There probably hasn’t been a better large-cap call than Boeing in the Dow Jones Industrial Average during the past couple years, and we have been all over it. But shares have now “rolled over,” and its valuation isn’t as attractive as it once was, both dynamics pointing to reasons for removal from the simulated Dividend Growth Newsletter portfolio. We continue to peruse our coverage universe for an adequate dividend growth replacement.

By Brian Nelson, CFA

I’ve said this time and time again. Valuentum is low turnover, not high turnover like momentum. We think too-much trading results in excessive commission fees and tax implications. We don’t make many moves in the simulated newsletter portfolios, but sometimes we do make changes.

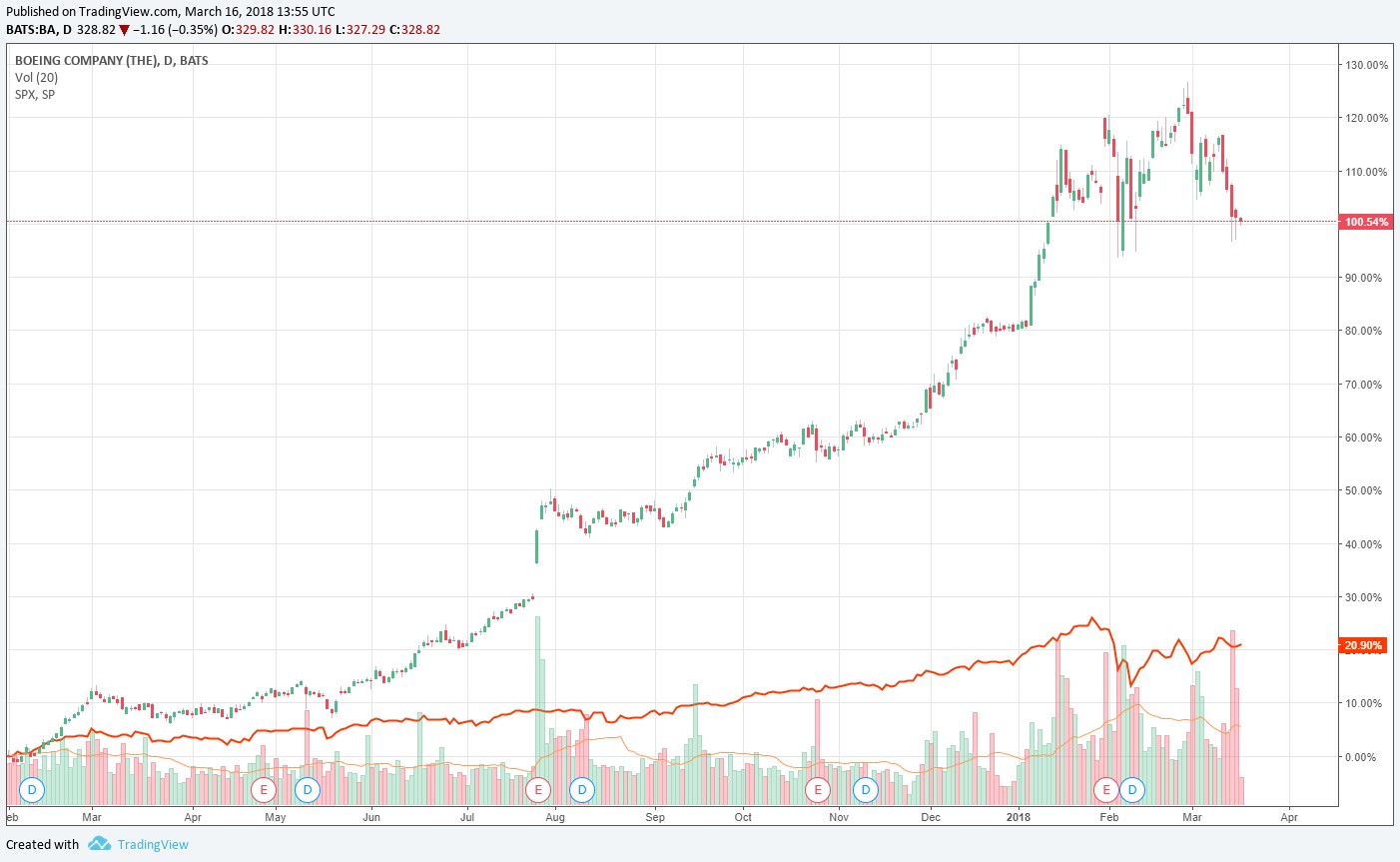

On January 27, 2017 (last year), Boeing (BA) was added to the simulated Dividend Growth Newsletter portfolio. Since then, the stock has roughly doubled, producing a return 5 times that of the S&P 500’s performance. We’ll be removing Boeing from the simulated Dividend Growth Newsletter today, March 16, and we continue our efforts to find an adequate replacement.

The primary reasons for the removal rest in a combination of Boeing’s value and technical/momentum considerations. Shares have soared to the high end of our fair value range, and now technically, they have started to roll over as investors, fair or not, worry about retaliation with respect to coming tariffs. We’re huge fans of Boeing on a fundamental basis, but a great company a great stock doesn’t always make.

We’re available for any questions. Enjoy this Friday, and hope you have a wonderful weekend!

————————-

Brian Nelson does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.