|

|

Recent Articles

-

Republic Services Pricing Strength Continues to be Evident

Republic Services Pricing Strength Continues to be Evident

Oct 30, 2024

-

Image Source: Republic Services.

Year-to-date, Republic Services returned $834.3 million to shareholders in the form of $329.5 million of share buybacks and $504.8 million in dividends paid. Looking to 2024, Republic Services now expects revenue near the low end of its 2024 guidance range ($16.075-$16.125 billion) and adjusted EBITDA at the high end of the range ($4.9-$4.925 billion). We like Republic Services moaty business model and its pricing strength, and the company remains a core holding in the newsletter portfolios.

-

Chipotle Targets 7,000 Restaurants in North America

Chipotle Targets 7,000 Restaurants in North America

Oct 30, 2024

-

For 2024, management is targeting full-year comparable restaurant sales growth in the mid to high-single digit range, while it adds 285-315 new company-operated restaurant openings with 80% having a Chipotlane. For 2025, Chipotle is targeting opening 315-345 company-operated restaurants with over 80% having a Chipotlane. Though comparable restaurant sales were lower than the consensus forecast in the third quarter, we like Chipotle’s long-term plans calling for 7,000 restaurants in North America, up from the 3,600 restaurants it currently has in the U.S., Canada, the United Kingdom, France, Germany, and Kuwait. Chipotle remains a key idea in the Best Ideas Newsletter portfolio.

-

Visa Reports Strong Fiscal Fourth Quarter Results

Visa Reports Strong Fiscal Fourth Quarter Results

Oct 30, 2024

-

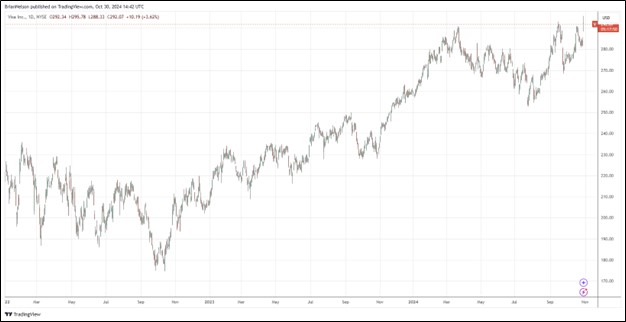

Image: Visa’s shares look poised to break out to new all-time highs.

At the end of the quarter, Visa’s cash and investment securities totaled $17.7 billion, while long-term debt stood at $20.8 billion, reflecting a modest but manageable net debt position. Visa returned $6.8 billion to investors in the form of share repurchases and dividends during the fiscal fourth quarter, while the board increased Visa’s quarterly cash dividend 13%, to $0.59 per share. For the twelve months ended September 30, Visa put up a 65.7% operating margin and a free cash flow margin of 52%. We continue to like Visa as a top idea in the Best Ideas Newsletter portfolio. The high end of our fair value estimate range stands at $329 per share.

-

Momentum Across Alphabet’s Business Is “Extraordinary”

Momentum Across Alphabet’s Business Is “Extraordinary”

Oct 29, 2024

-

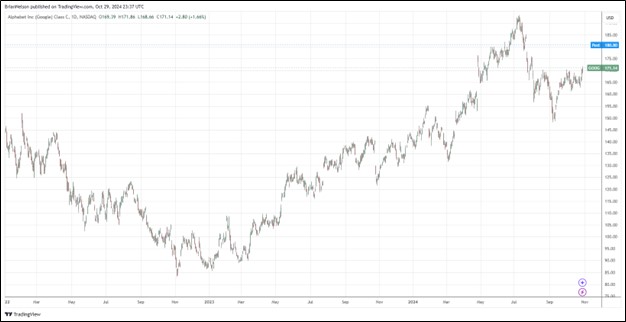

Image: Shares of Alphabet look poised to break out to all-time highs.

Alphabet ended the quarter with $93.2 billion in total cash and marketable securities and long-term debt of $12.3 billion. Cash flow from operations in the quarter was $30.7 billion, while capital spending totaled $13.1 billion, resulting in robust free cash flow generation of $17.6 billion. Year-to-date, cash flow from operations was $86.2 billion on capital spending of $38.3 billion, good for free cash flow generation of $47.9 billion. Alphabet also announced a cash dividend of $0.20 per share, to be paid to each of the company’s Class A, Class B, and Class C shares. Our fair value estimate stands at $188 per share.

|