|

|

Recent Articles

-

Dividend Increases/Decreases for the Week of August 30

Dividend Increases/Decreases for the Week of August 30

Aug 30, 2024

-

Let's take a look at firms raising/lowering their dividends this week.

-

Best Buy Reports Better Than Expected Q2 Results; Raises Bottom Line Outlook

Best Buy Reports Better Than Expected Q2 Results; Raises Bottom Line Outlook

Aug 29, 2024

-

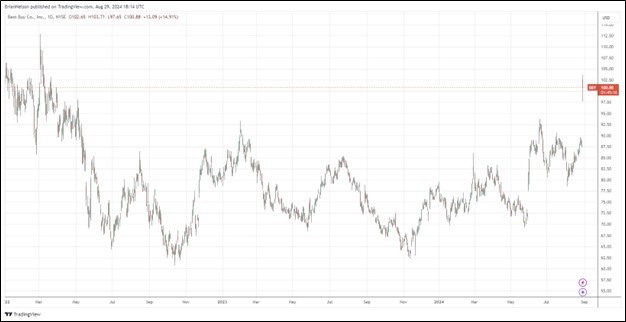

Image: Best Buy’s shares are bouncing back on an improved earnings outlook.

Looking to all of fiscal 2025, Best Buy's revenue is now expected in the range of $41.3-$41.9 billion (was $41.3-$42.6 billion) on comparable sales declines of 3% to 1.5%, compared to prior guidance for comparable sales to decline 3% to flat. Management noted that weakness in appliances, home theater and gaming was the main driver for the decline. Though the revised revenue performance wasn’t great news, management increased its non-GAAP diluted earnings per share guidance for fiscal 2025 to the range of $6.10-$6.35, up from prior guidance of $5.75-$6.20. Shares yield 3.7% at the time of this writing.

-

Salesforce Delivers on Second Quarter Fiscal 2025 Results

Salesforce Delivers on Second Quarter Fiscal 2025 Results

Aug 29, 2024

-

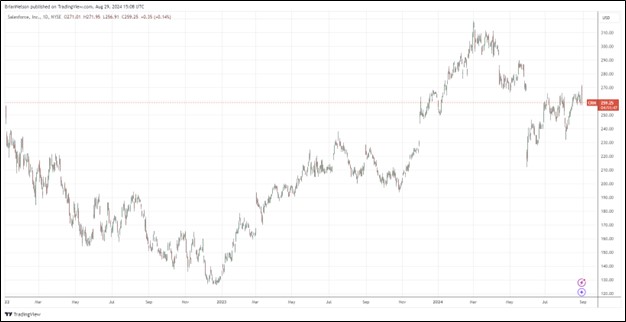

Image: Salesforce’s shares have bounced back nicely during the past year.

Looking to fiscal 2025, Salesforce maintained its fiscal year revenue guidance in the range of $37.7-$38 billion, up 8%-9%, while it also maintained its full year Subscription & Support revenue growth guidance of slightly below 10% year-over-year, or approximately 10% in constant currency. Management updated its fiscal 2025 GAAP operating margin guidance to 19.7% and non-GAAP operating margin guidance to 32.8%. Non-GAAP diluted earnings per share is targeted in the range of $10.03-$10.11 (versus consensus of $9.89). Salesforce also raised its full year operating cash flow growth guidance to the range of 23%-25%. Our fair value estimate stands at $271 per share.

-

Nvidia Beats Second Quarter Estimates

Nvidia Beats Second Quarter Estimates

Aug 28, 2024

-

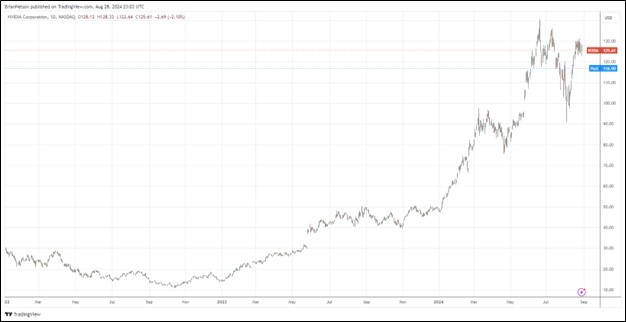

Image: Nvidia’s shares have been on a tear the past year.

On the heels of the strong second quarter fiscal 2025 report, Nvidia approved an additional $50 billion in share buybacks in addition to the $7.5 billion it still has remaining under its share repurchase authorization. Looking out to the third quarter of fiscal 2025, Nvidia expects revenue to be $32.5 billion, plus or minus 2%, while GAAP and non-GAAP gross margins are expected to be 74.4% and 75%, respectively, plus or minus 50 basis points. For the full year, management expects gross margins to be in the mid-70% range, which is a very healthy level of profitability. Our fair value estimate stands at $125 per share.

|