Clinical data reads can have an outsize impact on the fortunes of the research-based pharma industry, irrespective of the size of the organization. We came away very impressed with the recent release from Merck and felt a timely overview of the various pharmaceutical products developed by the company would be of value to readers.

By Alexander J. Poulos

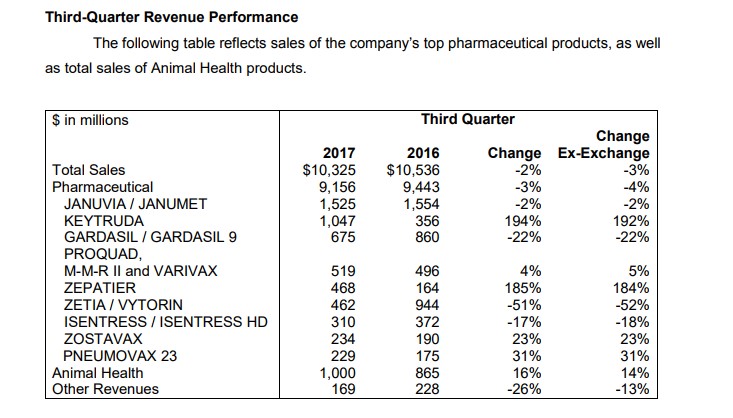

Third Quarter Results

Image Source: Merck

On October 27, Merck (MRK) released its third-quarter results. The results were met with an immediate sell-off in the shares as the pace of the clinical pipeline disappointed. To say the least, we were surprised by the aggressiveness of the sell-off–the catalyst for the leg down in the share price, in our view, is the declaration of an amendment to the clinical trial design for Keytruda.

Merck is amending the KEYNOTE-189 study to include overall survival as a co-primary endpoint. The updated completion date is Feb. 2019 and there will be opportunities for the company to conduct interim analyses. KEYNOTE-189 is a Phase 3 study of platinum-pemetrexed chemotherapy with or without KEYTRUDA in patients with first-line metastatic non-squamous non-small cell lung cancer (NSCLC).

Quote Source: Merck

We think the inclusion of overall survival data will be a key differentiator in what remains the early stages of the buildout of immune-oncology. Investors may view Merck as a stable behemoth with an attractive dividend–an assessment we share–, but what most may not realize is the enormous reliance of Merck on the prospects for Keytruda to jumpstart its flagging revenue. Let’s review the various medication franchises to gain a further understanding of the outsized importance of Keytruda.

Metabolic and Cardiovascular Franchise

Merck has remained at the forefront of combating cardiovascular disease since the introduction of Mevacor to help combat elevated levels of cholesterol. Merck followed up its initial success with Mevacor with Zocor which remains a widely prescribed agent even though patent protection was lost some time ago. Merck managed to remain in the vanguard with the acquisition of Schering-Plough in 2009 with the crown jewel of the purchase remaining the cholesterol-lowering agent Zetia.

Zetia remains a unique entity–it is the only “non-statin” that is dosed at once a day. The statin class which includes popular remedies such as Zocor and Mevacor may lead to severe muscle pain which will cause a patient to discontinue therapy. By acquiring Zetia, it opened an additional avenue to maintain Merck’s dominance in the area of cholesterol-lowering agents including line extension by combining Zetia with Zocor to form Vytorin. As is the norm in the industry, patent protection for Zetia has lapsed, which is placing top-line growth pressure on Merck as it looks to leverage its clinical pipeline for next-gen therapies that can advance the top-line.

Merck’s core Metabolic franchise is suffering from patient defection from Januvia to the SGlT2 class with Jardiance gaining particular favor due to a recent stellar outcomes trial. Jardiance lowered cardiovascular deaths in diabetics (a notable accomplishment as cardiac issues are particularly difficult to treat in the diabetics). We feel the data will lead to a slow drain away from Merck’s Januvia and Johnson and Johnson’s (JNJ) Invokana which will pressure the top-line of each of the pharma heavyweights.

Infectious Disease

Merck is a very late entrant into the Hepatitis C marketplace with its treatment Zepatier for Genotypes 1-4. The sales ramp of Zepatier is impressive but the good times will not last as Abbvie (ABBV) recently received approval of Mavyret for all six genotypes. The overall total course of therapy for Mavyret can be completed in as little as eight weeks versus the current standard for twelve weeks. The eight-week course is for those who have not been treated previously, with the bulk of the patients with a higher fibrotic score already been treated we feel Mavyret has a nice opportunity before it in the HCV market.

We would like to stress yet again the HCV market is no longer a growth market, but a significant number of patients still need to be treated, which will set up a nice annuity stream for Abbvie and industry leader Gilead Sciences (GILD). We expect the bulk of Mavyret’s gain will come at the expense of Merck’s Zepatier, thus further depriving Merck of an attractive growth asset.

Merck has decided to terminate further development of two clinical phase 2 assets in the field of HCV. We believe the decision to terminate the products in combination with Gilead’s proclamation to shift R&D dollars away from the field of HCV underscores we have hit a critical milestone in the quest to eradicate HCV. While Merck still has a nice asset in Zepatier, the era of growth has lapsed and Zepatier should now be considered a wasting asset.

Moving on the HIV, Merck’s Isentress continues to lose ground to newer therapies. Merck does have a few molecules in phase 3 testing, but we can’t help but feel it will be impossible for Merck to displace industry leader Gilead or its primary rival in Viiv Healthcare (a partnership with GlaxoSmithKline (GSK) and Pfizer (PFE).

Vaccines

The vaccine business remains an area of continued innovation at Merck. Merck’s Gardasil remains a star with continued growth as healthcare providers push for widespread adoption. For the first nine months of 2017, sales of Gardasil are up even with a huge year-over-year sales variance in the third quarter. As is the norm in the ultra-competitive vaccine market, a new entrant is poised to steal significant market share from Zostavax (Merck’s treatment for Herpes Zoster).

GSK recently gained approval for Shingrix a refrigerated product that has demonstrated superior clinical outcomes. Zostavax requires being kept frozen which has limited widespread adoption as healthcare providers are loath to shoulder the extra cost burden of a special unit just to store Zostavax. Merck does have a few interesting new treatments in phase 2-3 as the company continues to invest R&D dollars into vaccines.

Oncology

After reviewing the main growth drivers of Merck, one might come away with the conclusion new areas of focus to drive growth are necessary. The primary growth driver for Merck going forward remains Keytruda, its novel PD-1 therapy for the treatment of a wide range of cancers.

A bit of an overview: the consensus is the PD-1 class has the potential to radically reshape how cancer is treated, at least that was the initial thesis. The excitement was fueled by a string of impressive FDA approvals, but the first signs of doubt emerged in 2016 when Bristol Myers (BMY) competitive treatment Opdivo failed in a widely expected test for lung cancer. The miss was a shock as the share price of Bristol plummeted over 15% on the news. We are bringing this point up to underscore just how closely the future fortunes of Merck, Bristol-Myers and to a lesser extent Roche (RHHBY) are to the PD-1 and PD-L1 marketplace.

We had the distinct feeling of déjà vu when the shares of Merck plummeted last quarter upon the release of a change to the trial design for its combo of Keytruda. Keytruda posted nine-month sales in 2017 of $2.5 billion versus $919 million for the first nine months of 2016. The immediate fortunes of Merck are directly tied to further market share gains for Keytruda. Merck is looking to expand the prescribing label rapidly in order to capitalize on the enormous potential of the therapy.

Merck (NYSE:MRK), known as MSD outside the United States and Canada, today announced that the pivotal Phase 3 KEYNOTE-189 trial investigating KEYTRUDA® (pembrolizumab), Merck’s anti-PD-1 therapy, in combination with pemetrexed (Alimta®) and cisplatin or carboplatin, for the first-line treatment of patients with metastatic non-squamous non-small cell lung cancer (NSCLC), met its dual primary endpoints of overall survival (OS) and progression-free survival (PFS). Based on an interim analysis conducted by the independent Data Monitoring Committee, treatment with KEYTRUDA in combination with pemetrexed plus platinum chemotherapy resulted in significantly longer OS and PFS than pemetrexed plus platinum chemotherapy alone. The safety profile of KEYTRUDA in this combination was consistent with that previously observed.

Quote Source: Merck

In our view, the decision to include overall survival data is a masterstroke as Keytruda has now vaulted out into the pole position in the largest overall oncology market, non-small cell lung cancer. The second key point is that the side-effect profile is consistent with what is previously observed. We can read through that no new safety signals were detected, though the final confirmation will come when the entire data is released at an upcoming conference. We feel Keytruda has now opened up a commanding lead that will be difficult to displace by existing therapies.

As is the norm in the pharma/biotech (XLV, IBB, XBI) world, however, a new molecule may come to market, but we view this possibility as one that would only come many years down the road, offering Keytruda ample time to cement its role as the industry norm. A recent example of the stickiness of first-to-market is the market share held by Gilead Sciences in HCV. Even though new entrants have entered with one even coming up with a superior product due to a shorter course of therapy, Gilead has maintained over 80% market share. We feel Keytruda is solidifying itself as the PD-1 of choice for lung cancer, the most lucrative of all of the oncology disease states.

Role of the Dividend

We have assigned a Dividend Safety ratio of GOOD for Merck as its cash-flow profile amply covers the dividend. We do not foresee any sort of reduction in the near future. As for dividend growth, the potential is good, with Merck raising the dividend at roughly a 2% clip during the past few years. Merck is heavily investing in expanding the prescribing label for Keytruda, and if successful, we expect the cash-flow profile of Merck to improve markedly.

Animal Health Division

In keeping with our theme of 2018 shaping up to be the year of the merger in the pharma/biotech realm, Merck CEO Ken Frazier dropped noticeable hints as to the pharma giant’s appetite for additional deals. Just to add some context, Merck views Animal Health as a key pillar of growth along the lines of the Oncology division—big stuff!

We’re also looking carefully at other potential products in our pipeline, determining which opportunities have the highest potential to address unmet needs. For instance, we recently made the decision to prioritize certain opportunities in our pipeline for vaccines and for HIV. We believe these represent areas of long-term growth and could sizably add to our other key pillars of growth, namely oncology and Animal Health.

Quote Source: Merck Q3 2017 Earnings Presentation

We interpret “business development” as code for looking to make deals.

So, we are focused on driving long-term growth through innovation generally, and we see Animal Health as the innovation that we can create through that portal as a pillar of growth for the company. As we’ve noted this quarter, it surpassed $1 billion for the first time inside our portfolio, which is meaningful, and we continue to see it going forward as a key growth driver because it has healthy margins as well as a strong market outlook. So, from our perspective, we see it fitting very nicely in augmenting our growth as an overall company, and we intend, where we find opportunities, to further augment that business with additional business development. So, it’s an important part of our business,

Quote Source: Merck Q3 2017 Earnings Presentation

It will be interesting to see if Eli Lilly (LLY) does spin-out its animal health division called Elanco, and then would Merck become interested in an outright acquisition post a potential spin-out? There remain lots of plausible possibilities. All in, we’re keeping a very close eye on Merck’s tremendous opportunities, almost across the board.

Independent Contributor Alexander J. Poulos is long Gilead Sciences and Merck.