|

|

Recent Articles

-

Domino’s Pizza Breaks Through Downtrend on Uber Eats and Postmates Deal

Domino’s Pizza Breaks Through Downtrend on Uber Eats and Postmates Deal

Jul 12, 2023

-

Image Source: Domino’s Pizza is up nearly 14% on a year-to-date basis during 2023, but the company’s shares haven’t done much over the past 52 weeks.

On July 12, Domino’s Pizza announced that it had inked a new deal with Uber that would allow customers in the U.S. to order Domino’s food through the Uber Eats and Postmates apps with delivery provided by drivers of Domino’s and its franchisees. Domino’s Pizza continues to be a standout leader in digital initiatives across the restaurant arena, and the firm noted that the new agreement will open up Domino’s and its franchisees “to a new segment of customers and what (it) believes will be a meaningful amount of incremental delivery orders.” The high end of our fair value estimate of Domino’s stands at $450 per share.

-

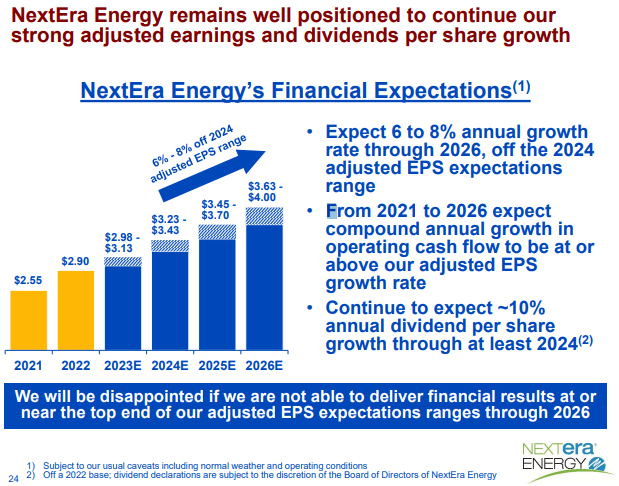

NextEra Energy Expects 10% Annual Dividend Growth

NextEra Energy Expects 10% Annual Dividend Growth

Jul 11, 2023

-

Image Source: Nextera Energy.

We think the utility sector is generally overrepresented in many dividend-oriented and income-producing portfolios, but we think NextEra Energy is a good fit for the well-diversified ESG Newsletter portfolio given its vast renewable resource assets. Shares of Nextera Energy have fallen more than 20% since the beginning of 2022, while the Utilities Select Sector SPDR Fund ETF is down more than 8% over the same time period. Shares of Nextera Energy yield ~2.6%.

-

Apple: $200 Per Share at the High End of the Fair Value Estimate Range

Apple: $200 Per Share at the High End of the Fair Value Estimate Range

Jul 9, 2023

-

The high end of our fair value estimate range for Apple now stands at $200 per share.

-

Dividend Increases/Decreases for the Week of July 7

Dividend Increases/Decreases for the Week of July 7

Jul 7, 2023

-

Let's take a look at firms raising/lowering their dividends this week.

|