|

|

Recent Articles

-

Procter & Gamble on Track to Deliver on Fiscal Year Guidance

Procter & Gamble on Track to Deliver on Fiscal Year Guidance

Jan 23, 2025

-

Image Source: Procter & Gamble.

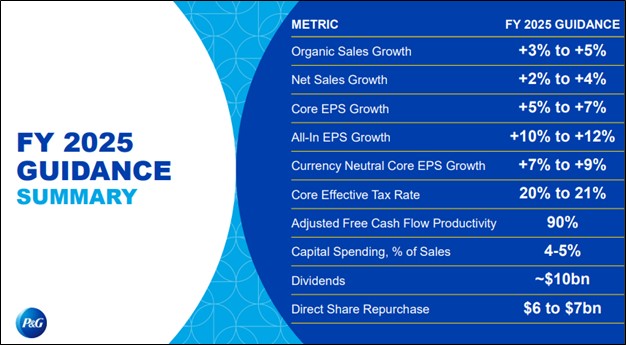

Looking to fiscal 2025 guidance, all-in sales growth is expected in the range of 2%-4% versus the prior year. Organic growth for the fiscal year is targeted in the range of 3%-5%. P&G reiterated its core earnings per share growth for the fiscal year to be in the range of 5%-7%, equating to a range of $6.91-$7.05, or a 6% increase at the midpoint. In fiscal 2025, P&G expects to pay around $10 billion in dividends and repurchase $6-$7 billion of common shares. At the time of this writing, shares of P&G yield ~2.5%.

-

Kinder Morgan Is Now Covering Cash Dividends Paid with Free Cash Flow

Kinder Morgan Is Now Covering Cash Dividends Paid with Free Cash Flow

Jan 23, 2025

-

Image: Kinder Morgan’s shares have been on a tear after the midstream energy giant reports healthier free cash flow that covers cash dividends paid.

Kinder Morgan is doing a much better job covering dividends with traditional free cash flow these days. For the three months ended December 31, 2024, cash flow from operations was $1.51 billion, with capital expenditures coming in at $772 million, resulting in free cash flow of $738 million, which was in excess of the company’s cash dividends paid of $642 million in the quarter. For the year ended December 31, 2024, free cash flow was $3 billion, which was in excess of cash dividends paid of $2.6 billion, resulting in free cash flow after cash dividends paid of $449 million.

-

Netflix Records Biggest Quarter of Net Adds in Its History

Netflix Records Biggest Quarter of Net Adds in Its History

Jan 22, 2025

-

Image Source: Netflix.

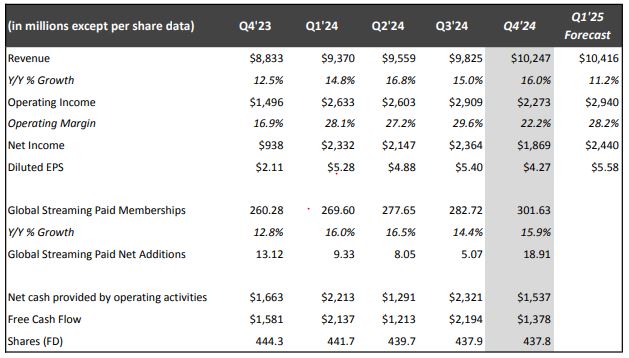

Looking to 2025, Netflix expects revenue to be between $43.5-$44.5 billion (12%-14% year-over-year growth), up $500 million from its prior forecast (despite foreign currency headwinds) and an operating margin of 29%, up one percentage point from its prior forecast and two percentage points higher than the 27% operating margin in 2024. Management noted that the return in 2025 of its biggest shows (Squid Game, Wednesday and Stranger Things) gives it optimism heading into the new year.

-

UnitedHealth Group’s 2025 Outlook Remains Robust

UnitedHealth Group’s 2025 Outlook Remains Robust

Jan 17, 2025

-

Image: UnitedHealth Group’s shares have been choppy the past couple years.

UnitedHealth Group reaffirmed its outlook for 2025 that it established in December 2024. Revenues for 2025 are anticipated in the range of $450-$455 billion (the midpoint below consensus of $455.6 billion), net earnings are targeted in the range of $28.15-$28.65, and adjusted net earnings are expected in the range of $29.50-$30.00 per share (the midpoint below consensus of $29.86 per share). Cash flow from operations is anticipated to increase to the range of $32-$33 billion, up materially from 2024. We continue to like UnitedHealth’s growth potential and free cash flow generation, and the company remains a core holding in the Best Ideas Newsletter portfolio.

|