|

|

Recent Articles

-

Lennar Sees Softness in Housing Market

Lennar Sees Softness in Housing Market

Jun 19, 2025

-

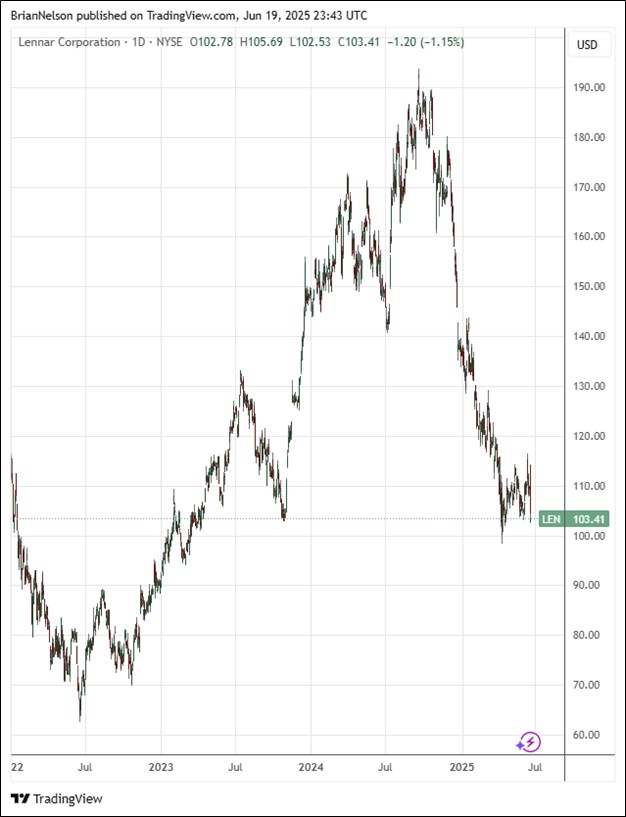

Image Source: TradingView.

On June 16, Lennar Corp. reported mixed fiscal second quarter results with revenue beating the consensus forecast but non-GAAP earnings per share missing the consensus mark. Total revenues fell to $8.4 billion in the quarter from $8.8 billion in the year-ago period, while second quarter net earnings, excluding mark-to-market losses on technology investments were $499 million, or $1.90 per share, compared to $3.38 per share in the same period a year ago.

-

Adobe Raises Guidance Due to AI Strength

Adobe Raises Guidance Due to AI Strength

Jun 19, 2025

-

Image: Adobe’s stock has been choppy the past few years.

Adobe’s cash flow from operations was $2.19 billion in the fiscal second quarter, and the firm exited the period with $19.69 billion Remaining Performance Obligations (RPO), with current accounting for 67% of them. During the quarter, Adobe repurchased approximately 8.6 million shares. Looking to all of fiscal year 2025, total revenue is targeted in the range of $23.5-$23.6 billion, better than the consensus estimate of $23.45 billion, while non-GAAP earnings per share is expected in the range of $20.50-$20.70 versus consensus of $20.36. We like Adobe's fundamentals, but don't include shares in any newsletter portfolio.

-

Dividend Increases/Decreases for the Week of June 13

Dividend Increases/Decreases for the Week of June 13

Jun 13, 2025

-

Let's take a look at firms raising/lowering their dividends this week.

-

Oracle Expects Accelerated Growth in Fiscal 2026

Oracle Expects Accelerated Growth in Fiscal 2026

Jun 12, 2025

-

Image: Oracle’s shares have broken out to new all-time highs.

On June 11, Oracle reported better than expected fourth quarter fiscal 2025 results with revenue and non-GAAP earnings per share exceeding the consensus forecasts. Total revenue was up 11% in the quarter, while the company posted non-GAAP earnings per share of $1.70, up from $1.63 in last year’s quarter and better than the consensus forecast of $1.64. Non-GAAP operating income was $7.0 billion, up 5% in USD and up 4% in constant currency. Fourth quarter remaining performance obligations jumped 41%, to $138 billion. Operating cash flow was $20.8 billion during fiscal year 2025, up 12% in USD.

|