Image Source: PayPal third-quarter earnings presentation

PayPal continues to benefit from secular trends away from cash and towards mobile, and its free cash flow generation and balance sheet strength remain impressive. Person-to-Person volume growth has been robust.

By Kris Rosemann

Simulated Best Ideas Newsletter portfolio idea PayPal (PYPL) continues to ride the secular trend away from cash, and nothing may be more exemplary of this than its continued rise in Person-to-Person volume, which advanced 50% in the third quarter from the year-ago period to roughly 25% of its total payment volume (TPV). PayPal’s third quarter report, released October 18, also revealed a 15% increase in active accounts added in the period on a year-over-year basis, and the 9.1 million active accounts added in the period, which brought total active accounts to 254 million, compared favorably to the 8.2 million added in the third quarter of 2017. TPV grew 24% from the year-ago period to $143 billion, and the company reported a 9.5% increase in payment transactions per active account on a trailing twelve month basis. Total payment transactions climbed 27% in the quarter to 2.5 billion.

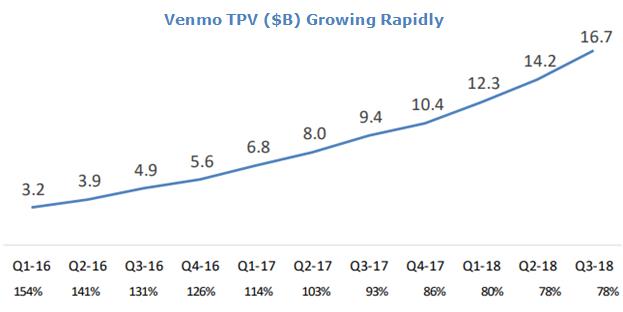

Mobile engagement has been strong for PayPal as mobile payment volume leapt ~45% in the third quarter on a year-over-year basis to roughly $57 billion, which represented 40% of overall TPV in the period. Growth at Venmo, the company’s social payments platform, has been a key factor in its Person-to-Person volume growth as TPV at Venmo jumped 78% from the year ago period to ~$17 billion. Management is optimistic that this business has the potential to deliver meaningfully impactful results moving forward as it continues to enhance the monetization of the platform, which it believes is reaching a tipping point. 24% of Venmo users have participated in a monetizable action as of the end of the third quarter, which is up from 17% one quarter earlier and 13% in May 2018.

PayPal also continues to reduce its reliance on its relationship with former parent company eBay (EBAY), and eBay-related volume accounted for 11% of PayPal’s volume in the third quarter, down from 20% three years ago. The multi-year trend has been driven by the company’s merchant services volume easily outpacing eBay marketplaces volume, and the former grew roughly 8 times faster than the latter in the third quarter of 2018. Other partnerships will be key to advancing PayPal’s in-store strategies, such as its recent partnership with retail giant Walmart (WMT).

PayPal’s non-GAAP operating margin expansion of more than 140 basis points in the third quarter on a year-over-year basis to 21.4% is a nice reminder of the scalability of the company’s business model as its top line continues to expand at a double-digit rate. Non-GAAP earnings per diluted share grew 26% from the year-ago period to $0.58, and net cash provided by operating activities skyrocketed (due in large part to changes in loans and interest receivable held for sale) to nearly $4.7 billion from ~$1 billion in the third quarter of 2017, which drove free cash flow generation to more than $4.4 billion, more than five times higher than the year-ago period. Free cash flow generation through the first nine months of 2018 came in at $3.75 billion, a 71% year-over-year increase despite capital expenditures growing 23%. As of the end of the quarter, PayPal held $2 billion in current debt, which compares to its $9.6 billion in cash, cash equivalents, and short-term investments.

For the full-year 2018 period, PayPal raised the low end of its revenue guidance range, which now sits at $15.42-$15.5 billion (growth of 18%-19% from 2017) compared to $15.3-$15.5 billion previously and includes the negative 3.5% impact related to the sale of US consumer credit receivables. Non-GAAP earnings per share guidance has been raised to a range of $2.38-$2.40 from $2.32-$2.35, and the company now expects to generate more than $4.5 billion in free cash flow in the year.

Looking ahead to 2019, management expects revenue to grow 17% on a currency neutral basis, which reflects expectations for a reduction in other value-added services revenue in the early part of the year as a result of the sale of its US consumer credit portfolio. Non-GAAP earnings per share are projected to grow roughly 20% after considering the impact of integration expenses related to four acquisitions announced in 2018, which are expected to be accretive to the bottom line in 2018.

We expect to continue highlighting PayPal as an idea in the simulated Best Ideas Newsletter portfolio for the foreseeable future, and shares continue to trade at a material discount to our fair value estimate of $109. The company’s robust free cash flow generation and net cash position on the balance sheet give it ample resources to continue pouring into areas of its business with high growth potential such as Venmo and business loans, and it will only continue to benefit from the societal trends moving away from cash, especially as it works to expand globally and enhance its in-store strategies.

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Kris Rosemann does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.