|

|

Recent Articles

-

Sonos Expected to Continue Growing Rapidly; Margin Concerns Remain Key Issue

Sonos Expected to Continue Growing Rapidly; Margin Concerns Remain Key Issue

Feb 7, 2022

-

Image Source: Sonos Inc – Fourth Quarter of Fiscal 2021 IR Earnings Presentation.

Sonos' financial performance staged an impressive turnaround in fiscal 2021. The company exited fiscal 2021 with a $640 million net cash position and generated $208 million in free cash flow that fiscal year. Sonos is leveraging its financial strength by buying back its stock. The firm is also considering potential M&A activities that could be used to enhance its growth runway, with an eye towards the potential for Sonos to expand into the premium wireless headphone space. Sonos forecasts that it will grow its revenues by double-digits annually in fiscal 2022, though its margins are expected to face moderate headwinds this fiscal year. Shares of SONO have faced sizable selling pressures of late as concerns mount over its medium-term outlook. We love the company's products, but we're cautious on the stock in the near-term given its cloudy EBITDA outlook. That said, we see potential upside in the stock to the high-$20s from a valuation perspective (modestly above where shares are trading at this time).

-

Weekly: Why We Missed Big on T and FB; Overpriced Staples, Our Call To Action; and More!

Weekly: Why We Missed Big on T and FB; Overpriced Staples, Our Call To Action; and More!

Feb 6, 2022

-

In this Valuentum Weekly, in video form, President of Investment Research Brian Nelson, CFA, explains why Valuentum missed big on T and FB, how volatility on names with huge market caps is spiking recklessly, and why the call to action in the book Value Trap remains as relevant as ever given current incentives.

-

Our Thoughts on Big Pharma’s Calendar Fourth Quarter Earnings Reports

Our Thoughts on Big Pharma’s Calendar Fourth Quarter Earnings Reports

Feb 5, 2022

-

Image Source: Merck & Company Inc – Fourth Quarter of 2021 IR Earnings Presentation.

We include the Health Care Select Sector SPDR Fund ETF in the Best Ideas Newsletter and Dividend Growth Newsletter portfolios to gain broad exposure to the health care sector. Instead of betting on one entity's pipeline (which could be hit or miss), we like the exposure to lots and lots of "shots on goal" when it comes to the vast collective pipeline in the XLV ETF. We wrote up the calendar fourth-quarter results of the top two weightings in the XLV ETF, United Health and Johnson & Johnson recently. We continue to like UNH a lot, but JNJ's story has become a lot more complicated for dividend growth investors in recent months. Let's have a look at some of the other key holdings in the XLV ETF, however. We'll cover the calendar fourth-quarter earnings reports from four heavyweights in the pharmaceutical arena (ABBV, GILD, LLY, and MRK). Additionally, we'll cover the performance of some of their top-selling treatments that have already received regulatory approval from the U.S. Food and Drug Administration (‘FDA’) and key clinical trials that could produce new commercial growth opportunities. The coronavirus (‘COVID-19’) pandemic has become more manageable during the past year or so after several vaccines and therapeutics for the virus were discovered in record time. While headwinds from the pandemic remain, the health care sector is steadily recovering and this space is home to plenty of attractive opportunities for capital appreciation and income seeking investors. XLV, UNH, JNJ, and VRTX are a few that we like a lot.

-

Undervalued PINS, SNAP Rallying; FB Incredibly Mispriced, and Refreshed Consumer Discretionary Reports

Undervalued PINS, SNAP Rallying; FB Incredibly Mispriced, and Refreshed Consumer Discretionary Reports

Feb 4, 2022

-

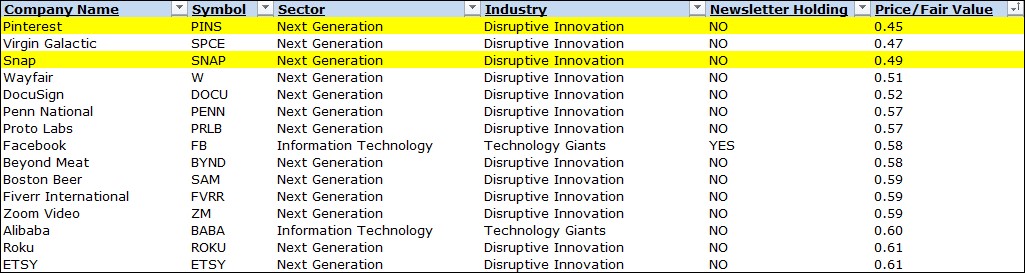

Image: Valuentum's Periodic Screener, February 4.

Two of the most undervalued stocks in our coverage Pinterest, Inc. and Snap Inc. are indicated to rally hard February 4 after issuing positive earnings reports, providing further evidence of the importance of the discounted cash flow process and the magnet that intrinsic value estimates are to stock prices.

|