|

|

Recent Articles

-

IBM Targeting $12+ Billion in 2024 Free Cash Flow

IBM Targeting $12+ Billion in 2024 Free Cash Flow

Oct 25, 2024

-

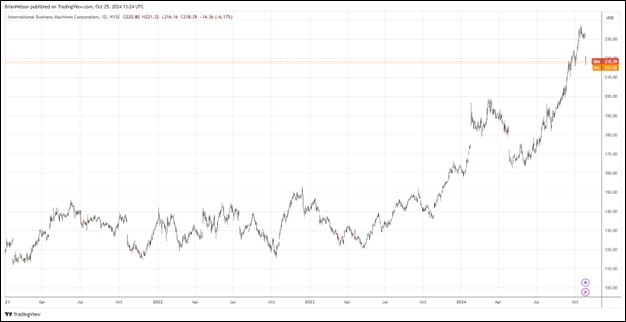

Image: Shares of IBM are flirting with record highs.

IBM continues to expect to generate more than $12 billion in free cash flow for 2024 and for fourth-quarter constant currency revenue growth to be consistent with its most recently reported third quarter. IBM ended the third quarter with $13.7 billion in cash and marketable securities versus debt, including financing debt, of $56.6 billion. Though IBM has a large net debt position, we’re generally positive on its dividend given free cash flow coverage. Shares yield 3% at the time of this writing.

-

Dividend Increases/Decreases for the Week of October 25

Dividend Increases/Decreases for the Week of October 25

Oct 25, 2024

-

Let's take a look at firms raising/lowering their dividends this week.

-

Coca-Cola’s Organic Growth Shines in Third Quarter

Coca-Cola’s Organic Growth Shines in Third Quarter

Oct 24, 2024

-

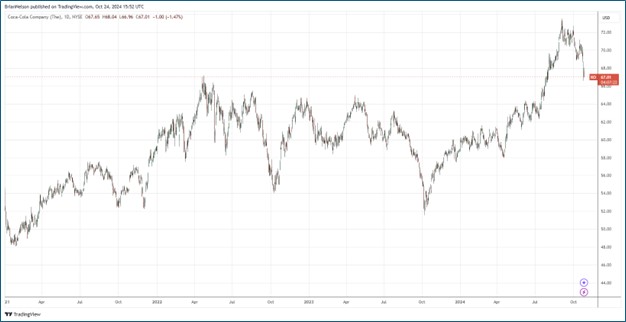

Image: Coca-Cola’s shares have done quite well the past couple years.

Coca-Cola’s organic growth continues to be impressive, and the firm’s non-GAAP numbers show expansion in the core business. Still, it’s hard for us to get excited about a company reporting unadjusted net revenue declines, with global unit case volume also declining in the period. We think Coca-Cola retains its place as a top blue chip stock, but we think there are better ideas for consideration in the newsletter portfolios. Our fair value estimate stands at $61 per share.

-

Honeywell Adjusts Full Year 2024 Guidance

Honeywell Adjusts Full Year 2024 Guidance

Oct 24, 2024

-

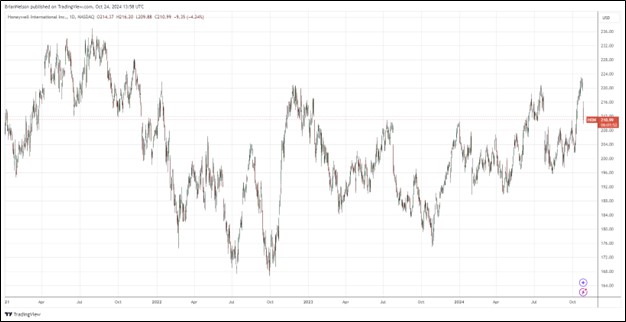

Image: Honeywell’s shares have traded sideways the past couple years.

Honeywell has a lot of moving parts these days. The company closed its $1.9 billion acquisition of CAES Systems and $1.8 billion acquisition of Air Products’ LNG business, while it plans to spin off its Advanced Materials business and exit its PPE business. We’re big fans of Honeywell’s aerospace division, which recorded its ninth consecutive quarter of double-digit organic growth thanks to strong commercial original equipment and solid growth in commercial aftermarket. Though the firm reduced its revenue and free cash flow outlook for 2024, we like the long-term story at Honeywell, and the company remains a core holding in the Dividend Growth Newsletter portfolio. Our fair value estimate stands at $216 per share.

|