|

|

Recent Articles

-

Salesforce Posts Mixed Results, Agentforce Capitalizing on AI Demand

Salesforce Posts Mixed Results, Agentforce Capitalizing on AI Demand

Dec 4, 2024

-

Image Source: Salesforce.

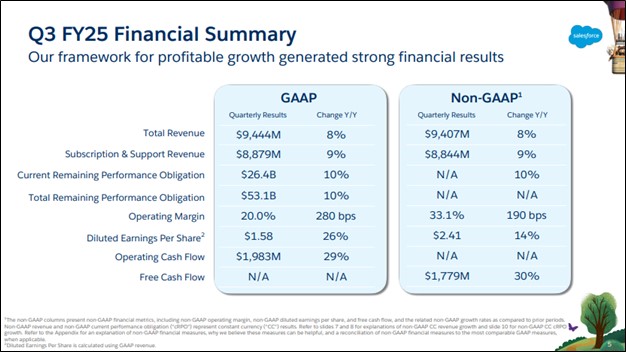

Looking to full year 2025 guidance, Salesforce raised the low end of its revenue expectations to $37.8-$38 billion, up 8%-9% year-over-year, while it maintained its Subscription & Support revenue growth guidance of approximately 10% in constant currency. The company also raised its full-year GAAP operating margin guidance to 19.8% and its non-GAAP operating margin guidance to 32.9%. Salesforce raised its full year 2025 operating cash flow growth guidance to the range of 24%-26%. Non-GAAP diluted earnings per share is expected in the range of $9.98-$10.03 for the year (midpoint of $10.01), below the consensus estimate of $10.11. Salesforce is a net cash rich, free cash flow generating powerhouse, and the company continues to deliver for shareholders.

-

Union Pacific’s Free Cash Flow Generation Remains Robust

Union Pacific’s Free Cash Flow Generation Remains Robust

Dec 2, 2024

-

Image Source: Union Pacific.

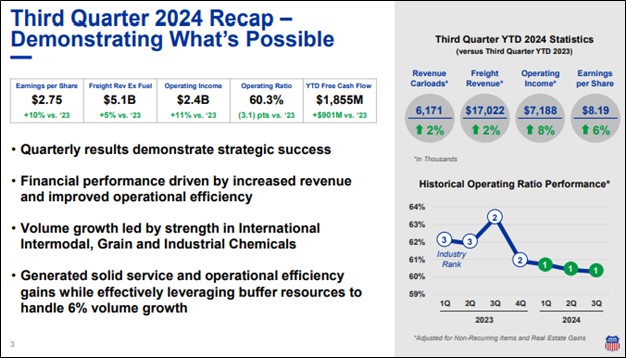

Union Pacific ended the third quarter with $947 million in cash and cash equivalents, while total debt stood at $31.4 billion. Year-to-date, cash provided by operating activities increased to $6.7 billion from $6 billion in the same period last year, while capital expenditures fell to $2.5 billion from $2.6 billion in the year-ago period. Year-to-date free cash flow was $4.2 billion, well in excess of cash dividends paid of $2.4 billion over the same time period. Management expects fourth quarter results to be “consistent sequentially from the third quarter, while improving year-over-year versus the fourth quarter 2023.” Shares yield 2.2%. The high end of our fair value estimate range for Union Pacific is $264 per share.

-

Verizon Covering Dividends with Free Cash Flow

Verizon Covering Dividends with Free Cash Flow

Dec 2, 2024

-

Image Source: Verizon.

Looking to 2024, Verizon expects total wireless service revenue growth in the range of 2%-3.5%, adjusted EBITDA growth of 1%-3% and adjusted earnings per share of $4.50-$4.70. The company’s total unsecured debt at the end of the third quarter was $126.4 billion, a $1.1 billion sequential increase, but a level that is lower compared to the end of the same period last year. Net unsecured debt to consolidated adjusted EBITDA was 2.5 times. Verizon’s Dividend Cushion ratio is weighed down by its massive net debt load, but the dividend is supported by free cash flow. Shares yield 6.1%. Our fair value estimate stands at $44 per share.

-

Dick’s Sporting Goods Raises 2024 Guidance

Dick’s Sporting Goods Raises 2024 Guidance

Dec 2, 2024

-

Image Source: Dick’s Sporting Goods.

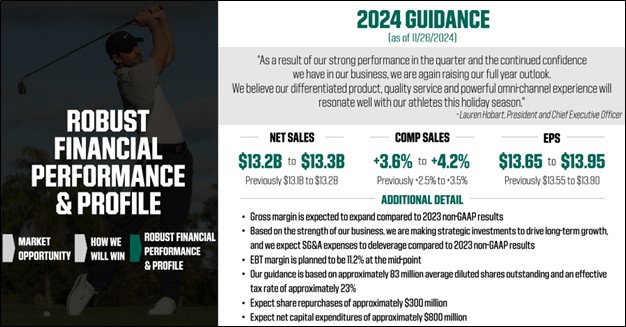

For the 39 weeks ended November 2, 2024, Dick’s Sporting Goods’ cash flow from operations was $680.3 million, while capital spending came in at $565.6 million, resulting in free cash flow of $114.7 million. Looking to all of 2024, management raised its guidance for comparable store sales growth to the range of 3.6%-4.2%, up from 2.5%-3.5% previously. Net sales are targeted at $13.2-$13.3 billion, up from $13.1-$13.2 billion previously. Dick’s Sporting Goods also raised its 2024 earnings per diluted share guidance to the range of $13.65-$13.95, up from $13.55-$13.90 previously. We liked Dick’s Sporting Goods’ quarterly performance and increased full year guidance, and the stock remains a key idea in the Dividend Growth Newsletter portfolio.

|