By Brian Nelson, CFA

Self-storage giant Public Storage (PSA) reported solid fourth quarter results February 20, with revenue and funds from operations [FFO] coming in better than expectations. The company is one of our favorite income-oriented ideas. It has now been in business for more than 50 years, and it boasts an enviable A2/A credit rating, allowing it easy access to the capital markets to fund future deals and projects. Public Storage’s same-store operating margin also runs higher than many of its peers, showcasing its more efficient operating model. We like Public Storage quite a bit, and the company yields ~4.2% at the time of this writing.

For the three months ended December 31, Public Storage’s revenue increased 6.6%, while net income allocated to common shareholders advanced 7.5% and core FFO available to common shares increased a modest 1.1%. Core FFO per share, excluding the impact of PS Business Parks, increased 1% on a year-over-year basis in the quarter, to $4.20, which was better than the consensus forecast. During the fourth quarter, self-storage net operating income increased $37.6 million from the same period a year ago, bolstered by non-same store facilities, while revenue from its same-store facilities increased 0.8% due to higher realized annual rent per occupied foot, offset in part by modest weakness in occupancy.

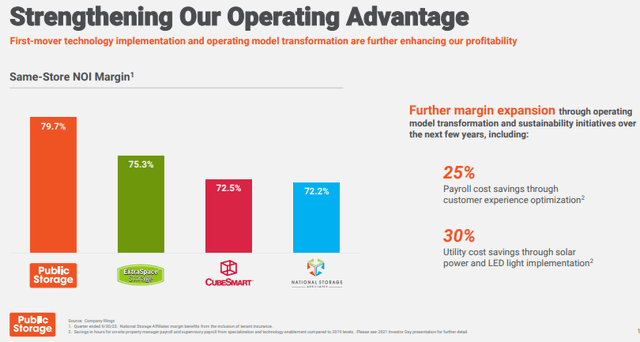

The company’s revenue and net operating income were records during 2023. Public Storage has done a good job integrating its newly acquired 90,000-customer Simply Self Storage portfolio, and we expect it to continue to drive efficiency gains. During the fourth quarter, its same store direct net operating income margin was an industry-leading 79.7% and is consistently above that of Extra Space Storage (EXR), Cube Smart (CUBE), and National Storage (NSA). Public Storage has potential for further margin expansion, too, as it optimizes the customer experience to save on payroll, and through solar and LED light implementation to save on utility costs.

Image Source: Public Storage

Though self-storage is a fragmented and competitive marketplace, Public Storage has a number of competitive advantages going for it. For starters, it has an iconic brand with strong customer recognition, which helps to drive incremental business easier than its rivals. Roughly half of the population in the U.S. lives within what Public Storage describes as a trade area, making its facilities accessible. The firm has been working hard to integrate technology and platform innovation, and its investment-grade credit ratings offer a strong backbone for growth-oriented endeavors. Management also notes that its position in the Los Angeles market (~17% of its same-store net operating income) continues to experience strong tailwinds due to solid demand and limited new supply.

Management is optimistic about performance in 2024:

We are well positioned in 2024 with our operating model transformation enhancing the industry’s highest margins, our high growth non-same store pool comprising nearly 30% of the portfolio, and our balance sheet positioned to fund significant external growth. Our ability to drive unmatched levels of performance and profitability uniquely positions us for growth and value creation into the future.

Looking ahead to 2024, Public Storage is targeting same-store revenue growth in the -1%-1% range, with net operating income growth in the range of -2.4%-0.7%. Acquisitions are targeted at $500 million on the year, while development openings are expected at $450 million. Capital spending its expected at $450 million on the year. For 2024, core funds from operations is targeted in the range of $16.60-$17.20 per share, which implies growth of -1.7%-1.8% and compares to $16.89 and $15.92 per share in 2023 and 2022, respectively. Funds available for distribution were ~$2.54 billion in 2023 and easily covered distributions paid to common shareholders (~$2.1 billion) on the year. We continue to like Public Storage’s fundamental positioning, and its prospects as an income-oriented idea are solid.

NOW READ: 12 Reasons to Stay Aggressive in 2024

NOW READ: 2023 Was a Fantastic Year! Are You Ready for 2024?

———-

Tickerized for PSA, NSA, EXR, CUBE

Brian Nelson owns shares in SPY, SCHG, QQQ, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.