|

|

Recent Articles

-

Lowe’s Experiences Softness in Bigger Ticket Discretionary Demand

Lowe’s Experiences Softness in Bigger Ticket Discretionary Demand

Jan 8, 2025

-

Image: Lowe’s shares have rallied nicely since the beginning of 2023.

Buoyed in part by anticipated modest storm-related demand in the fourth quarter, management expects total sales for the full year 2024 of $83.0-$83.5 billion (was $82.7-$83.2 billion)—consensus was $82.99 billion--and comparable sales to be between -3.0% to -3.5% (was -3.5% to -4.0%). Its adjusted operating margin for the year is now targeted in the range of 12.3%-12.4% (was 12.4%-12.5%), while adjusted diluted earnings per share is expected in the range of $11.80-$11.90 (was $11.70-$11.90), the midpoint above consensus of $11.81. Our fair value estimate of $242 for Lowe’s shares is roughly in-line with where the firm’s equity is trading, and while its recently raised guidance was well-received, we remain on the sidelines with respect to the company in the newsletter portfolios. Shares yield 1.9%.

-

Target Expects Ho Hum Holiday Results

Target Expects Ho Hum Holiday Results

Jan 6, 2025

-

Image Source: Target.

For the holiday fourth quarter, Target expects 1.5% comparable sales growth with GAAP and adjusted earnings per share in the range of $1.85-$2.45 (versus $2.64 consensus), translating to a full year expected GAAP and adjusted earnings per share range of $8.30-$8.90. The midpoint of the guidance range was down compared to its prior outlook in the range of $9.00-$9.70 and the consensus mark of $9.52. Target appears to be losing share against Walmart, Amazon and Costco, and there is no clear path to regaining it. Target’s shares yield 3.3% at the time of this writing.

-

HP Inc. Sets Q1'25 Expectations Below Consensus, Dividend Looks Healthy

HP Inc. Sets Q1'25 Expectations Below Consensus, Dividend Looks Healthy

Jan 6, 2025

-

Image Source: HP Inc.

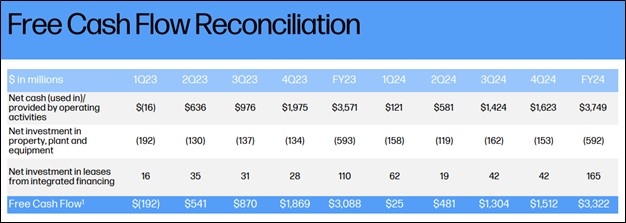

For fiscal 2025, HP Inc. expects non-GAAP diluted net earnings per share to be in the range of $3.45-$3.75, the midpoint in-line with the consensus forecast of $3.60. Free cash flow is targeted in the range of $3.2-$3.6 billion on the year, the midpoint up from $3.3 billion last fiscal year and well in excess of the company’s annual run-rate dividends of ~$1.1 billion. During fiscal 2024, the company returned $2.1 billion via share repurchases. HP ended the quarter with $3.3 billion in cash and cash equivalents and $9.7 billion in short-and long-term debt. HP is set to benefit from an AI PC refresh, and even though expectations weren’t set as high as what the market was looking for in the first quarter of fiscal 2025, HP Inc. remains a strong dividend payer. Shares yield 3.5% at the time of this writing.

-

Keeping the Horse Before the Cart: Valuentum’s Economic Castle™ Rating

Keeping the Horse Before the Cart: Valuentum’s Economic Castle™ Rating

Jan 5, 2025

-

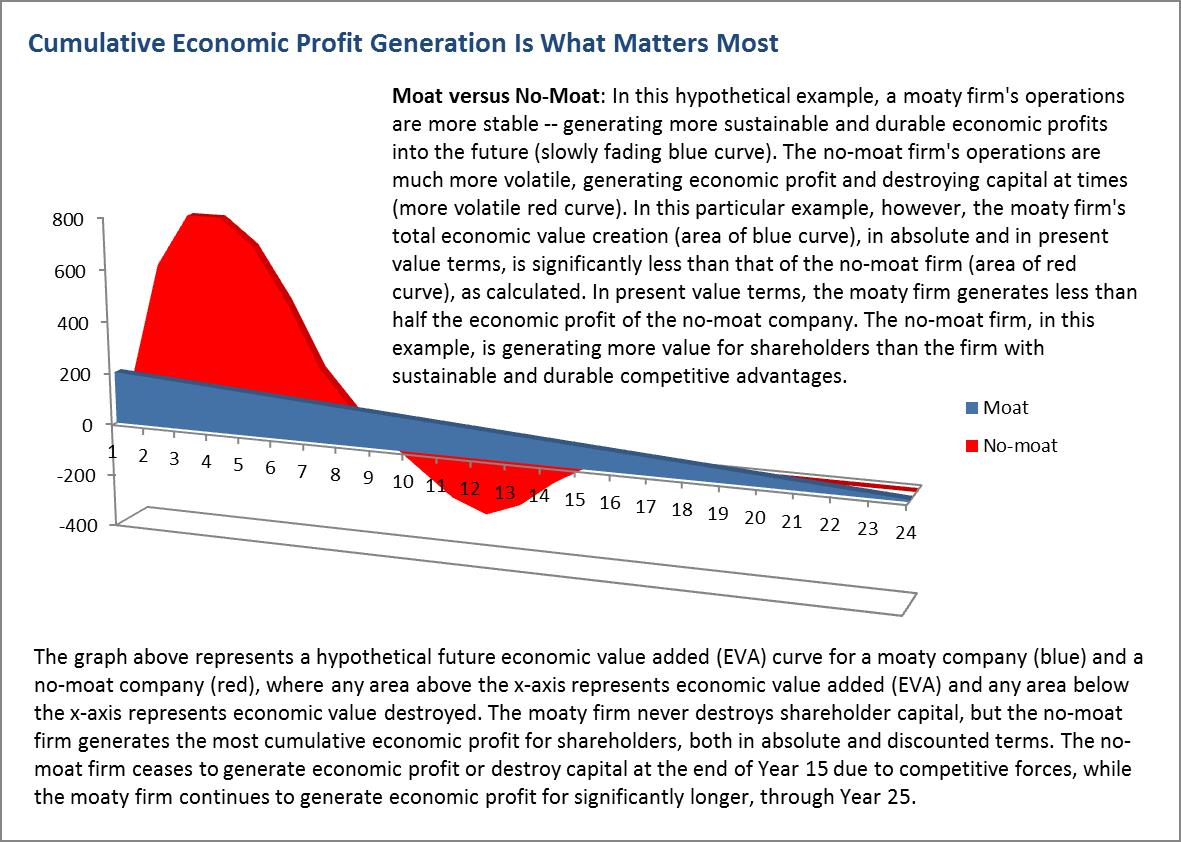

Image shown: An examination of the problem that might arise by focusing exclusively on companies that have economic moats, or sustainable and durable competitive advantages.

Without an economic castle, an economic moat doesn’t matter. Let's examine Valuentum's Economic Castle™ rating.

|