|

|

Recent Articles

-

Philip Morris’ Smoke-Free Portfolio Continues to Outperform

Philip Morris’ Smoke-Free Portfolio Continues to Outperform

Oct 21, 2025

-

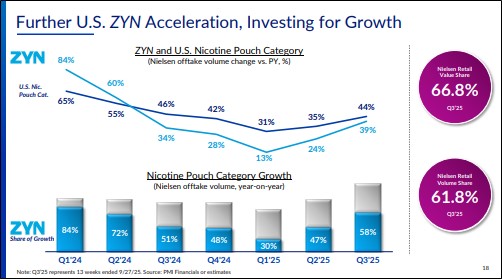

Image Source: Philip Morris.

Philip Morris’ work to continue to grow its smoke-free business (SFB) is bearing fruit. Its SFB now accounts for 41% of total net revenues, up 2.9 percentage points from last year’s quarter. In the quarter, the company’s SFB experienced net revenue growth of 17.7% (13.9% organically) with gross profit increasing 19.5% (14.8% organically). We continue to like Philip Morris’ oral SFB, which increased 16.9% in pouch or pouch equivalents (20.2% in cans), fueled by nicotine pouches. In the U.S., for example, its nicotine pouch product line-up ZYN accelerated growth to 39% in the third quarter. Philip Morris recently increased its regular quarterly dividend by 8.9%, to $1.47 per share, or annualized $5.88 per share. Looking to 2025, net revenue is expected to grow 6%-8% on an organic basis and adjusted diluted earnings per share, excluding currency, is targeted in the range of $7.36-$7.46, up from $6.57 in 2024, up 12.8% year-over-year at the midpoint. Shares yield 3.7% at the time of this writing.

-

Lockheed Martin Raises 2025 Guidance

Lockheed Martin Raises 2025 Guidance

Oct 21, 2025

-

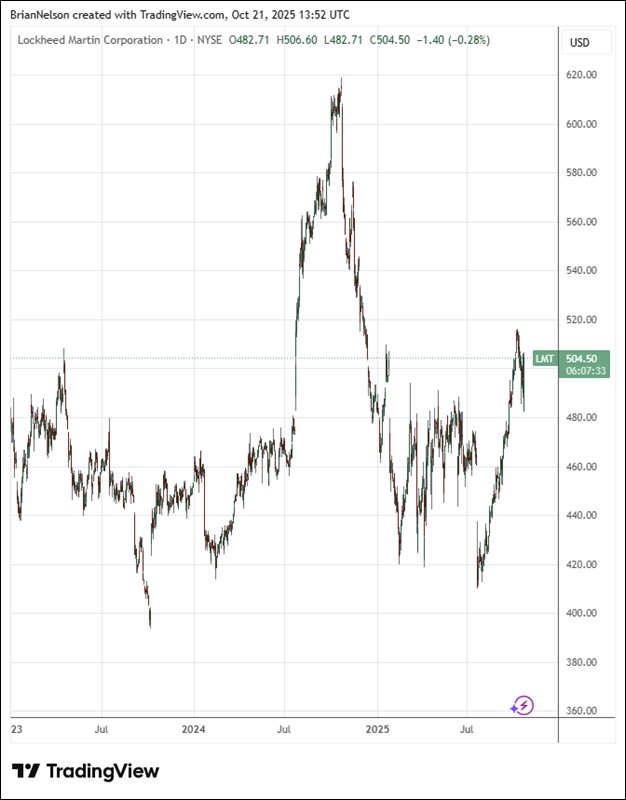

Image Source: TradingView.

Looking to all of 2025, Lockheed Martin raised its guidance. Sales are now expected in the range of $74.25-$74.75 billion, up from $73.75-$74.75 billion previously. Business operating profit is targeted in the range of $6.675-$6.725 billion, up from $6.6-$6.7 billion previously. Diluted earnings per share for 2025 are expected in the range of $22.15-$22.35, up from $21.70-$22.00 previously. Cash from operations for the year is expected at $8.5 billion, while free cash flow is targeted at $6.6 billion. Lockheed Martin’s board authorized the repurchase of its common stock up to an additional $2 billion, increasing the total authorization for potential future stock buybacks to $9.1 billion. The company raised its dividend payment to $3.45 per share, up 5% over its prior quarterly dividend payout. We continue to like Lockheed Martin as a holding in the Dividend Growth Newsletter portfolio.

-

Taiwan Semiconductor Looks to Strong Q4

Taiwan Semiconductor Looks to Strong Q4

Oct 19, 2025

-

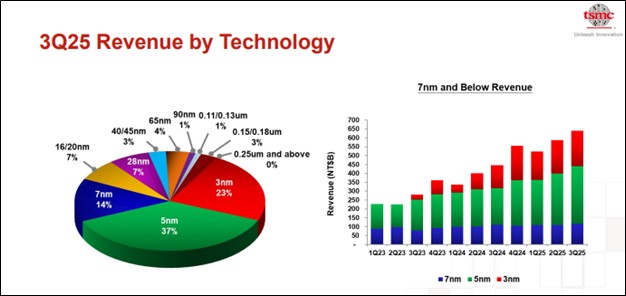

Image Source: TSMC.

Looking to the fourth quarter of 2025, Taiwan Semiconductor’s revenue is expected to be between $32.2-$33.4 billion, with gross margin expected to be between 59%-61% and its operating margin targeted in the range of 49%-51%. At the end of the third quarter, cash and investments totaled $90.1 billion, while bonds payable and bank loans came in at $31.4 billion. We like TSMC’s pure-play foundry business model, and trends continue to look favorable for the chip maker.

-

ASML Holding’s Net Bookings Beat Expectations

ASML Holding’s Net Bookings Beat Expectations

Oct 17, 2025

-

Image Source: TradingView.

Looking to the fourth quarter of 2025, ASML expects total net sales between €9.2 billion and €9.8 billion, the midpoint above the consensus forecast, and a gross margin between 51%-53%. For the full year 2025, total net sales are targeted to increase around 15% relative to 2024, with a gross margin around 52%. The company pays an interim dividend of €1.60 per ordinary share and repurchased around €148 million worth of shares in the third quarter. We like the momentum behind ASML’s business and continue to include shares in the ESG Newsletter portfolio.

|