|

|

Recent Articles

-

Our Reports on Stocks in the Mining & Chemicals Industry

Our Reports on Stocks in the Mining & Chemicals Industry

Jun 21, 2023

-

Image Source: Peter Craven.

Our reports on stocks in the Mining & Chemicals industry can be found in this article. Reports include APD, DD, EMN, ECL, LYB, PPG, BHP, FCX, NEM, RIO, VALE, WPM, AA, MLM, VMC, NUE, CSL, ALB, GGG, SHW, GTLS.

-

Dividend Increases/Decreases for the Week of June 16

Dividend Increases/Decreases for the Week of June 16

Jun 16, 2023

-

Let's take a look at firms raising/lowering their dividends this week.

-

UnitedHealth Group’s Long-Term Story Intact

UnitedHealth Group’s Long-Term Story Intact

Jun 14, 2023

-

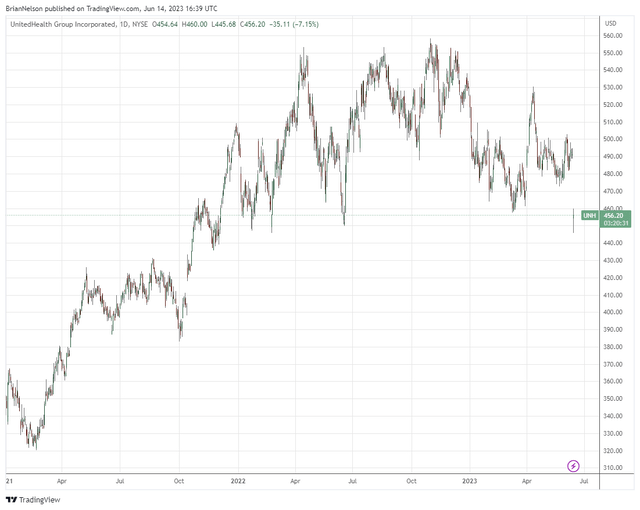

Image: UnitedHealth Group’s shares are facing pressure as the pace of medical procedures normalizes following COVID-19. We still like shares.

On June 7, UnitedHealth Group raised its quarterly dividend nearly 14%, to $1.88 per share, which reflects a forward estimated dividend yield of 1.65%. The company remains a staple in the Dividend Growth Newsletter portfolio and is a new add in the Best Ideas Newsletter portfolio. Recent comments by UNH’s John Rex on June 14 regarding the firm’s healthcare costs during the second quarter have put shares under pressure during the trading session. Discretionary surgeries have picked back up following a lull during most of the COVID-19 pandemic as hospital capacity was largely constrained during that time. We’re viewing the expectations for higher medical costs in the near term for UNH as a reflection of pent-up demand (e.g. hip, knee replacements) and therefore largely a one-time step up that will weigh on is financials during 2023, but not in the longer run as premiums are eventually reset (repriced) to better cover the cost pressures. We think the market is overreacting to the news and likely reallocating to more aggressive areas within big cap tech as defensive stocks within healthcare weaken in 2023. UNH’s shares are now trading in the lower bound of our fair value estimate range, and we still like this large cap growth idea in the long run.

-

ESG Facing Opposition But Still an Indispensable Component of Investing

ESG Facing Opposition But Still an Indispensable Component of Investing

Jun 13, 2023

-

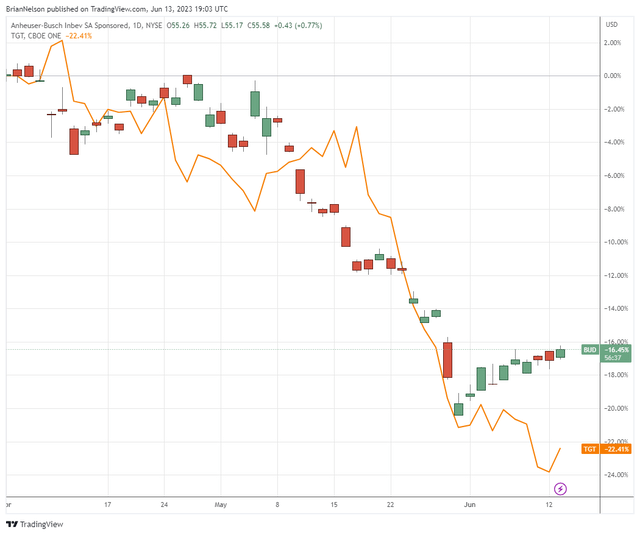

Image: Shares of Anheuser-Busch Inbev and Target have fallen 16%+ and 22%+, respectively, since the beginning of April.

ESG investing is facing numerous challenges during 2023 as investors look to reallocate funds to other areas, including higher-yielding bonds and AI-levered big cap tech. Social dynamics have also become increasingly more difficult to navigate as companies seek to extend their brands, and the missteps at BUD and TGT mean that C-suites have to pay more attention to how they incorporate social issues into their messaging than ever before. Regardless of the weak fund flows at ESG-focused financial instruments during 2023, the concepts embedded within ESG remain absolutely critical to an investor’s success.

|