Image Source: Public Storage

By Brian Nelson, CFA

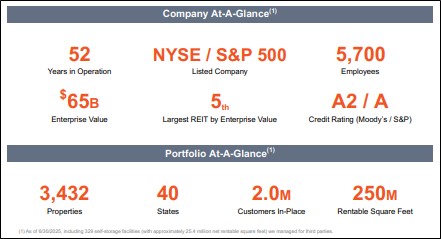

On July 30, Public Storage (PSA) reported mixed second quarter results with revenue coming in a bit light relative to Street forecasts, while funds from operations beat consensus. Net income allocable to common shareholders was $1.76 per diluted share, while core FFO allocable to common shareholders was $4.28 per diluted share. The storage giant achieved 78.8% same store direct net operating income margin in the period. Public Storage acquired sixteen self-storage facilities in the quarter with 1.1 million net rentable square feet and opened two newly developed facilities and completed various expansion projects, which combined added 0.2 million net rentable square feet.

Management had the following to say about the results and outlook:

We are raising our outlook based on stabilizing operations and accelerated acquisition volume. Strategic initiatives across the company are distinguishing our performance. Public Storage’s operating model transformation is enhancing the customer experience while bolstering our leading growth and profitability. Leveraging our platform strength, strong retained cash flow, reputation as a preferred acquirer, and unique in-house development team, we are executing on accretive acquisitions and development with more than $1.1 billion of investment anticipated this year.

Looking to 2025, Public Storage expects revenue growth in the range of -1.3% to 0.8%, with net operating income growth targeted in the range of -2.6% to 0.3% (was -2.9% to 0.2%). Public Storage raised its 2025 non-same store net operating income guidance to the range of $465-$475 million from $444-$464 million previously and its 2025 ancillary net operating income to the range of $200-$205 million from $198-$203 million previously. Interest expense is now targeted at $304 million for the year, up from expectations of $285 million previously. Core FFO per share is now anticipated in the range of $16.45-$17.00, up from the range of $16.35-$17.00. We like Public Storage’s improved outlook and continue to include shares in the High Yield Dividend Newsletter portfolio.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.