|

|

Recent Articles

-

Berkshire Hathaway’s Operating Earnings, Free Cash Flow Fall in Third Quarter

Berkshire Hathaway’s Operating Earnings, Free Cash Flow Fall in Third Quarter

Nov 4, 2024

-

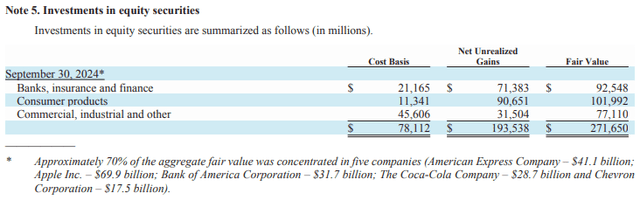

Image: Berkshire Hathaway has reduced its stake in Apple and Bank of America.

Berkshire’s third quarter operating results weren’t great, and the firm noted that it expects pre-tax incurred losses from Hurricane Milton to be between $1.3-$1.5 billion and be reflected in its fourth quarter earnings. Free cash flow has faced some pressure during the first nine months of the year, and Buffett continues to cash out of Apple and Bank of America. Berkshire’s cash balance continues to swell, perhaps indicating that Buffett views the market as overheated at the moment. Total shareholders’ equity was $631.8 billion at the end of September, translating into a price-to-book ratio of 1.54. Shares of Berkshire are not cheap, in our view, but the company remains a key holding in the Best Ideas Newsletter portfolio.

-

Amazon’s Operating Profit Surprises to the Upside

Amazon’s Operating Profit Surprises to the Upside

Nov 4, 2024

-

Image: Amazon’s shares have done quite well since the beginning of 2023.

Looking to the fourth quarter of 2024, Amazon's net sales are expected to be between $181.5 billion and $188.5 billion, growing 7%-11% compared with the fourth quarter of 2023 and the midpoint slightly below consensus of $186.4 billion. The top line guidance assumes an unfavorable impact of roughly 10 basis points from currency fluctuations. Operating income in the quarter is targeted in the range of $16-$20 billion, compared with $13.2 billion in the fourth quarter of 2023 and the midpoint above consensus of $17.5 billion. Amazon ended the quarter with $88 billion in cash and marketable securities and $54.9 billion in long-term debt.

-

Meta Platforms Expects Significant Capex Growth in 2025

Meta Platforms Expects Significant Capex Growth in 2025

Nov 4, 2024

-

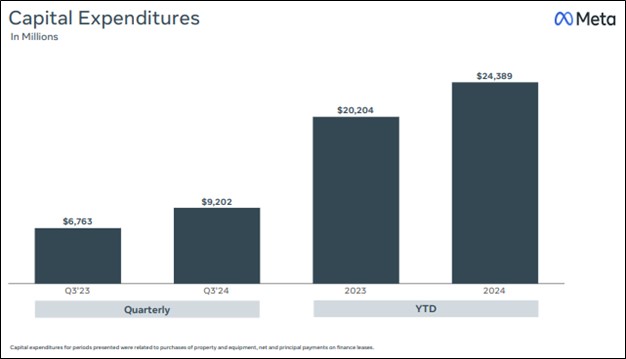

Image: Meta’s capital spending continues to be on the rise, but its free cash flow generation remains robust.

Meta Platforms put up excellent third quarter results with strong free cash flow generation. The company’s balance sheet also remains very healthy with a substantial net cash position. However, management spoke of continued capital spending growth, which will weigh on free cash flow generation in the coming periods. The company also noted cost pressures in depreciation and operating expense growth for next year, putting a damper on the excitement surrounding its third-quarter earnings beat. Though cost pressures should be expected, Meta Platforms remains a net-cash-rich, free-cash-flow generating powerhouse.

-

Apple’s Fiscal Fourth Quarter Report Shows Strength

Apple’s Fiscal Fourth Quarter Report Shows Strength

Nov 1, 2024

-

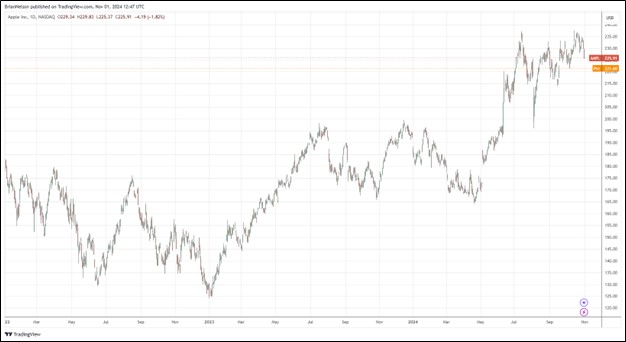

Image: Apple’s shares continue to flirt with all-time highs.

Apple ended the quarter with $157.7 billion of cash and marketable securities. Total debt totaled $106.6 billion at the end of the quarter. For the twelve months ended September 28, cash flow from operations advanced to $118.3 billion from $110.5 billion in last year’s period, while capital spending fell to $9.4 billion from $11 billion in the year-ago period. Free cash flow of $108.8 billion in the fiscal year easily covered the company’s cash dividends paid of $15.2 billion. Apple bought back $94.9 billion in common stock during the fiscal year. Our fair value estimate stands at $226 per share.

|