|

|

Recent Articles

-

Dividend Increases/Decreases for the Week of September 12

Dividend Increases/Decreases for the Week of September 12

Sep 12, 2025

-

Let's take a look at firms raising/lowering their dividends this week.

-

Booking Holdings Expects Mid-Teens Adjusted EBITDA Growth in 2025

Booking Holdings Expects Mid-Teens Adjusted EBITDA Growth in 2025

Sep 11, 2025

-

Image Source: TradingView.

Looking to the third quarter, Booking Holdings expects room nights growth in the range of 3.5%-5.5%, constant currency gross bookings growth of 4%-6%, constant currency revenue growth of 3%-5%, and adjusted EBITDA growth of 6%-9%. Looking to 2025, Booking Holdings expects constant currency gross bookings growth in the high-single-digits and constant currency revenue growth in the high-single-digits. Adjusted EBITDA growth for the year is targeted to expand at a mid-teens percentage pace. We continue to like Booking Holdings’ free cash flow profile, and the company remains an idea in the newsletter portfolios.

-

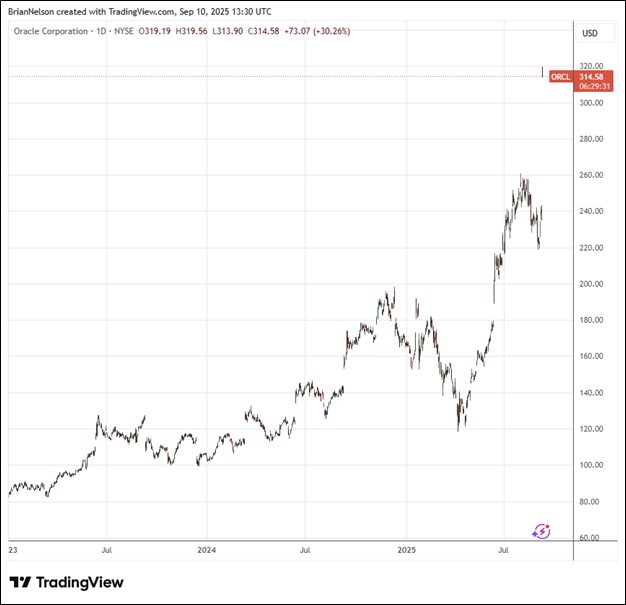

Shares of Dividend Growth Idea Oracle Surge!

Shares of Dividend Growth Idea Oracle Surge!

Sep 10, 2025

-

Image Source: TradingView.

Oracle’s non-GAAP operating income in the fiscal first quarter of 2026 was $6.2 billion, up 9% in USD and up 7% in constant currency. Non-GAAP net income was $4.3 billion in the quarter, up 8% in USD and up 6% in constant currency. We were impressed by the company’s remaining performance obligations growth in the quarter and management’s guidance calling for Oracle’s Cloud Infrastructure revenue to grow 77% to $18 billion this fiscal year—and then increase to $32 billion, $73 billion, $114 billion, and $144 billion over the subsequent four years. Management noted that most of the revenue in this 5-year forecast is already booked in its reported remaining performance obligations. Shares of Oracle surged on the news, and we continue to like Oracle in the newsletter portfolios.

-

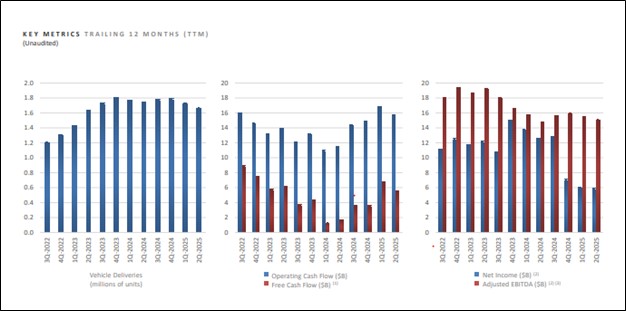

Tesla’s Second Quarter Results Weren’t Great

Tesla’s Second Quarter Results Weren’t Great

Sep 8, 2025

-

Image Source: Tesla.

Tesla’s cash flow from operating activities was $2.54 billion in the quarter, while it spent $2.4 billion in capex, resulting in free cash flow of $146 million. Its cash and investment balance was up 20% from last year, to $36.8 billion. All things considered, Tesla’s second quarter results weren’t great. The company experienced a decline in vehicle deliveries, lower regulatory credit revenue, reduced vehicle pricing, and a decline in Energy Generation and Storage revenue due to lower average sales prices. Meanwhile, operating income was impacted from higher operating expenses driven by AI and other R&D projects. We remain on the sidelines.

|