|

|

Recent Articles

-

Dividend Increases/Decreases for the Week of February 23

Dividend Increases/Decreases for the Week of February 23

Feb 23, 2024

-

Let's take a look at firms raising/lowering their dividends this week.

-

Market Darling Nvidia Delivers in Fiscal Fourth Quarter

Market Darling Nvidia Delivers in Fiscal Fourth Quarter

Feb 21, 2024

-

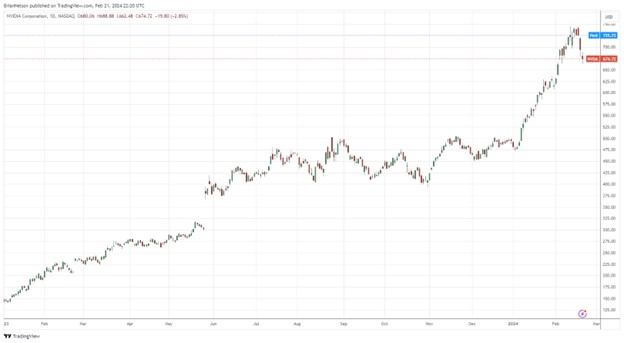

Image: Nvidia has been a market darling, and the company did not disappoint in its fourth-quarter fiscal 2024 report.

We like what we’re seeing at Nvidia these days, and what it implies for big cap tech and large cap growth, and we expect ongoing strength at the company. Competition from AMD and others is looming, but Nvidia continues to capture the lion’s share of AI investment at this time, and that will likely continue for some time yet. Speculative investors have made a bundle on Nvidia during the past 12-18 months, but we’ve been quite satisfied with the performance of Best Ideas Newsletter portfolio holding, the Technology Select Sector SPDR, which includes Nvidia as one of its top three holdings. Nvidia’s shares are showing strength after the quarterly report.

-

Lithium Prices Remain Volatile; Albemarle Adjusts Long-term Demand Forecast

Lithium Prices Remain Volatile; Albemarle Adjusts Long-term Demand Forecast

Feb 21, 2024

-

Image: Albemarle’s shares have faced significant pressure as a result of depressed lithium prices.

Albemarle’s shares have been under significant pressure of late due to volatile lithium prices, and the firm’s cash flows have faced weakness as a result. Operating cash flow dropped to ~$1.325 billion in 2023 from ~$1.91 billion in 2022, as capital spending soared. Unless lithium prices start to better reflect the underlying demand profile ahead of it, Albemarle will likely be free cash flow negative in 2024 as well. Right now, Albemarle is facing a tough road ahead with its fundamentals largely tied to lithium prices, but the firm is positioned well for a potential lithium-price rebound. Regardless, we view Albemarle as a speculative stock and one only for the most aggressive, risk-seeking investors.

-

Public Storage Puts Up Record Revenue and Net Operating Income in Fourth Quarter

Public Storage Puts Up Record Revenue and Net Operating Income in Fourth Quarter

Feb 21, 2024

-

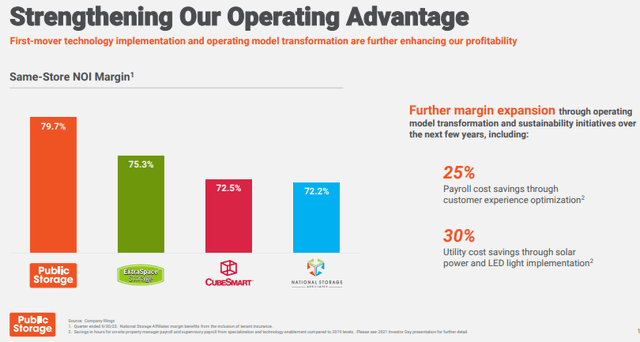

Image Source: Public Storage.

Self-storage giant Public Storage reported solid fourth quarter results February 20, with revenue and funds from operations [FFO] coming in better than expectations. The company is one of our favorite income-oriented ideas. It has now been in business for more than 50 years, and it boasts an enviable A2/A credit rating, allowing it easy access to the capital markets to fund future deals and projects. Public Storage’s same-store operating margin also runs higher than many of its peers, showcasing its more efficient operating model. We like Public Storage quite a bit, and the company yields ~4.2% at the time of this writing.

|