|

|

Recent Articles

-

Domino’s Long-Term Growth Outlook Looks Achievable

Domino’s Long-Term Growth Outlook Looks Achievable

Apr 29, 2024

-

Image Source: Domino's.

Domino’s continues to be shareholder-friendly, paying a nice quarterly dividend and buying back stock. As of March 24, it still had total remaining authorization on its buyback program of $1.12 billion. Looking to the firm’s long-term guidance, the firm is targeting 7%+ annual global retail sales growth, 1,100 annual global net store growth, and 8%+ annual income from operations growth. We think its targets are achievable.

-

Alphabet Posts Strong First Quarter, Initiates Dividend, Launches Huge Buyback

Alphabet Posts Strong First Quarter, Initiates Dividend, Launches Huge Buyback

Apr 28, 2024

-

Image: Alphabet’s valuable properties continue to put up nice revenue growth.

Alphabet ended the quarter with $108.1 billion in total cash and marketable securities against a long-term debt load of $13.2 billion, so Alphabet has an ample net cash position to support cash returns to shareholders. For the quarter ended March 31, 2024, Alphabet’s free cash flow totaled $16.8 billion, slightly lower than the same period last year due to a near doubling in capital spending, but nonetheless, the measure was healthy. We continue to like Alphabet as a top weighting in the Best Ideas Newsletter portfolio.

-

Microsoft's Balance Sheet and Cash Flow Generation Make It a Strong Consideration

Microsoft's Balance Sheet and Cash Flow Generation Make It a Strong Consideration

Apr 28, 2024

-

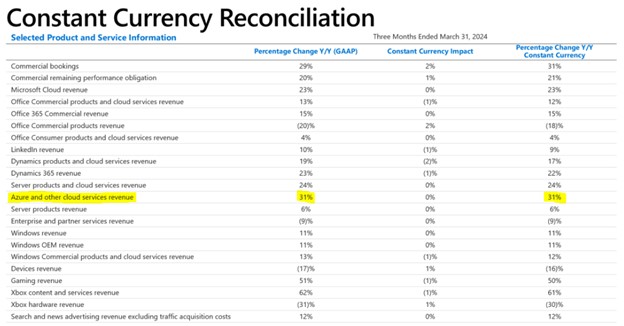

Image: Microsoft’s cloud business continues to showcase strong growth momentum.

We like Microsoft’s financials and fundamental momentum. The company continues to benefit from AI adoption across its product suite and guidance for the fourth quarter of its fiscal year was solid. We’re huge fans of Microsoft’s net cash position on its balance sheet, and very few other firms are showing the magnitude of operating cash flow increases we’re witnessing at Microsoft. The firm remains one of our favorite ideas in both the Best Ideas Newsletter portfolio and Dividend Growth Newsletter portfolio.

-

Dividend Increases/Decreases for the Week of April 26

Dividend Increases/Decreases for the Week of April 26

Apr 26, 2024

-

Let's take a look at firms raising/lowering their dividends this week.

|