|

|

Recent Articles

-

Walmart’s Business Update Likely Means U.S. Is In Recession, But Near-Term Weakness Is Already Baked Into Stock Market

Walmart’s Business Update Likely Means U.S. Is In Recession, But Near-Term Weakness Is Already Baked Into Stock Market

Jul 27, 2022

-

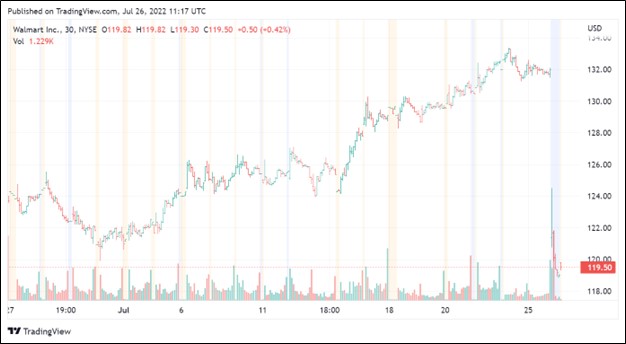

Image Shown: Shares of Walmart Inc dropped sharply during afterhours trading on July 25 as the retailer sharply cut its adjusted operating income and EPS guidance for the current fiscal year as inflationary pressures are taking a sizable toll on its bottom-line.

On July 25, Walmart Inc issued a business update that saw the retailer sharply cut its adjusted operating income and EPS guidance for fiscal 2023 (period ended January 2023), while boosting its consolidated net sales guidance. The company also adjusted its guidance for the fiscal second quarter. Shares of WMT plummeted during afterhours trading on July 25 as investors began to price in concerns over the retailer’s deteriorating margins. We anticipated ongoing weakness in Walmart’s business. On July 4, we released an audio report, “Nelson: I Have Been Wrong About the Prospect of Near-Term Inflationary-Driven Earnings Tailwinds,” highlighting our growing concerns about consumer-tied entities in the consumer staples and consumer discretionary spaces. We continue to expect troubles at the big box retailers and across the apparel space, more generally. Here’s what Nelson had to say in early July that remains applicable today: "I simply was not expecting the magnitude of such operating-income drops across consumer-tied companies, and while I think long-term inflation will eventually help drive higher nominal earnings in the longer run when conditions reach “normalization” again, the lag will be much longer than I originally thought. The numbers out of Walmart, Target, and Nike, for example, speak not only to tremendous earnings weakness, but also to the prospect of economic recession in the U.S." A recession in the U.S. is no reason for panic, however. For starters, we believe most of the fundamental weakness across retail is baked into the stock market, but more generally, investors should not worry about recessionary trends. But why? Well, implicitly embedded within a fair value estimate of a company are expectations of a “normal” economic cycle, complete with peak and trough, with the fair value estimate driven largely by mid-cycle expectations that feed into later stages of the model. The prospects for an unexpected recession in economic activity in the near term shouldn’t cause much of a change in the fair value estimate of a company either, given not only that a recession is already implicitly embedded in the fair value estimate, as noted, but also that near-term expectations don’t account for nearly as large of a contribution to the fair value estimate as long-term normalized expectations within the valuation construct. Most of a company’s intrinsic value is driven by its performance beyond year 5 in our model, or on a mid-cycle, going-concern basis. A company’s fair value estimate range (margin of safety) also captures various scenarios regarding economic activity, including a bull and bear case. With that said, recessionary tendencies may cause pricing impacts in the market in the event that consumers/investors use the stock market as a source of income by selling stocks, causing pressure on share prices, but the discounted cash flow (DCF) model already bakes in economic cyclicality and inevitable recessions, if not directly, then implicitly by targeting long-term mid-cycle expectations and via the application of the fair value estimate range. That’s why it’s great to be a long-term investor, scooping shares up when others are forced to sell in the near term, while holding them over long periods, letting compounding work its magic.

-

Johnson & Johnson’s Underlying Performance Remains Strong

Johnson & Johnson’s Underlying Performance Remains Strong

Jul 26, 2022

-

Image Source: Johnson & Johnson – Second Quarter of 2022 IR Earnings Presentation.

Johnson & Johnson reported second quarter 2022 earnings that beat both top- and bottom-line estimate consensus estimates. Johnson & Johnson maintained the midpoints of its full-year non-GAAP adjusted operational sales and earnings per share guidance during its latest earnings update but reduced its reported sales and earnings guidance due to headwinds stemming from a strengthening US dollar. We continue to like Johnson & Johnson as an idea in both the Best Idea Newsletter and Dividend Growth Newsletter portfolios. Shares of JNJ yield ~2.6% as of this writing. Please note that Johnson & Johnson is in the process of spinning off its ‘Consumer Health’ segment as a separate publicly traded entity by 2023 through a tax-free transaction. The firm is still working out the details and intends to finalize the organizational design of the new enterprise by the end of this year.

-

High-Yielding Life Storage Is One of Our Favorite Self-Storage REITs

High-Yielding Life Storage Is One of Our Favorite Self-Storage REITs

Jul 25, 2022

-

Image Source: Life Storage Inc – First Quarter of 2022 Earnings Press Release.

We are big fans of the self-storage industry as real estate investment trusts (‘REITs’) operating in this space have historically generated “excess” free cash flows after covering their total dividend obligations. Life Storage Inc, a self-storage REIT, is one of our favorite income generation ideas. As of this writing, shares of LSI yield ~3.9% after Life Storage pushed through a nice 8% sequential increase in its dividend in July 2022, bringing its quarterly payout up to $1.08 per share ($4.32 on an annualized basis).

-

Dividend Increases/Decreases for the Week of July 22

Dividend Increases/Decreases for the Week of July 22

Jul 22, 2022

-

Let's take a look at firms raising/lowering their dividends this week.

|