|

|

Recent Articles

-

Dividend Increases/Decreases for the Week of August 4

Dividend Increases/Decreases for the Week of August 4

Aug 4, 2023

-

Let's take a look at firms raising/lowering their dividends this week.

-

Best Idea Booking Holdings Soars!

Best Idea Booking Holdings Soars!

Aug 3, 2023

-

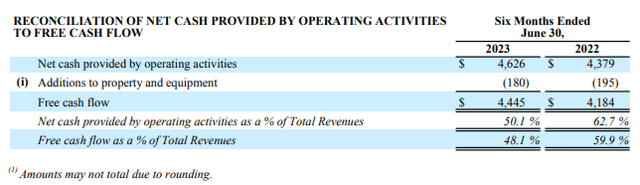

Image: Booking Holdings’ free cash flow conversion is about as good as it gets. The company remains a key idea in the Best Ideas Newsletter portfolio. Image Source: Booking Holdings.

Booking Holdings fits the mold of the type of companies that we’re looking for in this market environment. The company has an asset-light business model that is tied to secular growth trends, all the while it boasts a net cash position and significant free cash flow generation. The company’s outlook also speaks to continued strength as it relates to leisure demand, a key data point suggesting that the broad economic environment remains resilient despite rate increases and the erosion of excess consumer cash savings built up during the COVID-19 pandemic. The quarterly report was welcome news.

-

Not Expecting Much From Consumer Staples Stocks

Not Expecting Much From Consumer Staples Stocks

Aug 3, 2023

-

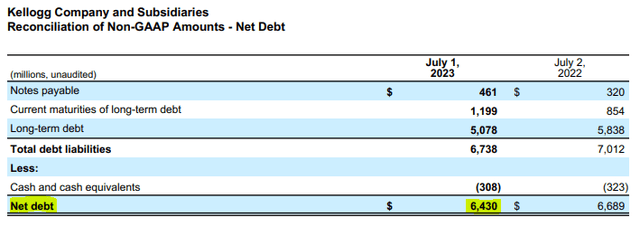

Image: Kellogg is representative of many consumer staples stocks that have considerable net debt positions. Image Source: Kellogg’s second-quarter press release.

Though consumer staples equities have shown tremendous resilience in the face of adversity and their dividend yields can make sense in certain portfolios, the group is overflowing with net debt positions, meager long-term growth prospects, and free cash flow generation that is largely absorbed by growing per-share dividend liabilities. On the other hand, big cap tech and large cap growth have tremendous net cash positions and substantial future expected free cash flow generation, paving the way for what could be considerable long-term return potential. As with the last decade, we expect cash-based sources of intrinsic value to prevail, and for that, we continue to point to big cap tech and large cap growth as areas for consideration.

-

Albemarle Is One of the Best Growth Stories on the Market Today

Albemarle Is One of the Best Growth Stories on the Market Today

Aug 2, 2023

-

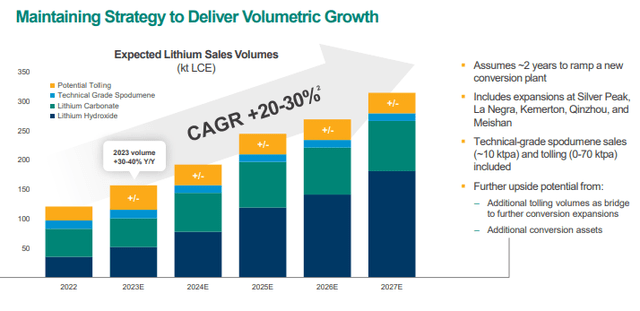

Image: Albemarle is a low-cost producer of lithium derivatives, an end market that is expected to experience tremendous demand in the coming years.

On August 2, Albemarle Corp. reported excellent second-quarter 2023 results that showed net sales advancing 60% and adjusted diluted earnings per share more than doubling in the quarter. For the full-year 2023, net sales are now expected to be between $10.4-$11.5 billion (was $9.8-$11.5 billion) thanks in part to continued strength in electric vehicle (EV) demand. Our fair value estimate for Albemarle stands at $257 per share, well above where shares are currently trading. We think the market is underestimating not only its growth potential but also mid-cycle levels of profitability.

|