|

|

Recent Articles

-

Eli Lilly Puts Up Strong Second Quarter Results, Raises Outlook

Eli Lilly Puts Up Strong Second Quarter Results, Raises Outlook

Aug 9, 2024

-

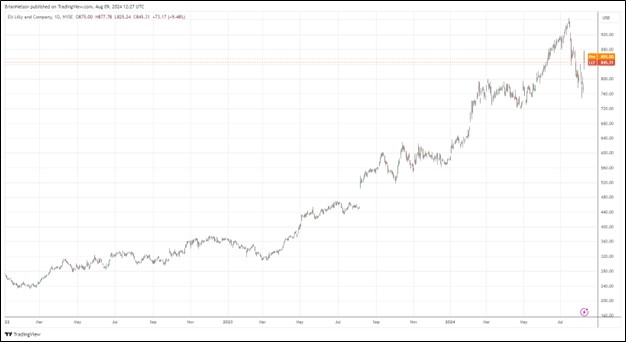

Image: Shares of Eli Lilly have been strong the past few years.

Looking to 2024 full-year guidance, Eli Lilly raised its revenue expectations by $3 billion, upped its reported earnings per share guidance $2.05, to the range of $15.10-$15.60, and increased its non-GAAP earnings per share guidance by $2.60 to the range of $16.10-$16.60, above the consensus forecasts. We continue to like Eli Lilly’s product portfolio, particularly Mounjaro and Zepbound, and we include the Health Care Select Sector SPDR Fund, which includes Eli Lilly as its top weighting, in the Best Ideas Newsletter portfolio.

-

Paper: Value and Momentum Within Stocks, Too

Paper: Value and Momentum Within Stocks, Too

Aug 9, 2024

-

Abstract: This paper strives to advance the field of finance in four ways: 1) it extends the theory of the “The Arithmetic of Active Management” to the investor level; 2) it addresses certain data problems of factor-based methods, namely with respect to value and book-to-market ratios, while introducing price-to-fair-value ratios in a factor-based approach; 3) it may lay the foundation for academic literature regarding the Valuentum, the value-timing, and ultra-momentum factors; and 4) it walks through the potential relative outperformance that may be harvested at the intersection of relevant, unique and compensated factors within individual stocks.

-

Dividend Increases/Decreases for the Week of August 9

Dividend Increases/Decreases for the Week of August 9

Aug 9, 2024

-

Let's take a look at firms raising/lowering their dividends this week.

-

Disney Achieves Profitability Across Combined Streaming Businesses

Disney Achieves Profitability Across Combined Streaming Businesses

Aug 7, 2024

-

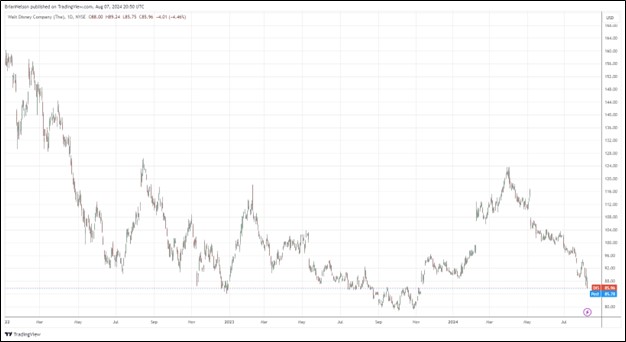

Image: Disney’s shares are under pressure despite marked improvement in earnings.

Disney noted that within its Experiences division, “segment revenue growth was impacted by moderation of consumer demand towards the end of Q3 that exceeded (its) previous expectations.” Though the pace of consumer demand at Disney theme parks remains a big question during the current fiscal fourth quarter, management’s new full year adjusted earnings per share growth target is now 30%, which reveals a company that is making progress from its troubles a couple years ago. We value shares of Disney just shy of $100 each.

|