|

|

Recent Articles

-

Johnson & Johnson’s Outlook Improving, Steadily Putting Legal Issues Behind It

Johnson & Johnson’s Outlook Improving, Steadily Putting Legal Issues Behind It

Mar 23, 2022

-

Image Source: Johnson & Johnson – Fourth Quarter of Fiscal 2021 IR Earnings Presentation.

On a price-only basis, shares of Johnson & Johnson are up ~2% year-to-date through the end of regular trading hours March 22, while the S&P 500 is down ~6% during this period. We include shares of Johnson & Johnson as an idea in both the Best Ideas Newsletter and Dividend Growth Newsletter portfolios, and we love the company's resiliency in the face of whatever challenges are thrown at it. Investors now have a much better idea of what Johnson & Johnson’s legal settlement liabilities could end up looking like as compared to where things stood a year ago, and while the pending spinoff of its consumer health operations has fundamentally altered its proposition as a straightforward dividend growth opportunity, the stock continues to hold up in an otherwise tumultuous environment. We're not counting J&J out by any means, and the stock remains a core holding in both the simulated Best Ideas Newsletter portfolio and simulated Dividend Growth Newsletter portfolio.

-

Dividend Growth Idea Home Depot Raises Payout as Its Growth Story Continues

Dividend Growth Idea Home Depot Raises Payout as Its Growth Story Continues

Mar 22, 2022

-

Image Shown: Dividend growth idea Home Depot Inc has put up strong financial performance of late. Image Source: Home Depot Inc – Fourth Quarter of Fiscal 2021 Supplemental Material.

Demand for home improvement and construction activities remains strong according to Home Depot Inc, an idea in the Dividend Growth Newsletter portfolio. When Home Depot reported its fourth quarter earnings for fiscal 2021 (period ended January 30, 2022) in February 2022, the company beat both consensus top- and bottom-line estimates. Home Depot also announced a 15% sequential increase in its dividend and issued out favorable guidance for fiscal 2022 in conjunction with its latest earnings report. The company’s new quarterly payout sits at $1.90 per share or $7.60 per share on an annualized basis. Shares of HD yield ~2.3% as of this writing.

-

ASML Holding Is a Tremendous Enterprise, Holds Fantastic Competitive Position

ASML Holding Is a Tremendous Enterprise, Holds Fantastic Competitive Position

Mar 21, 2022

-

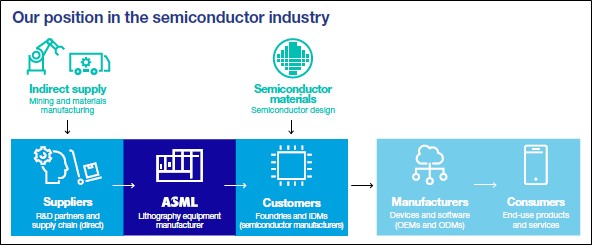

Image Source: ASML Holding NV – 2021 Annual Report.

The Dutch firm ASML Holding NV makes the photolithography systems used by semiconductor foundries to produce “chips” that power the modern economy. In part due to its immense technological lead over its competitors, ASML Holding effectively has a monopoly at the high end of its industry, meaning its photolithography systems are required to produce the most advanced semiconductor components. The company also offers semiconductor equipment services and stands to gain immensely from ongoing growth in its installed equipment base. We're huge fans of the company.

-

Dividend Increases/Decreases for the Week March 18

Dividend Increases/Decreases for the Week March 18

Mar 18, 2022

-

Let's take a look at companies that raised/lowered their dividend this week.

|