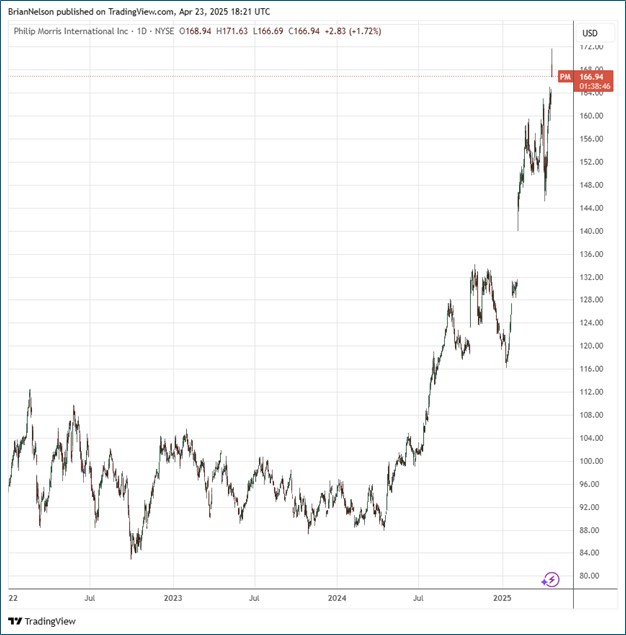

Image Source: TradingView

By Brian Nelson, CFA

On April 23, Philip Morris (PM) reported excellent first quarter results with revenue and non-GAAP earnings per share coming in higher than the consensus forecasts. Total net revenues advanced to $9.3 billion, which was up 5.8% on a reported basis and 10.2% on an organic basis. Gross profit increased to $6.3 billion, up 11.8% on a reported basis and 16% on an organic basis. Operating income increased to $3.5 billion, up 16.4% on a reported basis and 16% organically. Adjusted diluted earnings per share increased 12.7%, to $1.69, in the quarter.

Management was optimistic in the earnings report:

We achieved exceptionally strong performance in the first quarter, with continued volume growth supporting an excellent top-line performance and very strong margin expansion. Our smoke-free business goes from strength to strength, delivering organic growth of over 20% in net revenues and over 33% in gross profit. We remain confident in our ability to deliver superior results, despite an uncertain and volatile global economic environment, and now forecast double-digit adjusted diluted EPS growth in dollar terms for the full-year.

Looking to all of 2025, Philip Morris’ net revenue growth is targeted around 6-8% on an organic basis, with organic operating income growth to be between 10.5%-12.5%. The tobacco giant expects reported diluted earnings per share in the range of $7.01-$7.14, with adjusted diluted earnings per share targeted at $7.36-$7.49 (up 12%-14%) and adjusted diluted earnings per share, excluding currency, expected to be between $7.26-$7.39 (up 10.5%-12.5%). 2025 operating cash flow is targeted to be more than $11 billion at prevailing exchange rates, with capital expenditures of around $1.5 billion, which includes further investments in ZYN capacity in the U.S. We’re huge fans of Philip Morris’ stock.

—–

Brian Nelson owns shares in SPY, SCHG, QQQ, QQQM, DIA, VOT, RSP, and IWM. Valuentum owns SPY, SCHG, QQQ, QQQM, VOO, and DIA. Brian Nelson’s household owns shares in HON, DIS, HAS, NKE, DIA, RSP, SCHG, QQQ, QQQM, and VOO. Some of the other securities written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.