|

|

Recent Articles

-

Dividend Growth Idea Qualcomm Beats Estimates; Near Term Guidance Incredibly Bright

Dividend Growth Idea Qualcomm Beats Estimates; Near Term Guidance Incredibly Bright

May 12, 2022

-

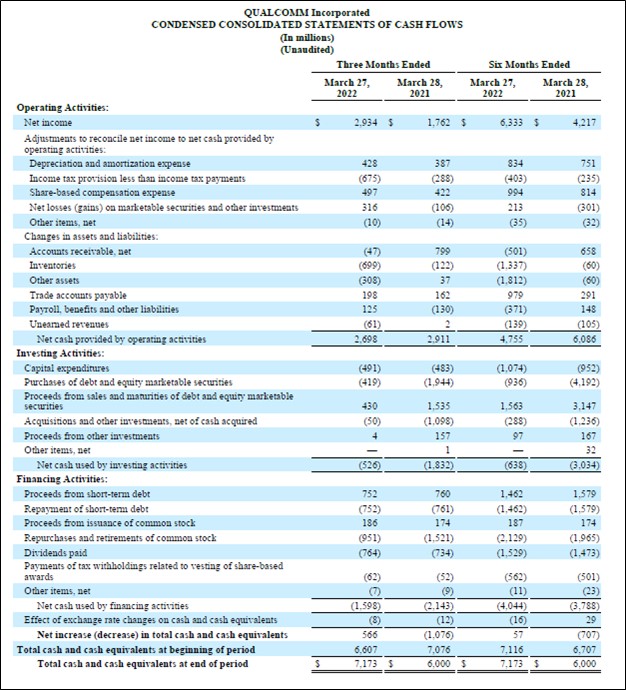

Image Shown: Dividend growth idea Qualcomm Inc has a stellar cash flow profile. Image Source: Qualcomm Inc – 10-Q SEC filing covering the Second Quarter of Fiscal 2022.

Qualcomm recently reported second quarter earnings for fiscal 2022 (period ended March 27, 2022) that beat both consensus top- and bottom-line estimates. The company is a leader in the technologies relating to 5G wireless, Internet of Things (‘IoT’) trend, semi-autonomous and autonomous driving, and handset operations. We include Qualcomm as an idea in the Dividend Growth Newsletter portfolio as we view its dividend strength and payout growth outlook quite favorably. Shares of QCOM yield ~2.3% as of this writing. The firm’s latest earnings update and near term guidance reinforces our bullish view towards the name.

-

Domino’s Longer Term Growth Runway Intact, Chipotle's Free Cash Flow Remains Robust

Domino’s Longer Term Growth Runway Intact, Chipotle's Free Cash Flow Remains Robust

May 11, 2022

-

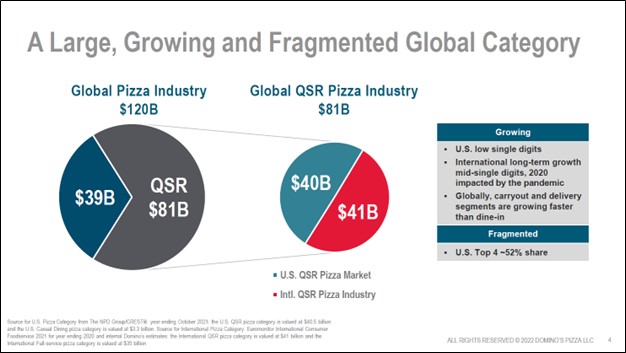

Image Source: Domino’s Pizza Inc – 2022 ICR Conference Presentation.

Domino’s Pizza is contending with serious inflationary pressures and headwinds from changing consumer spending habits as the worst of the coronavirus (‘COVID-19’) pandemic fades. We continue to view the firm’s longer term outlook quite favorably and appreciate its franchise-heavy business model (~98% of its stores are franchised), which enables Domino’s to generate substantial free cash flows in almost any operating environment. Our fair value estimate for Domino’s sits at $517 per share, and we include shares of DPZ as an idea in the Best Ideas Newsletter portfolio. Shares of DPZ yield ~1.3% as of this writing, offering incremental income generation upside potential to its favorable capital appreciation risk-reward scenario, in our view. Another one of our favorite restaurants, Chipotle Mexican Grill posted 9.0% year-over-year comparable restaurant sales growth in the first quarter of 2022. During Chipotle’s latest earnings call, management noted that in-store sales surged 33% due to the economy opening back up and consumers resuming “normal” dining activities. The firm’s digital sales held up relatively well and represented 42% of Chipotle’s total sales last quarter. During the period, Chipotle reported 16% year-over-year GAAP revenue growth and 18% year-over-year GAAP operating income growth as the firm effectively took advantage of its pricing power to get ahead of inflationary pressures. As with Domino's, we continue to like Chipotle as an idea in the Best Ideas Newsletter portfolio.

-

Ameresco Posts Solid First Quarter Earnings Update

Ameresco Posts Solid First Quarter Earnings Update

May 11, 2022

-

Image Source: Ameresco Inc – First Quarter of 2022 Earnings Press Release.

The rise of ESG investing and the political shift towards encouraging developments within the realm of green energy--from renewable energy projects to efforts to reduce water consumption and much more--has created numerous opportunities for investors. Ameresco offers energy efficiency solutions, infrastructure upgrades, and renewable energy solutions to its customers. The company also operates some of the renewable energy facilities it helps develop such as solar farms and biogas plants. Ameresco provides its services all over the globe, though the US remains its most important market (and the source of over 90% of its revenues). In the US, Ameresco will often help its clients secure the financing needed to fund relevant projects, particularly for its federal government customers. We include Ameresco as an idea in the ESG Newsletter portfolio and view its capital appreciation upside favorably. Due to Ameresco utilizing energy savings performance contracts (‘ESPC’), its financials can be a messy read. ESPCs enable its governmental customers in the US to finance infrastructure upgrades without needing to tap their capital budgets by taking advantage of the expected future energy cost savings. The company generally experiences large working capital builds on an annual basis due to growth in its federal ESPC receivables asset, a product of Ameresco’s overall business growing, making gauging its free cash flows a more difficult task.

-

ESG Newsletter Portfolio Idea Albemarle Beats Consensus Estimates and Raises Guidance

ESG Newsletter Portfolio Idea Albemarle Beats Consensus Estimates and Raises Guidance

May 9, 2022

-

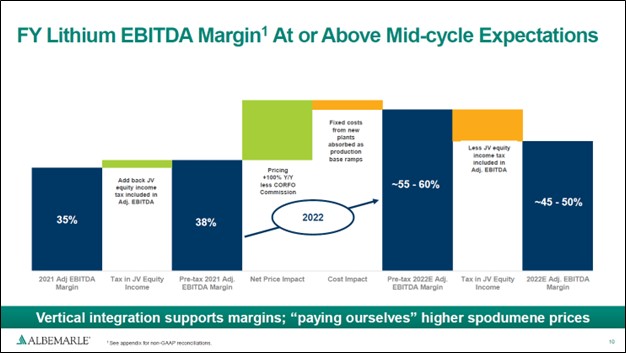

Image Shown: Albemarle Corporation’s lithium operations are benefiting from the favorable supply-demand dynamic and strong pricing of late, which is supporting its company-wide financial performance and outlook in a big way. Image Source: Albemarle Corporation – First Quarter of 2022 IR Earnings Presentation.

On May 4, Albemarle Corp reported first quarter 2022 earnings that beat both consensus top- and bottom-line estimates. Due primarily to the outperformance of its ‘Lithium’ business reporting segment, Albemarle boosted its full-year guidance for 2022 in a big way during its latest earnings update. Shares of ALB skyrocketed after the news broke, and we continue to be big fans of the company. We include Albemarle as an idea in the ESG Newsletter portfolio.

|