Image Source: Occidental Petroleum Corporation

Occidental Petroleum laid out a plan to generate positive free cash flow at various price points in 2019, and management has shown a willingness to adjust spending levels in the past. Let’s dig into the framework Occidental has established for how it can adjust effectively to changes in raw energy resource prices.

By Callum Turcan

Capital Spending Changes and Dividend Coverage

One of the hardest tasks raw energy resource producers face is managing their cash flow positions. Volatile operating cash flow from upstream operations makes setting capital expenditure budgets and paying out dividends a difficult task, especially if the goal is to cover those cash outlays within internally generated funds. Occidental Petroleum Corporation (OXY) offsets some of the volatility of its upstream financial performance with sizeable midstream and petrochemical operations. More importantly, the firm retains the ability to aggressively scale back its upstream-related capital expenditures when necessary and is hesitant to chase oil prices higher via capex increases.

In 2016, Occidental cut its capex in half from 2015 levels to $2.9 billion in response to low oil prices. As the OPEC+ production cut agreement came into force at the beginning of 2017, recovering oil prices encouraged Occidental to increase its capex to $3.6 billion. Occidental also paid $2.3 billion in dividends and generated roughly $5 billion in net operating cash flow in 2017, meaning it was unable to cover cash dividend paid with free cash flow generated in the year. Occidental’s Dividend Cushion ratio currently sits at 0.8, but its 16 year streak of consecutive annual dividend increases as of 2018 is certainly impressive. We think management has a good handle on its dynamic and potentially volatile cash flow profile, a notion we will discuss further shortly.

By 2018, rallying global oil prices and stronger operational performance increased its net operating cash flow to $5.2 billion during the first three quarters of the year, and capital spending grew to more than $3.6 billion. This resulted in free cash flow generation of just over $1.5 billion, which came up short of covering $1.8 billion in cash dividend payments, but an abnormally large working capital build of nearly $1.1 billion also played a role in the shortfall. Share buybacks totaled $0.9 billion over the same three quarter period and were funded by more than $2.7 billion in divestment proceeds as Occidental sold off some of its domestic midstream assets for a hefty sum.

Financial Flexibility

Occidental Petroleum issued an important statement during the firm’s third quarter conference call that set the tone for what to expect in 2019. In the words of CEO Vicki Hollub:

“We remain committed to developing our resources in a sustainable manner while spending within cash flow. Last quarter, we achieved our breakeven plan, meaning we will be cash flow neutral and pay our dividend at $40 WTI. And at $50 WTI, we can pay our dividend and grow production by 5% to 8-plus percent. This plan remains in place. Our relentless focus remains on allocating free cash flow to investments with the highest returns across our integrated business and returning capital to shareholders through our dividend and share repurchases. Since resuming our share repurchases program this year, we will have returned over $5 billion to shareholders through dividends and share repurchases by the end of 2019.”

Management wants to communicate to shareholders that Occidental’s top priority is generating shareholder value, not production growth. Higher oil prices will spur higher levels of capital expenditures, and vice-versa for lower oil prices. Many upstream operators have a myopic view of raw energy resource prices when times are good and are quick to increase their spending levels. However, when raw energy resource prices move lower, those upstream operators can’t seem to let their foot off the gas pedal. This leads to capital expenditures that are completely unsustainable, ultimately resulting in weak shareholder returns at times.

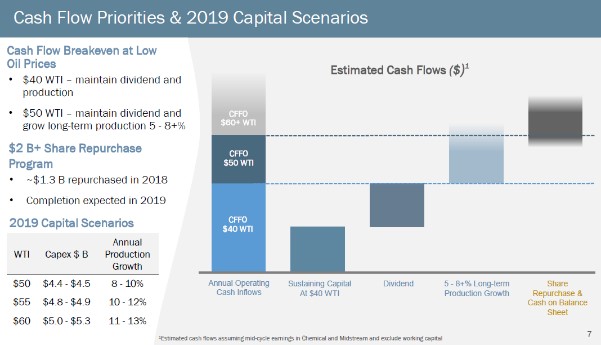

The slide below title “Cash Flow Priorities & 2019 Capital Scenarios” highlights Occidental’s strategy at various price points. When WTI is trading at $40, Occidental plans to spend just enough to cover its dividend and what the industry refers to as sustaining capital (the level of capex required to keep production levels flat) entirely with operating cash flow. In the event WTI is at $50 or $60, Occidental will spend more on capex to generate upstream production growth. If WTI trades below $50, Occidental will reduce capex to account for weaker upstream returns and its shrinking operating cash flow.

Cash on hand and any potential free cash flow generation (a product of the possibility of higher raw energy resource prices in 2019) will be used to cover its ongoing $2 billion share buyback program, which is equal to 4% of its market capitalization. That program is expected to be completed in 2019, with Occidental noting that $1.3 billion had been spent repurchasing shares in 2018. We note that Occidental repurchased a meaningful number of shares during the fourth quarter of 2018, when its share price tumbled from over $80 down to below $60 within less than three months.

Occidental’s CEO commented, “We are targeting more than $2 billion of share repurchases over the next 12 to 18 months,” in August 2018, implying there is additional repurchases potentially on the horizon. Occidental has also been steadily increasing its dividend, which was boosted to $3.12 per share on an annual basis in July 2018, resulting in a 4.7% yield as of this writing. At the end of the third quarter of 2018, Occidental held nearly $3 billion in cash and cash equivalents, up from ~$1.7 billion at the beginning of the year, and its total debt load sat at $10.3 billion, up from ~$9.8 billion at the beginning of the year. The company’s credit rating currently stands at A3, a strong investment grade rating.

Image Source: Occidental Petroleum Corporation

Capex Commentary

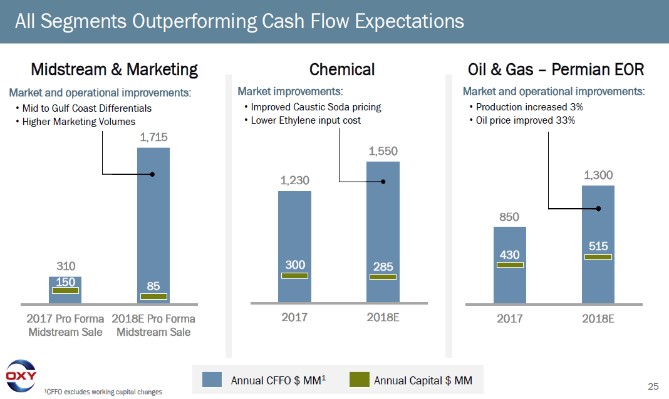

During the release of Occidental’s second quarter earnings, management raised the firm’s 2018 capital expenditure budget from $3.9 billion to $5 billion. An additional $0.9 billion was allocated to Occidental’s short-cycle Permian Resources unit and an extra $0.2 billion was allocated to its short/medium-cycle Permian EOR (enhanced oil recovery) unit. This backloaded upstream spending is why Occidental is expecting strong production growth this year, even in a $50 WTI world as you can see in the slide above.

Occidental’s CEO commented that the goal was to spend $5–$5.3 billion per year on capital expenditures through 2020, but that commentary came when Brent and WTI prices were closer to $80 and $70 per barrel, respectively, instead of $60 and $50 as of this writing. Based on the futures curve, oil prices in 2019 are expected to be much lower than where they traded in 2018. Management noted Occidental’s capex budget would be lowered to $4.4–$4.9 billion in a $50–$55 WTI price environment, ideally at the lower end.

The Great Balancing Act

It likely won’t be until Occidental issues its upcoming fourth quarter 2018 earnings report that the company will publish guidance for 2019, but investors will be laser-focused on its capital expenditure and production growth forecasts. In the shale world, high decline rates have made annual capex budgets all the more relevant. Significantly lower spending levels leads to material production declines, while significant spending increases can quickly generate output growth. Usually there is a six-month delay before changes in development activity starts impacting production levels, whereas most conventional projects (that aren’t bolt-on endeavors) take years to reach first-oil.

For reference, conventional oil fields usually see annual decline rates that range between 5%-9% after the first few years of production (the IEA reported that decline rates from mature oil fields came in at 6% in 2017, down from 8% in 2016). Base maintenance investments, such as adding water injection capacity or drilling new production wells, influences the rate of that decline, but the decline itself can’t be totally circumvented.

Horizontal wells stimulated via hydraulic fracturing activities (known as unconventional operations) have decline rates that range between 50%-80% during the first year of production. After two or three years over half of those well’s estimated ultimate recovery has already been produced, which is why these are short-cycle projects. The unconventional equivalent of base maintenance, re-stimulation activities, remains a pilot project for the industry at this point. For unconventional upstream operators to maintain their production bases, new wells must be drilled and completed on a constant basis.

Occidental’s upstream operations consist of conventional and unconventional properties in the US and around the world. Slowing down or halting production growth at its unconventional Permian division, which Occidental refers to as its Permian Resources asset, is about more than simply not spending any more money. It is about Occidental lowering its capital expenditures to levels that will see enough wells come online to replace some (if not all) of the lost output to maintain cash flow generation at one of its largest producing assets, while not spending so much as to incur an unsustainably large cash outflow. Occidental’s Permian Resources division produced a third of its company-wide upstream output during the third quarter of 2018.

Management is cognizant of this great balancing act, and that’s encouraging. Any upstream firm touting production growth without addressing the cash flow issue is a cause for concern, as is any upstream firm operating under the guise that production growth will completely mitigate the negative impact of lower raw energy resource prices.

Conclusion

If WTI trades at or above $40, Occidental Petroleum can flex its upstream capital expenditure budget up or down as market conditions dictate without sacrificing production and thus operating cash flow generation. Upstream capex that was spent during the second half of 2018 makes setting a 2019 budget much easier due to the expected uplift in Occidental’s output during the first half of this year. As management adjusts Occidental Petroleum’s cash flow outlays accordingly, part of its cash pile may be used to continue opportunistically repurchasing shares. Our fair value estimate for shares currently sits at $72 each, and shares are currently changing hands in the bottom half of our fair value range, which informs how we feel about the value creation potential of buybacks.

Related – Oil & Gas – Independent: APA, APC, CHK, CLR, COG, DNR, DVN, EOG, EQNR, MRO, NBL, OXY, PXD, RRC, SWN

—–

Valuentum members have access to our 16-page stock reports, Valuentum Buying Index ratings, Dividend Cushion ratios, fair value estimates and ranges, dividend reports and more. Not a member? Subscribe today. The first 14 days are free.

Callum Turcan does not own shares in any of the securities mentioned above. Some of the companies written about in this article may be included in Valuentum’s simulated newsletter portfolios. Contact Valuentum for more information about its editorial policies.