Image Source: Pfizer

We came away generally impressed with the progress at Pfizer during the second quarter as the company begins to replace its current patent protected line-up with next-generation treatments. Pfizer continues to gain political favor with its decision to forgo price hikes on its product line-up while announcing a re-organization of the business structure.

By Alexander J. Poulos

Key Takeaways

There has been lots of political intrigue as Pfizer seeks to gain favor with the White House via rolling back its annual drug price hikes.

The company announced plans to split into three companies, which we view as the first step towards a complete split of the company.

In the second-quarter earnings report, released July 31, Pfizer raised its earnings guidance as growth remains on track.

Pfizer’s dividend growth potential looks solid, boasting a Dividend Cushion ratio of 2.2. We value the company at $40 per share.

Shares yield 3.2% at the time of this writing.

Political Intrigue

We applaud the recent move by Pfizer (PFE) to join the growing ranks of pharma behemoths forgoing annual price hikes in order to gain additional political favor. In the case of Pfizer, CEO Ian Reed in our view wisely decided to rescind the price hikes of July 10 after a reported conversation with President Trump in what may later be viewed a textbook example of the Art of the Deal.

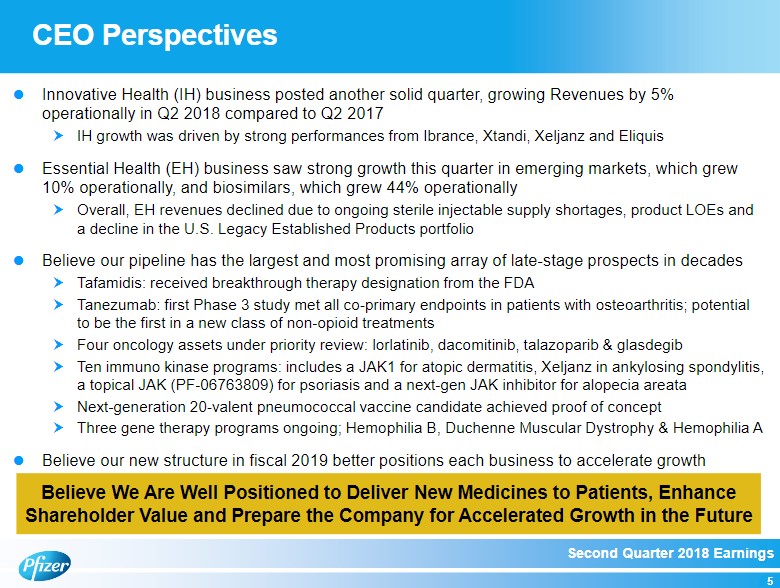

Following up on the price rollback, Pfizer issued a press release July 11 stating its intention to reorganize the business into three distinct divisions, each focusing on a different aspect of the business ranging from an Innovative Health (new therapies, biosimilars and hospital anti-infectives), Consumer Health (OTC meds) and Essential Health (older meds off patent).

We view the timing of the news release as a direct result of the discussion between Trump and Reed as the re-organization in our opinion lays the groundwork for the eventual split of the company into three separate companies each holding an individual listing. Let’s keep in mind–Reed has failed twice in his tenure to enact a major transformation, originally with the takeout of AstraZeneca (AZN) for a new tax-domicile in 2014 and the failed (lucky for Pfizer) acquisition of Allergan (AGN) again for a tax-domicile in 2016.

We have noticed a unique timeline is now in place, which in our view, further underscores the bold nature of such a move as the Trump administration seeks a radical transformation of the entire drug reimbursement process, including the all-important nascent biosimilar market, which in our view, will go a long way towards lowering overall healthcare costs. We found FDA commissioner Scott Gottlieb’s comments on July 18 particularly meaningful as it offers important clues as to the administration’s thought process towards biosimilars.

The growth of the biosimilar market remains a critical new growth vertical for Pfizer as it can leverage its expertise in manufacturing to produce a competitive product while maintaining strict safety and adherence to quality.

Underscoring the inherent rapidly changing healthcare nature, CEO Reed took a thinly veiled shot at AbbVie (ABBV), which remains woefully overexposed to the biosimilar threat as Reed elucidated his belief pertaining to the future viability of the current drug rebate system:

I think the President is trying to maintain a market-based system in the United States, which is positive. Probably one of the largest changes, which I think would be overall positive for the industry is the Secretary’s intention to remove the safe harbor for discounts so as to eliminate rebates. At the moment in time, about 40% of the pharmaceutical prices are subsidies to the rest of the health care system. We realized some 58% of our list price. The rest goes to subsidize profitability of PBMs; insurance companies; and frankly, premiums for those that are healthy. This is not a sustainable position. And so removal of the rebates, I believe, will be very beneficial to patients and our industry, especially those companies that are — who are at launching — those companies who are launching new products over the next 5 years or so would remove the rebates, will remove the sort of what we call the rebate trap, whereby access is denied to innovative products because of a strong position of another product with its rebates. An example would be Xeljanz slow penetration but steady into the — into its market given the situation of rebates of bigger competitors. I think the President is focused on improving free trade agreements, the free riding that occurs on American consumers and research. He wants to promote value-driven health care by linking payments to performance.

Quote Source: Pfizer Q2 2018 Earnings Conference Call

Reed is stating the administration is looking to reward innovation at the expense of entrenched monopolies who manage to stem the clinical uptake of newer more effective treatments via the “rebate trap.” We echo Reed’s sentiment as we view the pharmaceutical landscape as undergoing a radical shift, which will benefit those who are positioned favorably to reap the rewards of the new environment of more transparency versus the older system of obfuscation and opaque pricing schemes that are purposely designed to mask the true cost of therapies.

Innovative Health Review

We wish to focus the bulk of our quarterly analysis of Pfizer on the progress shown by the Innovative Health Division as we believe Innovative Health remains the key driver for future growth at Pfizer.

The sales leader at Innovative Health remains long-standing neurologic treatment Lyrica, which posted decent second-quarter sales growth. Pfizer stated it plans on transitioning Lyrica to the Essential Health division to manage the impending decline of the asset as it losses patent protection.

To its credit, Pfizer has adroitly pivoted to the Oncology landscape to drive growth, with its star treatment Ibrance posting stellar revenue growth. Ibrance remains Pfizer’s key oncology asset as the superior mix of efficacy, first-mover advantage and side-effect profile, in our view, has cemented Ibrance as the go-to treatment for ER-Positive and HER2 negative breast cancer.

Pfizer does possess additional assets in oncology that remain in their respective infancies headlined by recently-acquired Xtandi for the treatment of prostate cancer. Xtandi’s has a unique opportunity with archrival Johnson and Johnson’s (JNJ) Zytiga’s imminent patent expiration. Once patent protection is lost, we expect J&J to pull marketing support, thus providing Pfizer an opportunity to take share. We will be following Xtandi’s progress closely to determine if Pfizer wildly overpaid for Medivation. Pfizer did gain access to Talazoparib, a PARP inhibitor which management initially had high hopes for.

However, the competitive landscape for the PARP class has radically shifted with AstraZeneca cutting a deal with oncology star Merck (MRK) to bring out the full potential of Lynparza. Based on the subpar sales numbers posted by Lynparza’s primary rivals, we do not envision a robust market developing for Talazoparib unless it can post knockout clinical numbers.

The final marketed product we wish to highlight is the continued stellar growth of the anticoagulant Eliquis. Pfizer co-markets Eliquis with its partner Bristol-Myers Squibb (BMY), but this has not impeded Pfizer’s ability to drive sales with second-quarter sales tallying $889 million for an eye-popping 47% revenue growth. We remain highly impressed with the duo’s herculean efforts to aggressively take share from Boehringer Ingelheim (first mover advantage) and J&J. Eliquis continues to garner the bulk of new Rx’s written which bodes well for future sales growth.

Annual Guidance

Pfizer issued amended guidance due in large part to currency fluctuations thanks to the strength of the US dollar versus a basket of foreign currencies. Pfizer’s new guidance is for 2018 revenue to come in a range of $53-$55 billion versus the previous guidance of $53.5-$55.5 billion. Pfizer did raise its annual earnings-per-share guidance to a range of $2.95-$3.05 versus $2.90-$3.00, as a lower-than-expected tax rate coupled with a higher level of deductions offset previous currency weakness.

We are heartened by the increase in Pfizer’s earnings guidance, which has in our view, driven the company to trade slightly higher than the midpoint ($40) of our fair value range of $32-$48 per share. We continue to view Pfizer as possessing an Attractive Economic Castle along with a Dividend Growth and Safety rating of Good. Pfizer remains an interesting idea for those seeking income as the $0.34 quarterly dividend allows for an attractive dividend yield of over 3%.

While we remain impressed with the diverse nature of the multiple business lines possessed by Pfizer, we are not prepared to add the name to our simulated Best Ideas or Dividend Growth newsletter portfolios as the equity is trading towards the higher end of our fair value range. We will continue to monitor events at Pfizer, as they unfold with a special emphasis toward a potential split of the company to unlock the full potential of the Innovative Health Division, which remains masked by slower growing divisions.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Independent healthcare and biotech contributor Alexander J. Poulos does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.