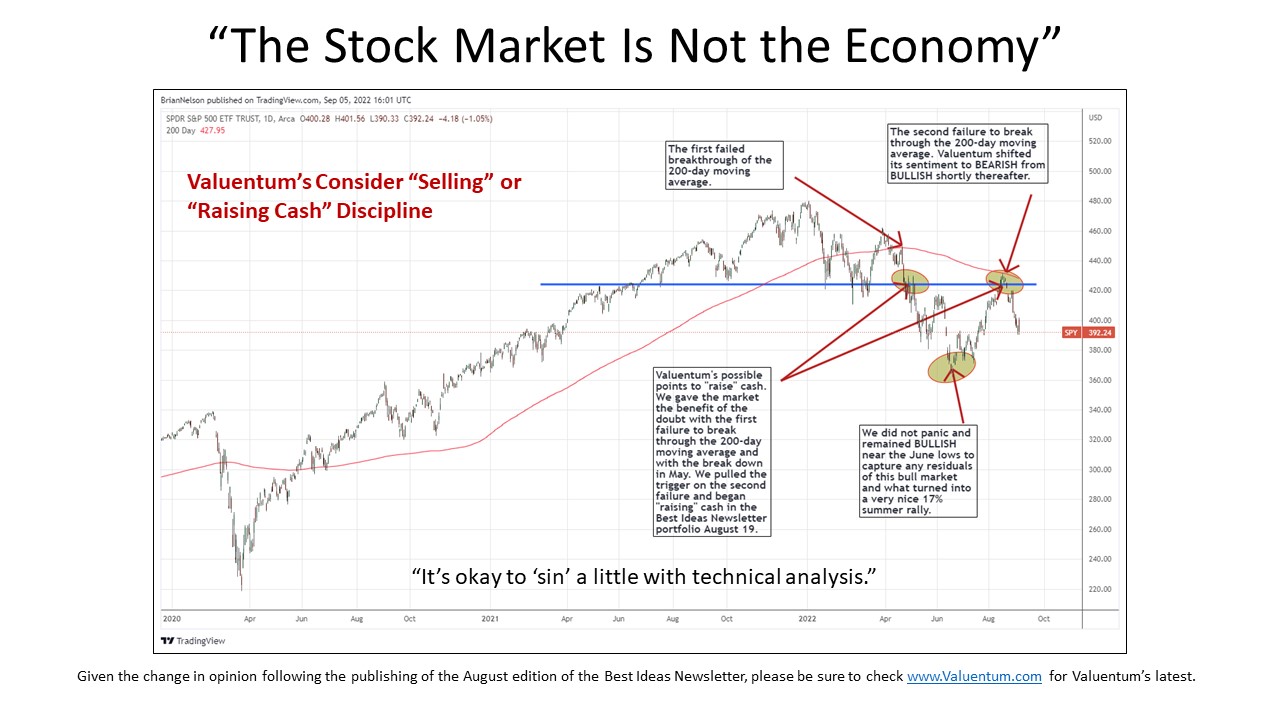

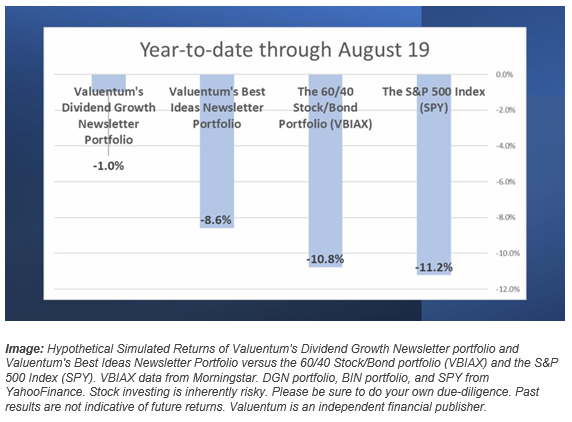

It’s easy to lose sight of the tremendous value that a Valuentum subscription provides during down markets, but we’ve been here for you every step of the way. 2019, 2020, and 2021 were fantastic years, and the simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio have delivered in 2022. The High Yield Dividend Newsletter portfolio is holding up nicely, and ideas within the Exclusive publication continue to boast impressive success rates. Members continue to receive options ideas to bet directionally on the stock market, and the book Value Trap has been true to its efforts, showcasing the ongoing benefits of forward-looking analysis. [Given the change in opinion following the publishing of the August edition of the Best Ideas Newsletter, please be sure to check www.Valuentum.com for Valuentum’s latest.]

-

Video: How Many Stocks Should You Own?

Video: How Many Stocks Should You Own?

Sep 4, 2022

-

Valuentum's President of Investment Research, Brian Nelson, CFA, explains the importance of diversification, how to think about firm-specific and systematic risk, how many stocks one should own to achieve 90% of the diversification benefits, how to think about active asset allocation versus active equity management, and why diversification is a means to achieve goals, not the goal itself. A content-packed 14-minute video. Don't miss it!

-

Dividend Increases/Decreases for the Week of September 2

Dividend Increases/Decreases for the Week of September 2

Sep 2, 2022

-

Let's take a look at firms raising/lowering their dividends this week.

|