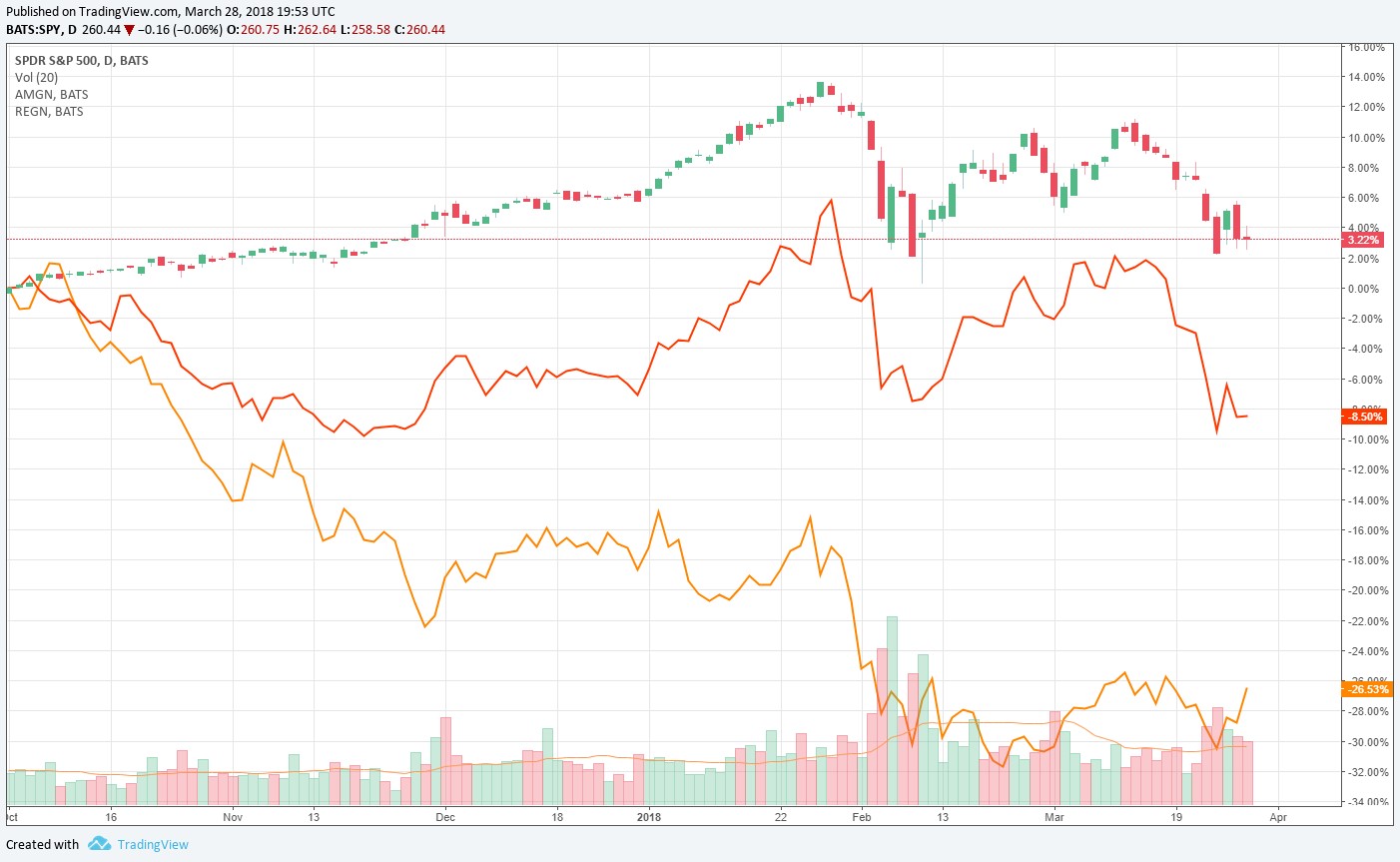

Image shown: Amgen and Regeneron have both meaningfully trailed the market since October of 2017.

The robustness of the clinical pipeline offers an important clue regarding the health and vitality of a biotech/pharma company, as the clinical pipeline is critical towards maintaining and growing the top line. One of the most promising, and dare-we-say, overhyped new treatments to enter the market is the PCSK9 cholesterol-lowering agents, with Amgen and Regeneron leading the pack. Let’s discuss the results of Regeneron’s treatment along with a discussion of the path forward for the treatment.

By Alexander J. Poulos

Amgen’s Repatha

The PCSK9 class is delineating into two competing treatments with little to differentiate between the two products. The key to perhaps gaining a leg up over the competition is through superior outcomes trial results with Amgen’s (AMGN) Repatha first to post results. As we detailed in a piece roughly one year ago entitled “Analyzing Amgen’s Sudden Fall,” Repatha failed to impress with a 15% relative risk reduction in Major Adverse Cardiac Events (MACE). When coupled with a price tag of over $1,000 per month, it has failed to ignite sales. Payers have been loath to pay such an enormous price tag, as evidenced by the less-than-stellar sales posted by Repatha thus far ($98 million in worldwide sales in the fourth quarter of 2017).

The lack of meaningful sales growth of Repatha nine quarters following initial marketing approval does not bode well for future growth at Amgen, in our view, as the management team has identified Repatha as the key asset in its clinical pipeline. Amgen decided to pivot towards investing significant assets into the field of new Cardiovascular treatments, but the results are clear: Amgen’s products are severely challenged, with Corlanor an unmitigated disaster, in particular, due to an unfavorable side-effect profile, and Repatha failing to post meaningful sales traction.

From where we stand, Amgen remains highly exposed to an aging pipeline with biosimilar entrants looming on the very near-term horizon. The weak clinical pipeline, in our view, is the main reason why the equity has traded in a near-sideways pattern since 2015. To say the least, Amgen’s returns post-2015 have lagged that of the overall market.

Regeneron’s Praluent

The results of Regeneron’s (REGN) Odyssey outcomes trial for Praluent were recently released on March 10 to far-less fanfare than what would have been expected just two years ago at the height of the PCSK9 hype. The primary endpoint for Praluent is a 15% reduction in MACE which is virtually identical to the results posted by Repatha. The main takeaway is in the patient population with an LDL-C >101 mg/dl– the risk reduction in MACE posted an impressive rate of 24%, surpassing the results posted by Repatha.

The risk reduction posted in the higher-risk population is empirically sound as a rapid decrease in cholesterol should reduce overall risk, as we have seen with the CANTOS study posted by Novartis (NVS). The CANTOS trial of Canakinumab a monoclonal antibody demonstrated a 27% relative risk reduction in MACE in the subgroup with a rapid decrease in highly-selective C-Reactive protein, a biomarker for inflammation while the overall group posted an identical MACE reduction of 15%.

We found it particularly noteworthy in a separate press release an offer to reduce the overall cost of Praluent is being offered in an attempt to boost usage of the product. We view this offer as a unique mea culpa as it seems as though it is tacitly admitting the initial pricing of the product may have been beyond what payers would reasonably pay. The enormous price tag, in our view, has virtually crippled new patient starts—never a good sign.

Our second takeaway is the results from both the Fourier (Amgen) an Odyssey (Regeneron) trials, while lowering cholesterol, have failed to demonstrate the “knock-out” decrease in mortality that would have forced the hand of payers to pony up over $1,000 per month for the treatment. The move to lower cost will stimulate additional demand, but the product class may never come close to living up to the hype once foisted upon it.

Amgen May Need M&A

We have grown less constructive on the robustness of Amgen’s near-term pipeline as we view the recently brought-to-market products–namely Blincyto, Repatha, Corlanor, and Kyprolis–as not nearly good enough to power the company forward. While we believe Aimovig is a good product in a new therapeutic class, payer pushback will be fierce as near identical products are poised to enter at virtually the same time, potentially limiting sales due to favorable formulary placement. The most likely scenario to emerge is payers pushing back by offering favorable placement to the developer that offers the greatest price concession.

Not only do we have doubts about the strength of Amgen’s pipeline, but the company’s pivot towards developing a large swath of biosimilars may be a tactical blunder that could come back to haunt the company as the next decade unfolds. A biosimilar, by definition, is a “generic” version of a biological product, which remain among the most costly products on the market today. By introducing competition into “monopolistic” therapies thanks to patent protection, profit margins on Amgen’s endeavors may come in far less than what is normally generated in branded patent-protected products. It’s even possible biosimilars may destroy the profitability of its top two selling products—Enbrel and Neulasta, which combined account for over 50% of Amgen’s 2017 revenue.

For us to become more constructive on the future path of Amgen, we would implore the management team to utilize its balance sheet towards purchasing a new and innovative product line via an acquisition. We feel a well-timed takeout similar to Gilead Sciences (GILD) acquisition of Kite Pharma may help Amgen better diversify its pipeline and help to build greater revenue resiliency, which is needed, in our view, given questions within its existing pipeline and concerns over strategic direction.

Conclusion

Amgen is a venerable name in the biotech field–one of the true pioneers–but the company is heading into a crucial area where the near-term product lineup appears to be less than stellar. This has us concerned. For the shareholders of Regeneron, the failure of Praluent to significantly better the results posted by Repatha may, in our opinion, cripple the prospects for this once over-hyped treatment. Regeneron may need to produce another string of hits from its clinical pipeline to offset the loss of theoretical income from Praluent. Amgen and Regeneron fill a much-needed role in our coverage but we still prefer Gilead, Johnson & Johnson (JNJ) and Novartis as our favorite ideas in the pharma space.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Independent healthcare and biotech contributor Alexander J. Poulos is long Gilead Sciences and Johnson & Johnson. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.