We view the acquisition of differentiated, late-stage molecules at an attractive rate as the optimal use of free cash flow for many in the biotech industry. The finite commercial life of a patented drug forces continued innovation as near-total revenue erosion is a certainty once patent protection has lapsed. Let’s review some of the recent events at Alexion to gain a further understanding of the underlying trends affecting the business.

By Alexander J. Poulos

Key Takeaways

We have become incrementally more-positive in our outlook for Alexion. Our fair value estimate of $158 per share stands considerably higher than the company’s share price at the moment.

Last year, Alexion’s shares had been punished by reports of questionable sales practices of Soliris, but its first-quarter 2018 numbers were good, revealing 7% top-line growth, and non-GAAP diluted earnings per share growth north of 20%.

We continue to be disappointed in the performance of Kanuma, however. Alexion issued sales guidance for 2018 of $545-$565 million (was $525-$550 million) for its metabolic franchise, which consists of Kanuma and Strensiq, but most of these sales will come from Strensiq.

We like Alexion’s tuck-in acquisition of Wilson Therapeutics, especially in light of the disappointing deal for Synageva. We’re still awaiting more details, as the company’s drug, WTX101, is in Phase 3 testing, but we tend to agree with management that the transaction will help rebuild its clinical pipeline.

In our opinion, WTX101, Wilson Therapeutics’ lead compound neatly addresses the main shortfalls of modern therapy. The drug’s initial tests have garnered it orphan drug status in the US and Europe, thus minimizing competition if the therapy is successfully brought to market. Alexion has detailed an EU and US potential patient population of 20,000, with nearly 10,000 currently undiagnosed.

Alexion continues to be overly-reliant on Soliris for its sales growth (over 80% of its revenue), thus the need for additional compounds to round out the product line-up. We think it is still one for the watch list.

Executive Turmoil at Alexion

Though Alexion Pharmaceuticals (ALXN) reported improved first-quarter 2018 results April 26 that showed first-quarter revenue up 7% and non-GAAP earnings per share advancing more than 20%, there may be more that meets the eye. The company may remain in “the penalty box” for some time yet, as a result of reports of shady sales practices involving its top-selling product Soliris. In the third quarter of 2016, a former employee shed light on irregular sales practices at Alexion, which led to a delay in filing its quarterly 10-Q as the finance and audit committee saw fit to investigate the allegations fully.

Upon completion of a thorough review of its sales and revenue recognition procedures, Alexion reported it does not need to restate its earnings, but the leadership team (CEO David Hallal and CFO Vikas Sinha) both resigned which created a leadership vacuum at the company. An interim CEO was announced as the board searched for new leadership. The short tenure of CEO David Hallal, in our view, could be viewed as a disappointment due to the what we think was the overpaying for a late-stage pipeline that has dramatically failed to live up to the initial hype. Hallal was focused on diversifying Alexion’s clinical pipeline by utilizing the cash hoard generated by its profitable Soliris pipeline.

In hindsight, Hallal seemed to have jumped head first into a costly acquisition in an attempt to make an immediate mark upon the official start of his tenure as CEO. Hallal assumed the CEO title in April of 2015, with in our view, a lightning-quick deal announced on May 6, and completed on June 23rd 2015. Much to the detriment of Alexion’s shareholders, Hallal’s target for the acquisition was Synageva Biopharm–a developmental stage company with a promising yet unproven late-stage asset in Kanuma.

Alexion will acquire Synageva for consideration of $115 in cash and 0.6581 Alexion shares, for each share of Synageva, implying a total per share value of $230 based on the nine-day volume-weighted average closing price of Alexion stock through May 5, 2015. The acquisition strengthens Alexion’s global leadership in developing and commercializing transformative therapies for patients with devastating and rare diseases.

The transaction has been unanimously approved by both companies’ Boards of Directors and is valued at approximately $8.4 billion net of Synageva’s cash.

Quote Source: Alexion Press Release

We didn’t like the terms of the deal as it included an unfortunate dilution of the existing shareholders of Alexion for a rare drug with marginal sales potential.

Kanuma

Alexion was proven correct in its assessment of the potential of Kanuma to gain US marketing approval, but the sales potential radically departed from the logic used in consummating this deal.

Kanuma, in its second full year on the market, posted total sales of just $65 million (the drug delivered $19.6 million in sales during the first quarter of 2018). We can’t envision a scenario where Kanuma morphs into a blockbuster product (sales of $1 billion or more), particularly in light of Alexion’s seeming unwillingness to test the compound for additional indications.

Alexion issued sales guidance for 2018 of $545-$565 million (was $525-$550 million) for its metabolic franchise, which consists of Kanuma and Strensiq. Keep in mind Strensiq posted net sales of $339.8 million in 2017 and $110.7 million in net sales during the first quarter of 2018. Thus, the vast majority of the sales will continue to come from further growth in Strensiq.

Further complicating matters for Alexion is the second compound gained in the Synageva acquisition was discontinued by the interim CEO in a strategic overview of the business. We view the move as a “clearing of the decks” maneuver to give the incoming CEO (Ludwig Hantson) a clean slate to begin his tenure.

Enter Sweden’s Wilson Therapeutics

We commend new Alexion CEO Ludwig Hantson for not rushing into another ill-fated acquisition after accepting the top job at Alexion. In our view, the recently-announced acquisition of Wilson Therapeutics is a master-stroke, as the deal offers an enviable combination of an underserved market with respect to Wilson’s specialization in rare copper-mediated disorders and a very favorable price tag. The terms augur well for the long-term economics of the deal assuming the product gains marketing approval in the US and Europe.

Wilson Therapeutics’ product, WTX101, is currently in Phase 3 testing as a treatment for Wilson disease, an autosomal recessive disorder that leads to an unhealthy build-up of copper in the vital organs, most notably the liver. A build-up of excess copper can lead to a cascade of unwanted side effects with neurological disorders such as tremors in addition to involuntary muscle movement along with potential cirrhosis of the liver or outright failure of this vital organ.

Current Treatments

The current treatment paradigm is of questionable effectiveness, with chelators such as penicillamine and trientine serving as the primary agents for the treatment of this disease. The main drawback with chelation therapy is the potential for an exacerbation of neurological side effects such as tremors. The key for a new treatment is to improve on the side-effect profile while greatly reducing the amount of free copper floating around in the bloodstream. The chelation agents in current use do not have a high affinity to copper, thus they may bind to additional minerals, thereby limiting the overall effectiveness of the treatment.

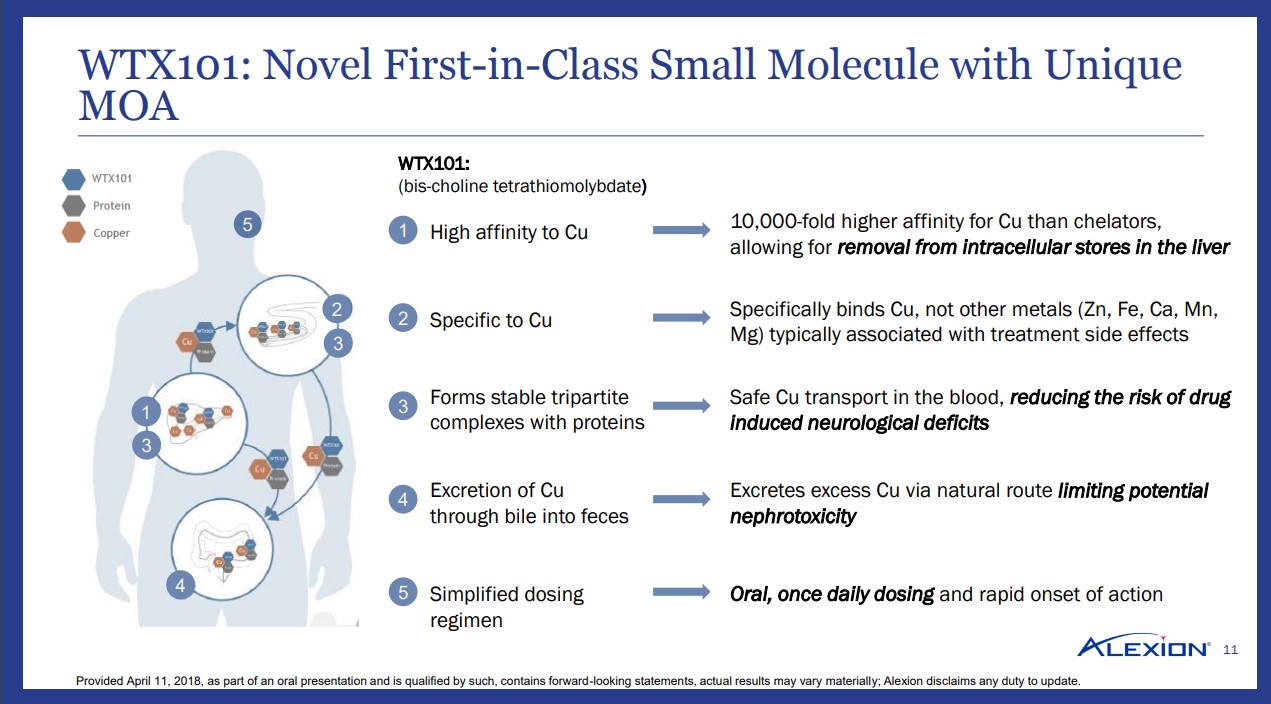

Image Source: Alexion

In our opinion, WTX101, Wilson Therapeutics’ lead compound neatly addresses the main shortfalls of modern therapy. We would like to highlight the high affinity for copper coupled with excretion through natural route (feces) as a near-optimal set-up. If the product is proven to work in its ongoing Phase 3 study, a patient afflicted with Wilson’s disease will simply excrete via waste any excess copper in a similar fashion as other excess products in the body.

The once-a-day oral method of drug administration should ensure nearly 100% compliance as most will remember to simply take one pill a day. We have seen numerous potential therapies fail due to the need to dose 4 or more times a day, which in our view, virtually guarantees poor compliance.

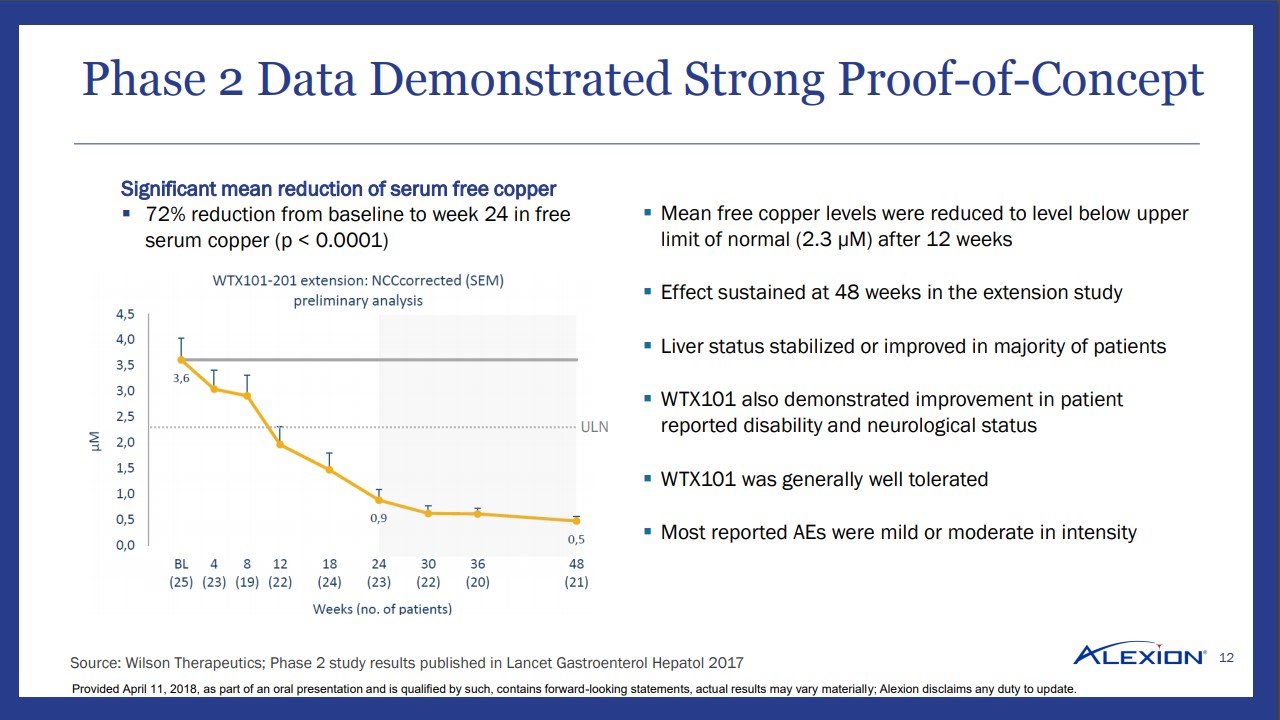

Image Source: Alexion

Proof of Concept Study

Thus far, the initial Phase 2 results appear very promising for those afflicted with Wilson’s disease. We found it notable that plasma copper levels dipped to the highest level of normal within twelve weeks, which we view as an indication the product has a rapid effect. The initial observation is borne out in a 72% reduction in serum-free copper at 24 weeks–the therapy continues to absorb and excrete excess copper from the patient.

The initial results have garnered orphan drug status in the US and Europe, thus minimizing competition if the therapy is successfully brought to market. The FDA has further bestowed fast-track status to the product thus opening a pathway towards an accelerated review due to high unmet need. Alexion on its slide deck detailing the transaction noted an EU and US patient population of 20,000 with nearly 10,000 undiagnosed–an educational marketing campaign targeting hepatologists and neurologists should increase overall awareness, and by extension, treatment.

Concluding Thoughts

We have become incrementally more-positive in our outlook for Alexion, in light of the recent transaction to acquire Wilson Therapeutics. We have assigned a fair value of $158 to Alexion with a Value Risk rating of High in large part due to the overhang from a biosimilar hitting the market for its chief revenue source Soliris. Alexion continues to be overly-reliant on Soliris for its sales growth (over 80% of its revenue), thus the need for additional compounds to round out the product line-up. Alexion suffered a severe setback with the ill-fated Synageva transaction, but we feel the new CEO is off to a good start with the recent move to acquire Wilson Therapeutics. Alexion is one for the watch list.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Independent Healthcare Contributor Alexander Poulos does not own shares of any securities mentioned in this article. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.