Image Source: Republic Services

By Brian Nelson, CFA

On February 27, trash taker Republic Services (RSG) reported excellent fourth-quarter results that showed beats on both the top and bottom lines. Total revenue advanced 8.6% in the quarter, consisting of 5.7 percentage points of organic growth and 2.9 percentage points coming from acquisitions. The firm’s pricing initiatives continue to bear fruit, with core price on total revenue increasing 7.2% in the quarter. Volume increased revenue by 0.3% in the period. Thanks in part to its pricing strength, the firm’s adjusted EBITDA margin increased 260 basis points from last year’s quarter. Adjusted earnings per share advanced 24.8% in the quarter, a very strong showing.

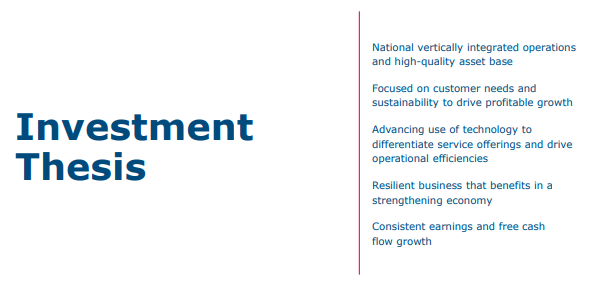

Republic Services is one of our favorite industrial entities. The company has valuable property in the form of disposal facilities, and its collection operations, while always facing a competitive environment, are essential services, making its business relatively recession-resistant. Republic Services is also a strong cash-flow generator. During 2023, for example, the garbage hauler generated cash flow from operations of ~$3.618 billion (was $3.19 billion in 2022) and adjusted free cash flow of ~$1.985 billion (was $1.742 billion in 2022). The company’s cash dividends paid were $638.1 million and $592.9 million in 2023 and 2022, respectively, so Republic Services is doing a great job covering its payout with traditional measures of free cash flow.

Looking to all of 2024, Republic is targeting revenue in the range of $16.1-$16.2 billion (was $14.96 billion in 2023), with contributions from its pricing initiatives in the range of 5.5%-6% and volume growth expected in the range of 0-0.5%. Adjusted EBITDA is guided to be in the range of $4.825-$4.875 billion (was $4.45 billion in 2023) for the year, while the firm is targeting adjusted earnings per share of $5.94-$6.00 (was $5.61 per share in 2023). Adjusted free cash flow is expected to be in the range of $2.1-$2.15 billion (was ~$1.985 billion in 2023), with the company targeting net capital investment in the range of $1.76-$1.8 billion (was ~$1.6 billion in 2023). Fundamental performance continues to move in the right direction at Republic, and we continue to like shares in the newsletter portfolios.

NOW READ: Waste Management’s Pricing Power Is Fantastic, Sustainability Initiatives Are Noble

———-

Tickerized for RSG, WM, WCN, CWST.

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.