|

|

Recent Articles

-

Chinese Equities Still Uninvestable

Chinese Equities Still Uninvestable

Jan 22, 2024

-

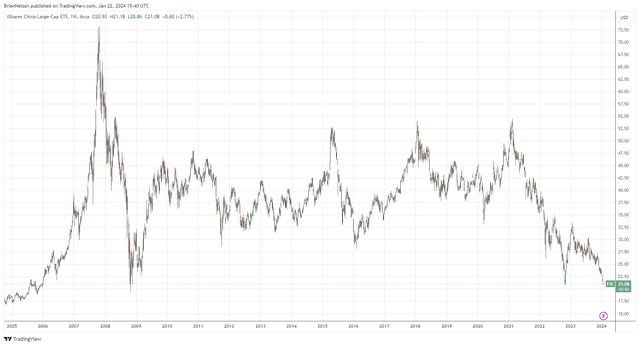

Image: Large cap Chinese equities are back to levels first reached in 2005, almost two decades ago.

Things have been so bad in Chinese equities that China’s largest broker has even taken steps to curb short sales. For the past 52 weeks, Alibaba’s shares have fallen more than 41%, Baidu’s shares have dropped more 22%, JD.com’s shares are off more than 63%, Bilibili’s shares are down more than 65%, while Tencent Holdings has fallen more than 30%. Though the steep declines in shares of Chinese equities may attract some bottom fishing, we’re not interested in any Chinese exposure at this time. We continue to like ideas in the newsletter portfolios.

-

3 Substantial Benefits of Dividend Growth Investing

3 Substantial Benefits of Dividend Growth Investing

Jan 21, 2024

-

Image Source: www.epictop10.com.

There are three primary benefits of a well-executed dividend growth strategy, one that is carried out with prudence and care and one that pays careful attention to the intrinsic value of the stock and its critical cash-based components. Albert Einstein is reported to have called compound interest the "eighth wonder of the world," but dividend growth investing has the potential to offer long-term investors so much more! Let's explain.

-

Stock Reports on 25 Dividend Kings to Pad Your Dividend Growth Portfolio

Stock Reports on 25 Dividend Kings to Pad Your Dividend Growth Portfolio

Jan 19, 2024

-

Image Source: Jason Train.

Investors love dividends! After all, research has shown that companies that have paid an ever-increasing dividend for a long time do quite well in the stock market. In this note, you can download the stock reports of 25 Dividend Kings, or stocks that have raised their dividends in each of the past 50 years!

-

Latest Report Updates

Latest Report Updates

Jan 19, 2024

-

Check out the latest report updates on the website.

|