Image Source: Global Panorama

AbbVie’s top-line performance has been relatively strong (unlike its big pharma peers), translating into a generous dividend–further enhancing the appeal of the equity. But is the company’s attractive fundamentals about to change? Let’s take a look at AbbVie’s fundamentals following its second-quarter report, released July 28.

By Alexander J. Poulos

Overview

One of the main appeals of big-pharma companies such as AbbVie (ABBV) and peers Merck (MRK), Eli Lilly (LLY), and Pfizer (PFE) is their comparatively attractive dividend-yield potential as high margins generated from patent-protected compounds lead to internally generated cash flows above the funding needs of the business. As long as big pharma firms can continue to churn out a steady stream of new products to offset the loss of revenue from the lapse of patent protection, a higher level of profits and dividends should theoretically follow.

The biggest challenge to such a thesis, however, is the inherent difficulty of the drug discovery and marketing business. Vast sums of money will be spent on the R&D process with little in the way of assured success. The most costly failures occur in later-stage studies where a significant amount of time and resources are utilized to generate a product that ends up not being a commercially-viable product. In essence, the larger a company becomes, the degree of difficulty to maintain and grow revenue is magnified, and the field remains generally devoid of numerous blockbuster products–defined as products that can generate over a billion dollars in sales per year.

Another risk big pharma companies are often willing to take is engaging in high-premium M&A which can strain balance sheets via the debt-financed purchase of a promising pipeline asset. Again, little in the way of assured success is present in these transactions that are often based around unproven products still in the pipeline.

Humira

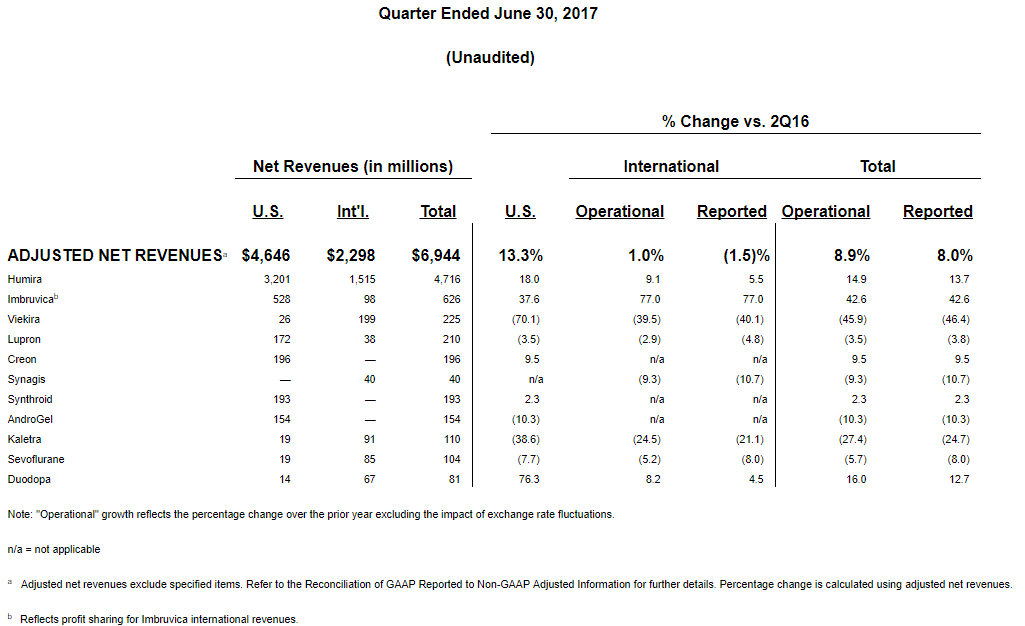

Humira remains the primary driver of profitable sales growth for AbbVie as the product retains the title of the most valuable pharmaceutical product on the planet. Humira sales continue to power higher, registering a staggering $4.7 billion in the second quarter of 2017. The fact that a mature product nearing the end of its patent protection cycle in such a highly lucrative yet fiercely competitive market can generate double-digit growth is a testament to the product’s unique staying power. AbbVie retains a commanding lead in inflammatory diseases, a market in which the company plans to rigorously defend its position in the coming years.

The largest drawback in AbbVie’s investment case at this point rests in the likelihood that the company will be hard-pressed to offset the rate of revenue decline for Humira once patent protection wanes. The management team at AbbVie has gone to great lengths to lay out a thesis on how it anticipates events will unfold, but we are far more cautious on its prospects in this avenue. We need to be mindful of AbbVie’s over-reliance on the future sales growth of Humira, which accounts for a staggering 65%+ of revenue.

Image Source: AbbVie press release

A quick scan of AbbVie’s roster of products shows a relative dearth of growth prospects outside of its star oncology product Imbruvica. Imbruvica is expected to continue to grow at a healthy clip, but AbbVie only controls the US sales of the product as newsletter portfolio holding Johnson & Johnson (JNJ) markets the product overseas.

We may be seeing the beginning of a slowdown in AbbVie’s International sales as Humira competitor and JAK-1 inhibitor Olumiant was recently approved by Europe’s version of the FDA. Olumiant has produced better head-to-head outcomes, giving it a leg up in the marketing of the product, and we anticipate the once-a-day oral dosage to be far more patient friendly than Humira’s injections. Humira will lose European patent exclusivity in 2018, meaning we may very well be on the cusp of peak sales for the drug.

Clinical Pipeline

The management team of AbbVie is well aware of the pending patent cliff and has moved aggressively to hopefully produce a string of new products whose cumulative sales should, at least in part, offset the expected revenue decline from Humira. AbbVie levered up its balance sheet to acquire Pharmacyclics and gain control of Imbruvica in 2015, and it then purchased Stemcentryx in 2016 to gain access to its lead product Rova-T, a late stage compount for small cell lung cancer treatment.

We expect the $21 billion spent in cash and stock to acquire control of the US sales of Imbruvica will prove to be a modest success, but it is clearly a defensive move on the part of AbbVie as it recognizes the need to rapidly replace Humira sales. For the time being, Imbruvica is among the most promising oncology products available, and without Imbruvica, our opinion on the future prospects of AbbVie would be far more negative.

The Stemcentryx deal has been a disappointment thus far, in our opinion, even as we note that lead compound Rova-T did show an impressive response rate of 39% for those who are considered high expressers of the DLL3. The disappointing portion of the results, however, is the incremental median overall survival rate of 5.8 months, which is only slightly superior to the current treatment standard. AbbVie is targeting a third-line indication for small cell lung cancer for the drug, and we feel the target market at present may not justify the price it paid to acquire Stemcentryx, especially if the treatment is only effective in patients with a high DLL3 expression, which will only further shrink its addressable market. Additional data will be released as the year progresses.

We feel AbbVie’s best hope to offset the loss of Humira rests in its own internally developed JAK-1, Upadacitinib, and the company touted its impressive efficacy in a recent press release with nary a mention of the side-effect profile, which is likely to receive heightened scrutiny after the FDA’s recent decision to not approve Eli Lilly’s rival therapy Olumiant due to a slight increase in the risk of blood clots. We cannot understate the importance of Upadacitinib for the future outlook of AbbVie, and the market seems to share this view as data releases related to the product led to an impressive run in AbbVie’s share price recently. AbbVie will release further details at an upcoming medical conference in November 2017, which is standard fare in the industry. The full data reveal will provide greater insight into the potential of Upadacitinib and will be an equity moving event in all likelihood.

The last therapy worth mentioning is MAVYRET, a pan genomic treatment for Hepatitis C. The overall HCV market looks to be in secular decline, and AbbVie’s most recent entry may be a bit late. We expect Gilead Sciences (GILD) to continue dominating the shrinking market. Mavyret’s initial claim to fame is the 8-week course of therapy for those who do not have cirrhosis and are treatment naïve. Interestingly, the following precautions are listed in the FDA approval press release:

MAVYRET must not be taken if people:

· Have certain liver problems

· Are taking the medicines:

o atazanavir (Evotaz®, Reyataz®)

o rifampin (Rifadin®, Rifamate®, Rifater®, Rimactane®)

AbbVie made a splash in the HCV market a few years ago with Viekira Pak seeming poised to steal significant market share from Gilead, but the hype never manifested as Viekira was quickly marginalized after the initial marketing push. We feel AbbVie’s best hope is to target treatment naïve patients without cirrhosis and those with chronic kidney disease. AbbVie may engage in a price war to generate share, and the most recent round of price concessions resulted in reduced profitability for Gilead as it matched the lower reimbursement rates offered by AbbVie. Gilead’s pan-genomic therapy Epclusa has a head start with clinicians, and unless AbbVie’s Mavyret gains favorable formulary placement, clinicians will continue to utilize the Gilead treatment particularly since it can be used to treat patients who also have cirrhosis.

Concluding Thoughts

We remain cautious on AbbVie’s fundamentals as we feel the expected patent cliff is nearing and will be steep. Further clarity on the promise of AbbVie’s clinical pipeline would be necessary for us to consider adding the idea to the newsletter portfolios, and we are anxiously awaiting the presentation of the full data on Upadacitinib in November. Shares look to be fairly valued by the market at current prices, and its Dividend Cushion ratio continues to hover near parity.

Healthcare and Biotech contributor Alexander J. Poulos is long Gilead Sciences.