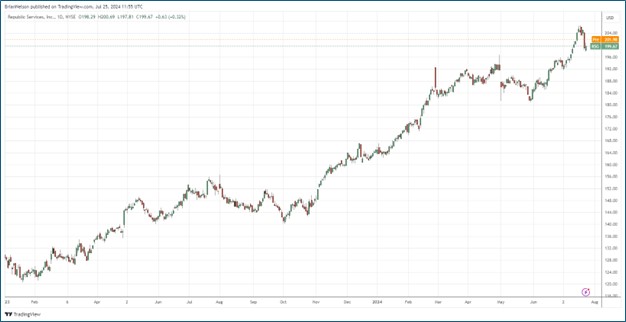

Image: Republic Services’ stock has been consistently strong since the beginning of 2023.

By Brian Nelson, CFA

On July 24, Republic Services (RSG) reported better than expected second quarter results with both revenue and non-GAAP earnings per share exceeding the consensus forecast. Second quarter total revenue growth was 8.6% consisting of 5.6% organic expansion and 3% growth from acquisitions. Though volumes faced some pressure in the quarter, Republic Services continues to display pricing power, with average yield and total price increasing 5.5% in the three months ended June 30.

Republic’s second quarter adjusted EBITDA came in at $1.26 billion, with its adjusted EBITDA margin expanding 110 basis points on a year-over-year basis, to 31.1% of total revenue. On an adjusted basis, net income per diluted share was $1.61 versus $1.41 in the comparable period last year. Management commentary was upbeat on the company’s performance and outlook:

We continue to prioritize our differentiating capabilities – Customer Zeal, Digital and Sustainability – to help our customers achieve their operational and sustainability goals, and drive significant value for our stakeholders. During the second quarter, we delivered double-digit growth in EBITDA and EPS, and expanded EBITDA margin by 110 basis points. Pricing in excess of cost inflation and solid operational execution underpinned strong results across the business. As a result of our performance and outlook for the remainder of the year, we are raising our full-year financial guidance.

For 2024, Republic expects revenue in the range of $16.075-$16.125 billion, adjusted EBITDA in the range of $4.9-$4.925 billion, and adjusted diluted earnings per share in the range of $6.15-$6.20. Adjusted free cash flow is expected to be in the range of $2.15-$2.17 billion on the year. Management continues to be shareholder friendly buying back stock, and the firm raised its quarterly dividend by $0.045, to $0.58 per share. We like Republic’s pricing strength, its attractive disposal assets, as well as its free cash flow generation. The company remains a holding in the newsletter portfolios.

—–

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.