|

|

Recent Articles

-

Broadcom Misses with Guidance for Its Fiscal Fourth Quarter

Broadcom Misses with Guidance for Its Fiscal Fourth Quarter

Sep 8, 2024

-

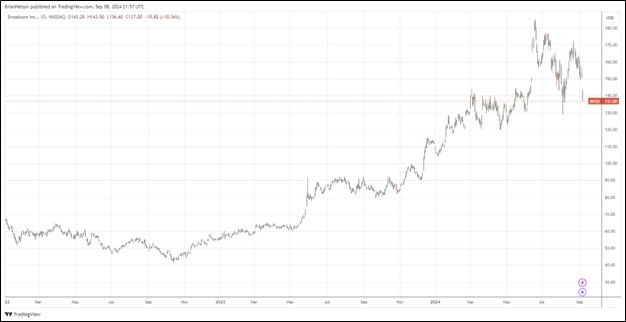

Image: Broadcom’s shares fell after the company issued fiscal fourth quarter guidance that came up short with respect to the consensus estimate.

Looking to the fourth quarter of fiscal 2024, Broadcom expects revenue of approximately $14 billion, and fourth-quarter adjusted EBITDA of approximately 64% of projected revenue, or $8.96 billion. Though the firm’s revenue guidance for the fourth quarter wasn’t poor, it did come in lower than the $14.13 billion that the Street was expecting, and shares were punished as a result. We’re not reading much into one quarterly report, however, and we maintain that trends in artificial intelligence are prolific.

-

Dividend Increases/Decreases for the Week of September 6

Dividend Increases/Decreases for the Week of September 6

Sep 6, 2024

-

Let's take a look at firms raising/lowering their dividends this week.

-

Casey’s General Stores Is Executing Well

Casey’s General Stores Is Executing Well

Sep 5, 2024

-

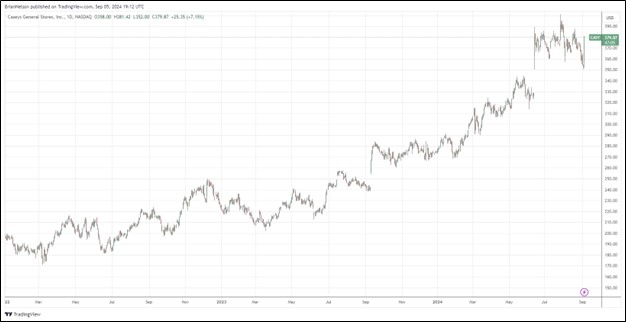

Image: Shares of Casey’s General Stores have done quite well since the beginning of 2022.

Looking to fiscal 2025, Casey’s continues to expect EBITDA to advance at least 8%, with inside same-store sales to increase 3%-5% and inside gross margin comparable to fiscal 2024. Same-store fuel gallons sold are expected to be between negative 1% and positive 1%. We liked Casey’s fiscal first quarter results, and while the name doesn’t make the cut for any newsletter portfolio, it’s one that we are watching closely.

-

Dollar General's Business Model Challenged By Walmart’s Strength

Dollar General's Business Model Challenged By Walmart’s Strength

Sep 4, 2024

-

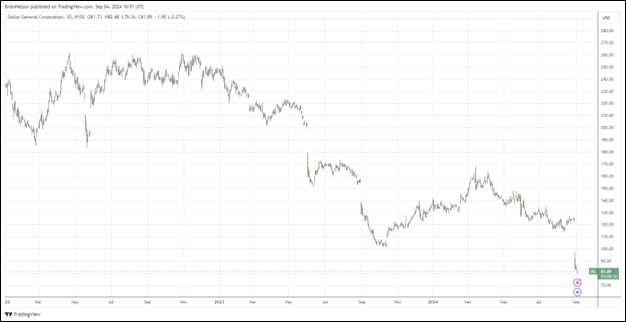

Image: Dollar General’s shares have been under considerable pressure the past couple years.

Dollar General cut its outlook for fiscal 2024. Net sales growth is now expected in the range of 4.7%-5.3% compared to its previous expectation of 6%-6.7%. Same store sales growth is now anticipated in the range of 1%-1.6%, compared to previous expectations of 2%-2.7%. Diluted earnings per share are now targeted in the range of $5.50-$6.20, compared to prior expectations of $6.80-$7.55. Shares of Dollar General plummeted on the news, and we see no reason to jump into the name, particularly given the competitive market environment, with Walmart likely gaining share.

|