|

|

Recent Articles

-

Disney’s 5-Year Returns Have Been Pitiful

Disney’s 5-Year Returns Have Been Pitiful

May 14, 2023

-

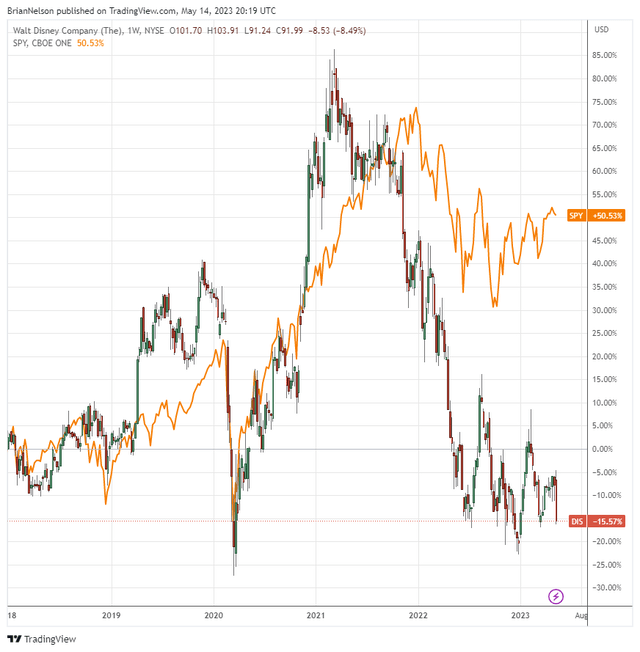

Image: Since the beginning of 2018, Disney’s shares have fallen, while the S&P 500 has surged. Though we liked the company more recently, we no longer include shares in the Best Ideas Newsletter portfolio.

Disney has its hands full with its feud with Florida Governor DeSantis, a weakening linear television market, and intense rivalries in the streaming market. All of this won’t be solved overnight and might even worsen. From where we stand, investors simply don’t need the complexity of the Disney story at this time, and the company’s 5-year returns tell the story of a troubled company. With shares of Disney largely fairly valued, we won’t be adding the company back to the Best Ideas Newsletter portfolio anytime soon.

-

There Are No Free 'Income' Lunches

There Are No Free 'Income' Lunches

May 14, 2023

-

Image Source: Jeffrey Beall.

2023 has been a great year thus far, and we continue to highlight the best areas for consideration following a great relative year in 2022. Highly-rated ideas on the Valuentum Buying Index are few and far between, but we’ll be going to “fully invested” soon enough. The regional banking crisis is having a muted impact on market sentiment at this point, and the Fed looks to be winning the battle against inflation. We’re excited about what the back of 2023 may look like, and we hope you are, too.

-

Dividend Increases/Decreases for the Week of May 12

Dividend Increases/Decreases for the Week of May 12

May 12, 2023

-

Let's take a look at firms raising/lowering their dividends this week.

-

We Prefer Visa

We Prefer Visa

May 11, 2023

-

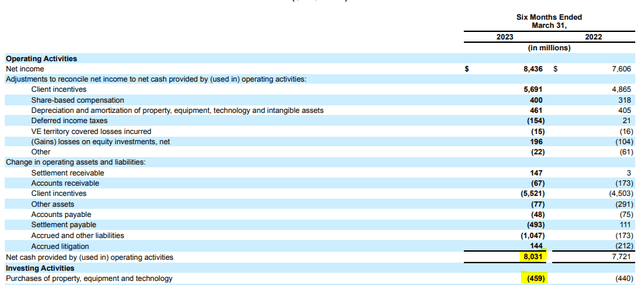

Image: Visa’s operating cash flow of $8 billion, and free cash flow of ~$7.5 billion through the first half of its fiscal 2023 is remarkable. Image Source: Visa.

Visa's second-quarter fiscal 2023 results released April 25 were enough to support our continued positive take on the moaty entity, as it beat the consensus estimate on both the top and bottom line. During its quarter ending March 31, 2023, net revenues advanced 11%, while GAAP earnings per share leapt 20%, to $2.03 per share. Payments volume advanced 10% in the quarter on a year-over-year basis, while total cross-border volume increased 24%. Processed transactions advanced 12% in the quarter from the same period a year ago.

|