|

|

Recent Articles

-

Starbucks Surprises Investors with Weak Fiscal Second Quarter Results

Starbucks Surprises Investors with Weak Fiscal Second Quarter Results

May 7, 2024

-

Image: Starbucks’ shares face some challenges as the firm struggles to right the ship.

Starbucks surprised investors with very weak second-quarter 2024 results that showed a miss on both the top and bottom lines. We’re steering clear of Starbucks as a cautious consumer spending environment and execution remain key issues for the firm. We prefer Domino’s and Chipotle instead.

-

Amazon's Operating Income Growth Is Solid

Amazon's Operating Income Growth Is Solid

May 6, 2024

-

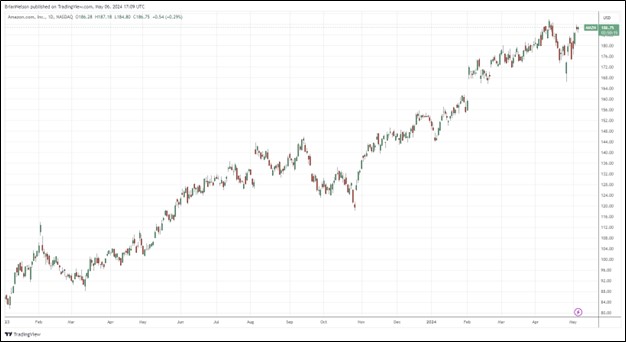

Image: Amazon’s shares have made a solid run higher since the beginning of 2023.

We’re liking what we’re seeing at Amazon these days, especially the company’s AWS performance, operating income expansion, and free cash flow trends. Right now, we don’t include Amazon in any newsletter portfolio given the valuation sensitivity of key inputs, but for risk-seeking investors, Amazon is one interesting consideration.

-

Apple Raises Dividend; Launches $110 Billion More in Buybacks

Apple Raises Dividend; Launches $110 Billion More in Buybacks

May 5, 2024

-

Image: Apple’s fiscal second quarter of 2024 didn’t disappoint.

Apple’s massive buyback announcement stole the show, but on a fundamental basis, things are looking on the up and up for iPhone sales, despite a heightened competitive environment in China. According to reports, Apple CEO Tim Cook told CNBC that “overall sales would grow in the ‘low single digits’ during the June quarter.” We’re huge fans of Apple’s Services business, the expected pick-up in iPhone sales coupled with a strong showing with respect to returning cash to shareholders.

-

Dividend Increases/Decreases for the Week of May 3

Dividend Increases/Decreases for the Week of May 3

May 3, 2024

-

Let's take a look at firms raising/lowering their dividends this week.

|