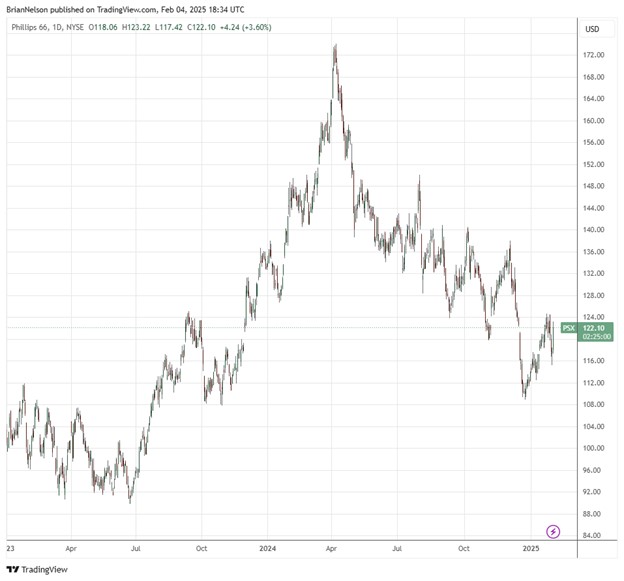

Image Source: TradingView

By Brian Nelson, CFA

Phillips 66 (PSX) reported fourth quarter results on January 31 with non-GAAP earnings per share coming in ahead of the consensus forecast. The company reported fourth-quarter earnings of $8 million, or $0.01 per share, and an adjusted loss of $61 million, or $0.15 per share. Earnings in the quarter were impacted by $230 million pre-tax of accelerated depreciation related to its Los Angeles Refinery. In the fourth quarter, it returned $1.1 billion to shareholders through dividends and share repurchases. Phillips 66 registered record NGL fractionation and LPG export volumes in Midstream and set a record clean product yield in Refining.

Management had the following to say about the quarter and outlook:

During the fourth quarter, we achieved our strategic priority targets for shareholder distributions and asset dispositions. We also delivered on our goal of improving Refining performance by continuing to run above industry-average crude utilization, setting record clean product yields and achieving our targeted cost reductions of $1 per barrel.

In support of our Midstream wellhead-to-market strategy, we recently announced an agreement to acquire EPIC’s NGL business, bolstering our Permian and Gulf Coast footprint. Upon closing, these assets will be accretive to earnings and highly integrated with our existing infrastructure, providing additional opportunities to enhance returns and shareholder value.”

Building on our successes, I (CEO Mark Lashier) am pleased to announce that we have set new financial and operational targets that prioritize debt reduction, a lowered cost structure and EBITDA growth. Supported by world-class operations, we are committed to returning over 50% of operating cash flow to shareholders.

2024 was a pivotal year for Phillips 66. The team executed well on an ambitious set of strategic priorities, substantially improving the company’s competitiveness, and is well positioned to successfully deliver on a new set of targets through 2027.

During the fourth quarter, adjusted EBITDA fell sequentially to $1.1 billion from $2 billion in the third quarter of 2024. Cash flow from operations came in at $1.2 billion in the fourth quarter of 2024, up from $1.13 billion quarter-over-quarter. Capital expenditures and investments advanced to $506 million from $358 million in the sequential third quarter. Free cash flow came in at $692 million in the quarter, and the company returned more than $1.1 billion to shareholders in the form of share buybacks and dividends paid on common stock. Phillips 66 ended the quarter with $1.74 billion in cash and $20.1 billion in debt.

Looking forward to its strategic priorities through 2027, Phillips 66 plans to return greater than 50% of operating cash flow to shareholders, achieve 2% higher than industry average crude utilization, target annual adjusted controllable costs of $5.50 per barrel in Refining, grow Midstream and Chemicals mid-cycle adjusted EBITDA $1 billion in total by 2027, and maintain financial strength and flexibility by reducing total debt to $17 billion. Though the quarterly performance was messy, we continue to like Phillips 66. Shares yield 3.9% at the time of this writing.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.