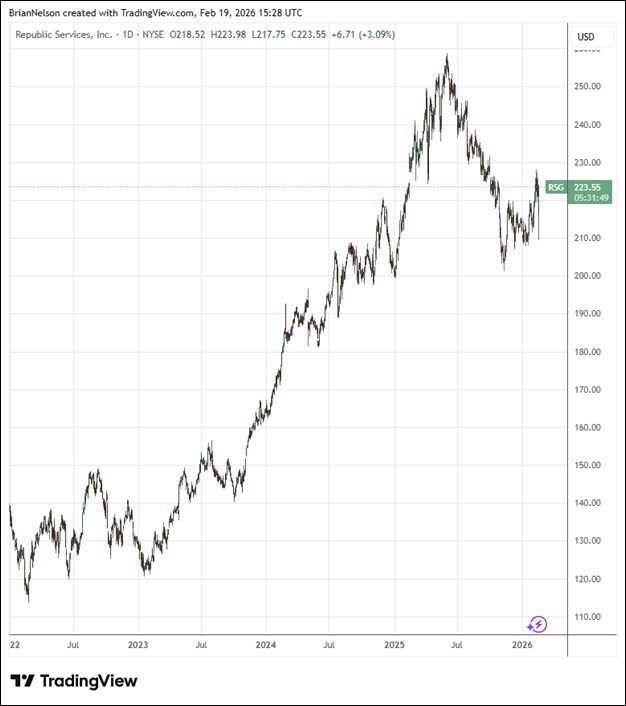

Image Source: TradingView

By Brian Nelson, CFA

On February 17, Republic Services (RSG) reported fourth quarter results that were mixed with non-GAAP earnings per share coming in better than expected but revenue coming in a bit light relative to forecasts. Total revenue growth in the quarter was 2.2% thanks to 2.9% organic growth from its recycling and waste business, 1.3% growth from acquisitions, and a 2% organic decline from its environmental solutions business. Core price on total revenue increased by 5.8%. Volume decreased total revenue by 1%. Adjusted EBITDA was $1.3 billion or 31.3% of revenue, an increase of 30 basis points from the same period a year ago. Quarterly net income was $545 million on a margin of 13.2%, while adjusted earnings per share of $1.76 increased 11.4% over the prior year’s mark.

Management had the following to say about the results:

We delivered another strong year of results in 2025, underscoring the resilience of our business model and the strength of our differentiated capabilities. Through healthy pricing and disciplined cost management, we successfully navigated cyclical demand headwinds and exceeded expectations for full-year adjusted earnings and adjusted free cash flow. We continued to invest across the business to position us for sustained, value-creating growth while returning $1.6 billion to shareholders through dividends and share repurchases.

We expect to deliver another year of profitable growth in 2026 in a macro environment that remains dynamic. Our outlook is supported by continued pricing in excess of cost inflation, steady productivity gains from our digital tools, and ongoing investments in strategic acquisitions — all of which position us well to drive long-term value.

For 2025, cash provided by operating activities was $4.3 billion, an increase of 9.2% over the prior year, while adjusted free cash flow was $2.43 billion, an increase of 11.5% versus last year. Republic Services bought back $854 million in stock during the year, while it paid $738 million in dividends. Looking to 2026, Republic expects revenue to be in the range of $17.05-$17.15 billion, with average yield on total revenue to be in the range of 3.2%-3.7% and volume to provide a one percentage point headwind. Adjusted EBITDA is expected to be in the range of $5.475-$5.525 billion, while adjusted diluted earnings per share is targeted in the range of $7.20-$7.28. Republic expects adjusted free cash flow to be in the range of $2.52-$2.56 billion. We continue to like Republic Services as an idea across our newsletter portfolios. Shares yield 1.2% at the time of this writing.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.