Image Source: Public Storage

By Brian Nelson, CFA

Public Storage (PSA) reported mixed fourth quarter results February 24 with revenue coming in line with the Street’s expectations, but funds from operations (FFO) falling below the consensus forecast. Net income allocable to common shareholders was $3.21 per diluted share, while core FFO allocable to common shareholders was $4.21 per diluted share. In the fourth quarter, Public Storage achieved 79.2% same store direct net operating income margin, acquired 17 self-storage facilities with 1.3 million net rentable square feet, and opened three new facilities and completed several expansion projects that added 0.4 million net rentable square feet. At the end of 2024, Public Storage had a number of facilities in development and expansion, which are expected to add 4 million of net rentable square feet.

Management had the following to say in the press release:

Our fourth quarter performance reflected broad operational stabilization across the portfolio. In the new year, we are inspired by the strength of the Los Angeles community in response to the fires and are fully supporting impacted customers and team members. Due to the associated pricing restrictions, our guidance anticipates an approximate $0.23 per share impact to Core FFO in 2025 while portfolio operations outside of Los Angeles continue to improve. Our completed Property of Tomorrow enhancement program, industry-leading transformation initiatives, sizeable and high-growth non-same store pool, and growth-oriented balance sheet have us well positioned for improving fundamentals and increased transaction market activity moving forward.

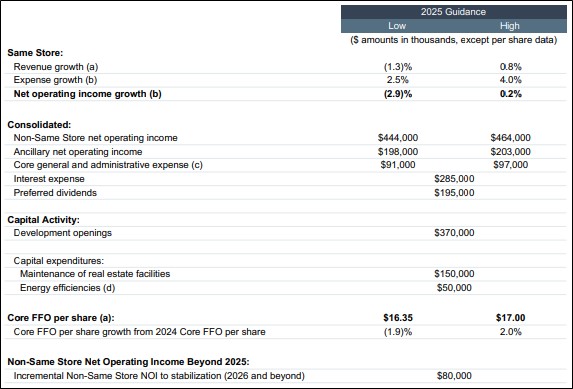

Looking to 2025, Public Storage expects revenue growth in the range of -1.3%-0.8%, with net operating income growth in the range of -2.9%-0.2%. On a consolidated basis, non-same store net operating income is expected to be between $444-$464 million, while ancillary net operating income is expected to be between $198-$203 million. Funds for development openings is targeted at $370 million with maintenance of real estate facilities and energy efficiencies expected at $150 million and $50 million, respectively. Core FFO per share is expected to be between $16.35-$17.00 (below the consensus forecast of $17.18), implying growth of -1.9%-2% on a year-over-year basis. The wildfires in Southern California in early 2025 will negatively impact core FFO for 2025 by $0.23 on both the low-end and high-end of its guidance range.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.