|

|

Recent Articles

-

Walmart Delivers Another Strong Quarter

Walmart Delivers Another Strong Quarter

Nov 20, 2025

-

Image Source: Walmart.

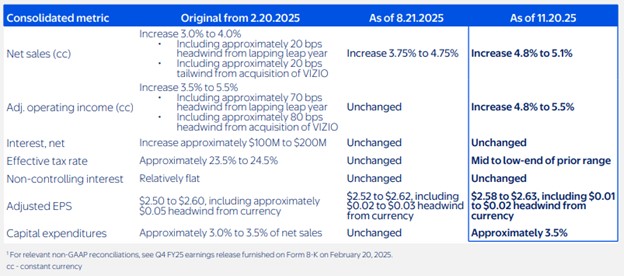

Walmart’s operating cash flow came in at $27.5 billion in the third quarter, an increase of $4.5 billion from last year’s tally. Free cash flow was $8.8 billion in the quarter, an increase of $2.6 billion from the same period a year ago. Year-to-date, Walmart repurchased 73.5 million shares for roughly $7 billion. Cash and cash equivalents came in at $10.6 billion, with total debt of $53.1 billion. At the end of the quarter, inventory totaled $65.4 billion, an increase of $2.1 billion or 3.2%. Looking to all of fiscal year 2026, Walmart raised its outlook for growth in net sales to the range of 4.8%-5.1% and adjusted operating income to the range of 4.8%-5.5%, both in constant currency. Adjusted earnings per share is expected to be between $2.58-$2.63, which includes a currency headwind of a penny or two. Shares yield 0.9% at the time of this writing.

-

Nvidia Says “Blackwell Sales Are Off the Charts”

Nvidia Says “Blackwell Sales Are Off the Charts”

Nov 20, 2025

-

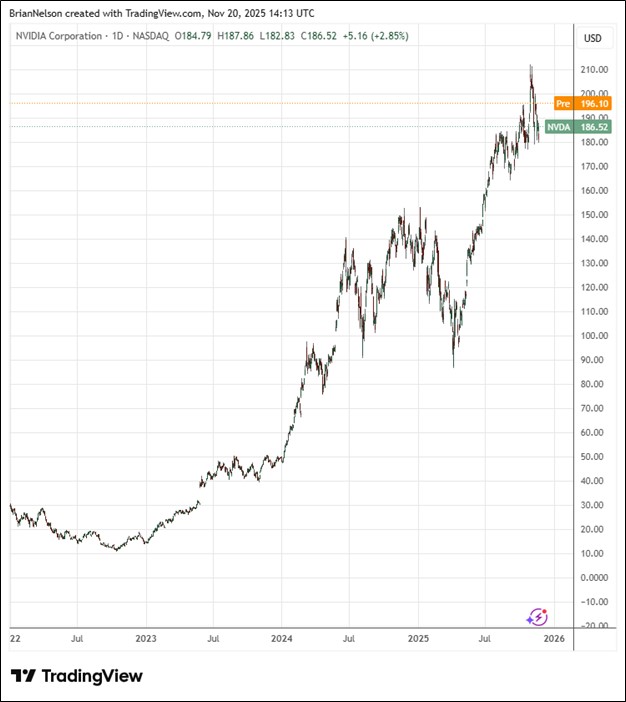

Image Source: TradingView.

In the first nine months of fiscal 2026, Nvidia returned $27 billion to shareholders in the form of share buybacks and cash dividends. At the end of the third quarter, Nvidia had $62.2 billion remaining under its share repurchase authorization. Looking to the fiscal fourth quarter, management is targeting revenue to be $65 billion, plus or minus 2% (versus $62 billion consensus), with non-GAAP gross margin of 75%, plus or minus 50 basis points. We think Nvidia is still in the early innings of an AI build cycle, and the firm remains a core idea in the Best Ideas Newsletter portfolio.

-

Public Storage Raises Outlook for Second Consecutive Quarter

Public Storage Raises Outlook for Second Consecutive Quarter

Nov 17, 2025

-

Image Source: TradingView.

Looking to 2025, Public Storage's revenue growth is anticipated in the range of -0.3%-0.3%, narrowed from the prior range of -1.3%-0.8%. Expense growth is targeted in the range of 1.8%-2.8%, down from the prior range of 2.3%-3.0%. Net operating income is now expected to decline 1.2%-0.2% versus a range of down 2.6% and up 0.3% previously. Non-same store net operating income is expected in the range of $475-$485 million, up from the range of $465-$475 million. Core FFO per share is now targeted in the range of $16.70-$17.00, up 0.2%-2.0% and the lower end of the guidance range raised from $16.45-$17.00. Public Storage is one of our favorite REITs, with the company yielding 4.4% at the time of this writing.

-

Republic Services’ Pricing Strength Drives Results

Republic Services’ Pricing Strength Drives Results

Nov 17, 2025

-

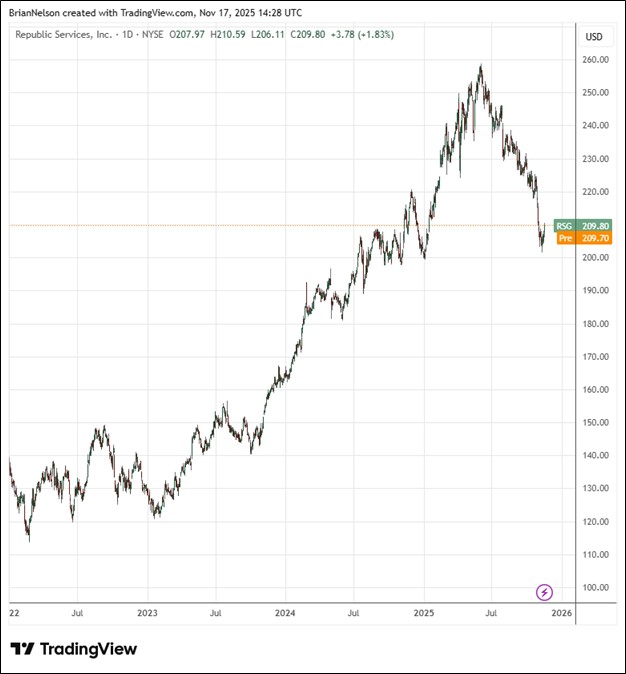

Image Source: TradingView.

Republic Services continues to price ahead of cost inflation. In the quarter, core price on total revenue increased 5.9%, while revenue growth from average yield on total revenue was 4.0% as volume decreased total revenue by 0.3%. Year-to-date cash flow from operating activities was $3.32 billion, while adjusted free cash flow came in at $2.19 billion. Year-to-date cash returned to shareholders was $1.13 billion, which included $584 of share buybacks and $544 million of dividends paid. Republic ended the quarter with $13.3 billion in total debt and $84 million in cash and cash equivalents. We like Republic Services’ pricing power, and the garbage hauler remains a core holding in the newsletter portfolios.

|