|

|

Recent Articles

-

Cisco Buys Splunk

Cisco Buys Splunk

Sep 21, 2023

-

Image Source: Brandon Leon.

Dividend Growth Newsletter portfolio holding Cisco is all about growing its recurring revenue base these days, and its announcement that it will buy Splunk on September 21 will not only help in a big way towards that goal, but the deal will also position Cisco for tremendous opportunities in the booming market that has become artificial intelligence [AI]. That said, some investors were not fans of the purchase price – some $28 billion in cash – but we think the price is fair and strategically, there’s nothing wrong with adding to the fold an asset-light, recurring-revenue business that has the foundation to be a key long-term player in AI. We’ll be taking a close look at our valuation model on Cisco as we further digest this proposed transaction, but for now, we’re comfortable with our $53 per-share fair value estimate of the networking giant.

-

Details Regarding Visa’s Exchange Offer

Details Regarding Visa’s Exchange Offer

Sep 21, 2023

-

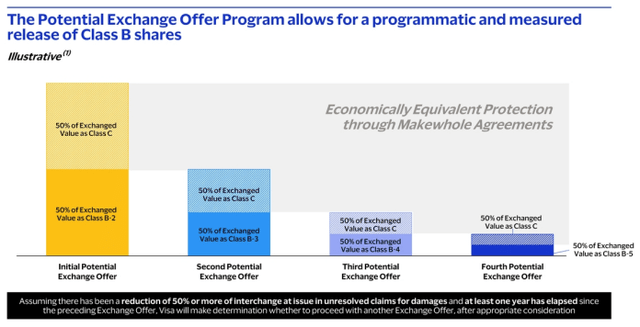

Image: Visa's 8-K.

Visa remains a free-cash-flow generating powerhouse, and the firm’s operating and free cash flow margins are about as good as it gets. Future potential exchange offers from Visa corresponding to its various share classes should be viewed as a minor intermediate-term inconvenience that will only provide but a modest potential headwind to the advancement of the company’s intrinsic value over time, and only in the scenario where diluted shares outstanding increase relative to expectations based on then-conversion rates for non-A class shares when converted. We continue to like Visa as a holding in the simulated Best Ideas Newsletter portfolio, and we like it and Mastercard more than their rivals such as American Express and Discover Financial that take on credit risk.

-

ICYMI: Questions for Valuentum’s Brian Nelson

ICYMI: Questions for Valuentum’s Brian Nelson

Sep 20, 2023

-

Valuentum's President Brian Nelson, CFA, answers your questions.

-

Fed Rate Decision, UAW Strike Continues, Microsoft Ups Payout

Fed Rate Decision, UAW Strike Continues, Microsoft Ups Payout

Sep 19, 2023

-

Image Source: Mike Mozart.

If you’re thinking like us about the ongoing Fed rate-hiking cycle, you’re probably thinking that perhaps we’ll see another rate hike or two down the road, even if the Fed pauses at today’s September 20 meeting. However, whether the Fed pauses from here on out or executes a couple more hikes, it really shouldn’t matter much to long-term investors. From where we stand, the conversation about interest rates should now be shifting away from worries about elevated inflation to the future positive prospects that correspond to the work that the Fed has already done. With the market-cap weighted S&P 500 just a stone’s throw away from all-time highs, despite aggressive contractionary monetary policy, we believe the market may start to view the existing levels of “high” near-term interest rates as dry powder for the Fed to stimulate the economy in the future, if or when it’s needed. The Fed has now built up a very nice insurance policy with little damage done to the U.S. stock market, and we think equities, particularly the stylistic area of large cap growth, may continue to reward investors as such a positive view is eventually factored in. New highs may once again be in the cards, and we remain bullish on the equity markets today, despite the ominous volatility experienced the past 20+ months.

|